STATE HOUSING FINANCE AGENCIES

Mortgage Tax Credit Certicate (MCC)

OVERVIEW

State HFAs may also manage a program that provides

home purchasers with a signicant tax credit in connec-

tion with their home loans. The credit can be used in

a manner that assists people in making their monthly

payments more affordable (affecting underwriting) for

as long as the home remains their primary residence.

Participating bankers provide information to their

customers about the tax credit and apply to the HFA for

the certicate on the borrower’s behalf.

The Mortgage Tax Credit Certicate (MCC) program

was established by the Decit Reduction Act of 1984

and was modied by the Tax Reform Act of 1986.

8

Under the law, states can convert a portion of their

federal allocation of private activity bonds (PABs)

to MCC authority on a four-to-one basis. Mortgage

tax credit certicates can help lenders increase their

appeal to rst-time homebuyers and help more bor-

rowers qualify for homes by reducing their mortgage

payments. MCCs are not a loan product, but rather

a federal tax credit. MCCs are certicates issued by

HFAs that increase the federal tax benets of owning a

home and helps low- and moderate-income, rst-time

homebuyers offset a portion of the amount they owe in

mortgage interest.

An MCC is not a tax deduction, but rather it provides

a dollar-for-dollar tax credit to recipients to increase

housing payment affordability. In some cases, MCCs

can also help borrowers who might not otherwise

qualify for a loan by reducing their net monthly mort-

gage payment.

MCCs are issued directly to qualifying homebuyers

who are then entitled to take a nonrefundable fed-

eral tax credit equal to a specied percentage of the

interest paid on their mortgage loan each year. These

tax credits can be taken at the time the borrowers le

their tax returns. Alternatively, borrowers can amend

their W-4 tax withholding forms from their employer

to reduce the amount of federal income tax withheld

from their paychecks in order to receive the benet on

a monthly basis.

The tax credit percentages vary by state, but are

generally in the amount of 20 percent to 40 percent

of the total mortgage interest. The remaining interest

obligation may be deducted (by those who itemize

deductions) as a standard home mortgage interest

deduction. Regardless of the tax credit percentage

issued, the Internal Revenue Service caps the maxi-

mum tax credit that may be taken for any given year

at $2,000 for each MCC recipient. The MCC tax credit

remains in place for the life of the mortgage, so long

as the residence remains the borrower’s principal

residence.

The total MCC tax credit for each year cannot exceed

the recipient’s total federal income tax liability for that

year, after accounting for all other credits and deduc-

tions. Credits in excess of the current year tax liability

may be carried forward for use in the subsequent three

years. Therefore, it is important to consider the poten-

tial limitations of the credit for those homebuyers with

a minimal tax obligation.

Unlike down payment and closing cost assistance

programs, MCC programs generally do not restrict

the type of mortgage nancing with which they are

coupled. In particular, MCCs do not have to be com-

bined with an HFA rst-lien mortgage. First mortgages

originated in connection with MCCs but not originated

under an HFA rst-lien mortgage program are retained

by the lender (rather than sold to the HFA) and can be

held or sold at the discretion of the lender.

8

Tax Reform Act of 1986, Pub L. 99-514, 100 Stat. 2085, enacted October 22, 1986.

23 | FDIC | Affordable Mortgage Lending Guide

-

MCC EXAMPLE

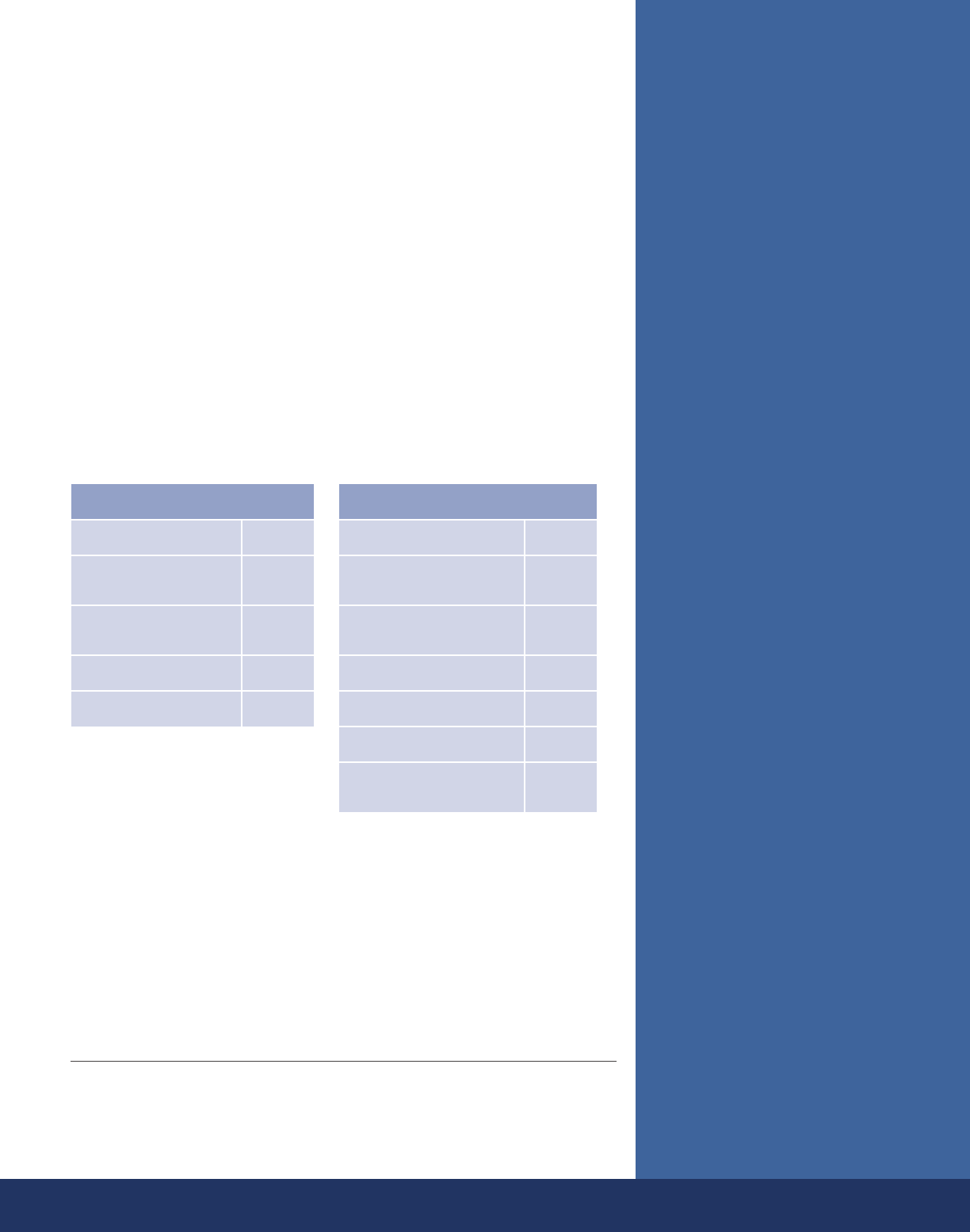

Joe and Sylvia are purchasing their rst home. Their annual income is

$50,000. The mortgage interest that they will owe in the rst year of

owning their new home is $10,000.

Without an MCC, Joe and Sylvia would be able to deduct all of the

$10,000 in mortgage interest that they paid during year one, assum-

ing their other deductions are high enough that taking the standard

deduction is not a better tax strategy. However, if Joe and Sylvia get an

MCC for 20 percent of the interest on the mortgage, they will be able

to deduct $8,000 of their mortgage interest AND also receive a $2,000

dollar-for-dollar credit.

The tables below show an extremely simplied illustration of Joe and

Sylvia’s federal tax obligation with and without a mortgage tax credit

certicate.

9

It is important to note that if Joe and Silvia do not item-

ize deductions, they will get no tax benet from the mortgage without

the MCC.

WITHOUT AN MCC WITH AN MCC

Annual income $50,000

Mortgage interest

to deduct

$10,000

Taxable income

(assume 15% tax rate)

$40,000

Federal income tax $6,000

Total Income Tax Owed $6,000

Annual income $50,000

Mortgage interest

to deduct (80% total)

$8,000

Taxable income

(assume 15% tax rate)

$42,000

Federal income tax $6,300

Minus 20% MCC tax credit ($2,000)

Total Income Tax Owed $4,300

Net gain from MCC

(rst year)

$1,700

In this example, Joe and Sylvia would save $1,700 in federal taxes in the

rst year they received a mortgage tax credit. This annual credit could

also be added to their annual income for the purpose of qualifying for

a mortgage by amending their W-4 tax withholding forms, which may

boost their chances of loan approval. They would also continue receiv-

ing the annual MCC benet, albeit in a smaller amount as the interest

they pay on the mortgage declines, for as long as they keep their

mortgage.

POTENTIAL BENEFITS

Mortgage Tax Credits increase

borrowers’ payment affordability.

Mortgage Tax Credits

help lenders reach and

qualify more low- and moderate-

income borrowers.

Mortgage Tax Credits can be

coupled with most first mort

gage loans.

POTENTIAL CHALLENGES

The application, benefits, and

limitations of the Mortgage Tax

Credit Certificate program can be

difficult to explain to borrowers.

Borrowers may be subject to

recapture tax (although this is a

low risk).

State HFA MCC programs are

subject to funding availability

and may run out when the bond

funds allocated to MCCs are

expended.

9

This simplied illustration is intended to show how a tax credit can be applied and does not account for indi-

vidual nancial circumstances. For instance, the assumed 15 percent tax rate applied to the taxable income

does not account for personal exemptions or other deductions and credits that may apply. It is important to

analyze the nancial circumstances of each potential tax credit recipient in order to properly advise.

FDIC | Affordable Mortgage Lending Guide | 24

RECAPTURE TAX

A portion of the MCC benet is subject to recapture

by the Internal Revenue Service if a recipient meets all

three of the following conditions:

1. the borrower sells the home within nine years

of purchase;

2. the borrower earns signicantly more income than

when he/she bought the home;

10

and

3. the borrower has a gain from the sale of the home.

Only borrowers who meet all three criteria will be

subject to recapture. MCC borrowers are not subject to

recapture if they sell, give away, or dispose of the home

more than nine full years after closing. The maximum

amount of recapture, which is payable on the sale of

the home, is 6.25 percent of the original principal bal-

ance of the loan or 50 percent of the gain on the sale

of the home, whichever is less.

Most HFAs report that the majority of their pro-

gram recipients are not subject to tax recapture.

Nevertheless, many HFAs have Reimbursement

Recapture Tax programs that will reimburse borrowers

for any recapture tax incurred.

11

Number of HFAs that Offer MCCs

Of the 54 HFAs found in this Guide, 33 HFAs offer

mortgage tax credit certicates.

BANK ELIGIBILITY AND APPLICATION PROCESS

HFA MCC program approval requirements are gener-

ally more streamlined than the process to become an

approved rst mortgage and down payment assistance

approved lender. To use MCC programs, lenders need

to be approved by the insuring agency for which they

originate loans, i.e., the Federal Housing Administration

(FHA), the U.S. Department of Veterans Affairs (VA), the

U.S. Department of Agriculture’s Rural Housing Services

(RHS), Fannie Mae, or Freddie Mac and have an ofce

physically located in the state for which it is approved.

Minimum net asset requirements may apply. Generally,

lenders will need to sign a participation agreement that

outlines the lender’s responsibilities and requirements

associated with the program, such as submitting docu-

ments for approval to the HFA and record-keeping

responsibilities. Participation agreements generally

outline the documentation and borrower certication

requirements associated with the program. In many

cases, the HFAs charge an annual fee for lenders to

participate in the program.

BORROWER CRITERIA

Income and sales price limits: Income and sales price

limits are standard eligibility requirements for all MCC

programs. These limits vary by state.

First-time homebuyers: MCC programs are limited to

rst-time homebuyers (borrowers who have not had

an ownership interest in a principal residence in three

years). The rst-time homebuyer requirement is waived

for those borrowers purchasing a home in targeted

areas as dened by the U.S. Department of Housing

and Urban Affairs (HUD) at the census tract level or

designated as such by state governments, as well as for

active military and veterans.

Occupancy: Borrowers must use the home as their

principal/primary residence.

Homeownership counseling: Many HFA programs

require some form of pre-purchase homebuyer educa-

tion. These requirements vary by state.

PROGRAM CRITERIA

First loan purpose combined with MCCs: MCCs are

restricted to use in combination with purchase loans

(renances are not eligible). However, if a borrower cur-

rently has an MCC, and decides to renance into a new

mortgage, many programs allow the borrower to apply

to receive a new MCC issued against their renanced

mortgage.

10

A borrower will not meet this condition for recapture unless they earn the

maximum income limit that would have applied to their qualifying household

size at the time of purchase, compounded by 5 percent per year from the date

of purchase until the home is sold or transferred.

11

The following HFAs offer a recapture tax reimbursement program:

Connecticut, Idaho, Maine, Massachusetts, New York, North Dakota, Ohio, and

South Dakota. Check with your state HFA to determine whether they offer a

recapture tax reimbursement program.

25 | FDIC | Affordable Mortgage Lending Guide

First loan type with MCCs: Most xed-rate loan types

are eligible. Loans must be underwritten according to

FHA, VA, RHS, or conventional loan criteria as appropri-

ate and offered at prevailing market rates.

Combination with other HFA programs: Some states

allow the MCC program to be combined with other

HFA programs on the same transaction, such as allow-

ing a borrower to receive an HFA rst-lien mortgage

loan and down payment assistance and also receive

an MCC. Other states limit the degree to which HFA

subsidy programs can be combined.

HFA MCC fees: HFAs typically charge a one-time

MCC fee to the borrower, which is applied at the time

of closing. In some programs, this fee is waived or

reduced if the MCC is being issued in combination with

an HFA rst-lien mortgage product. Fees vary by state.

Lender MCC fees: Lender MCC fees are generally

allowed, but capped at a specic amount. Fee caps

vary by state.

Other lender fees: The loan origination and other

service-related fees may be capped on loans receiving

an MCC in some states.

Potential Benets

• Mortgage Tax Credits increase borrowers’ pay-

ment affordability.

• Mortgage Tax Credits help lenders reach and qual-

ify more low- and moderate-income borrowers.

• Mortgage Tax Credits can be coupled with most

rst mortgage loans.

Potential Challenges

• The application, benets, and limitations of the

Mortgage Tax Credit Certicate program can be

difcult to explain to borrowers.

• Borrowers may be subject to recapture tax

(although this is a low risk).

• State HFA MCC programs are subject to funding

availability and may run out when the bond funds

allocated to MCCs are expended.

A COMMUNITY BANKER CONVERSATION

Using the Mortgage Tax Credit

Certicate program

A banker from Kentucky helps her customers take advantage of the

Mortgage Tax Credit Certificate (MCC) program offered by the HFA. She

said she uses MCCs, which are certificates issued to qualifying homebuy-

ers that increase the federal tax benefits of owning a home. This helps

low- and moderate-income, first-time homebuyers offset a portion of

the amount they owe in mortgage interest by providing a tax credit that

can increase housing payment affordability. In some cases, an MCC may

also help borrowers qualify for a higher loan amount by increasing the

monthly income that can be used toward qualifying. “The MCC represents

an unclaimed pool of resources that even those of us who have been doing

this for a long time don’t always think about. People think it’s a lot of extra

work but it’s not; it’s just a few extra documents.”

RESOURCES

IRS MCC form

https://www.irs.gov/pub/irs-pdf/f8396.pdf

IRS Federal Recapture Tax information

https://www.irs.gov/instructions/i8828/ch01.html

See individual state HFA descriptions in Appendix A for

helpful mortgage tax credit certicate resources related

to the housing nance agency in each state.

FDIC | Affordable Mortgage Lending Guide | 26