Para información en español, visite www.consumerfinance.gov/learnmore o escribe a la

Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

A Summary of Your Rights Under the Fair Credit Reporting Act

The federal Fair Credit Reporting Act (FCRA) promotes the accuracy, fairness, and

privacy of information in the files of consumer reporting agencies. There are many types of

consumer reporting agencies, including credit bureaus and specialty agencies (such as agencies

that sell information about check writing histories, medical records, and rental history records).

Here is a summary of your major rights under the FCRA. For more information, including

information about additional rights, go to www.consumerfinance.gov/learnmore or write

to: Consumer Financial Protection Bureau, 1700 G Street N.W., Washington, DC 20552.

• You must be told if information in your file has been used against you. Anyone who uses

a credit report or another type of consumer report to deny your application for credit,

insurance, or employment – or to take another adverse action against you – must tell you, and

must give you the name, address, and phone number of the agency that provided the

information.

• You have the right to know what is in your file. You may request and obtain all the

information about you in the files of a consumer reporting agency (your “file disclosure”).

You will be required to provide proper identification, which may include your Social

Security number. In many cases, the disclosure will be free. You are entitled to a free file

disclosure if:

• a person has taken adverse action against you because of information in your credit

report;

• you are the victim of identity theft and place a fraud alert in your file;

• your file contains inaccurate information as a result of fraud;

• you are on public assistance;

• you are unemployed but expect to apply for employment within 60 days.

In addition, all consumers are entitled to one free disclosure every 12 months upon request

from each nationwide credit bureau and from nationwide specialty consumer reporting

agencies. See www.consumerfinance.gov/learnmore for additional information.

• You have the right to ask for a credit score. Credit scores are numerical summaries of

your credit-worthiness based on information from credit bureaus. You may request a credit

score from consumer reporting agencies that create scores or distribute scores used in

residential real property loans, but you will have to pay for it. In some mortgage transactions,

you will receive credit score information for free from the mortgage lender.

• You have the right to dispute incomplete or inaccurate information. If you identify

information in your file that is incomplete or inaccurate, and report it to the consumer

reporting agency, the agency must investigate unless your dispute is frivolous. See

www.consumerfinance.gov/learnmore for an explanation of dispute procedures.

• Consumer reporting agencies must correct or delete inaccurate, incomplete, or

unverifiable information. Inaccurate, incomplete, or unverifiable information must be

removed or corrected, usually within 30 days. However, a consumer reporting agency may

continue to report information it has verified as accurate.

• Consumer reporting agencies may not report outdated negative information. In most

cases, a consumer reporting agency may not report negative information that is more than

seven years old, or bankruptcies that are more than 10 years old.

• Access to your file is limited. A consumer reporting agency may provide information about

you only to people with a valid need -- usually to consider an application with a creditor,

insurer, employer, landlord, or other business. The FCRA specifies those with a valid need

for access.

• You must give your consent for reports to be provided to employers. A consumer

reporting agency may not give out information about you to your employer, or a potential

employer, without your written consent given to the employer. Written consent generally is

not required in the trucking industry. For more information, go to

www.consumerfinance.gov/learnmore.

• You many limit “prescreened” offers of credit and insurance you get based on

information in your credit report. Unsolicited “prescreened” offers for credit and

insurance must include a toll-free phone number you can call if you choose to remove your

name and address from the lists these offers are based on. You may opt out with the

nationwide credit bureaus at 1-888-5-OPTOUT (1-888-567-8688).

• You may seek damages from violators. If a consumer reporting agency, or, in some cases,

a user of consumer reports or a furnisher of information to a consumer reporting agency

violates the FCRA, you may be able to sue in state or federal court.

• Identity theft victims and active duty military personnel have additional rights. For

more information, visit

www.consumerfinance.gov/learnmore.

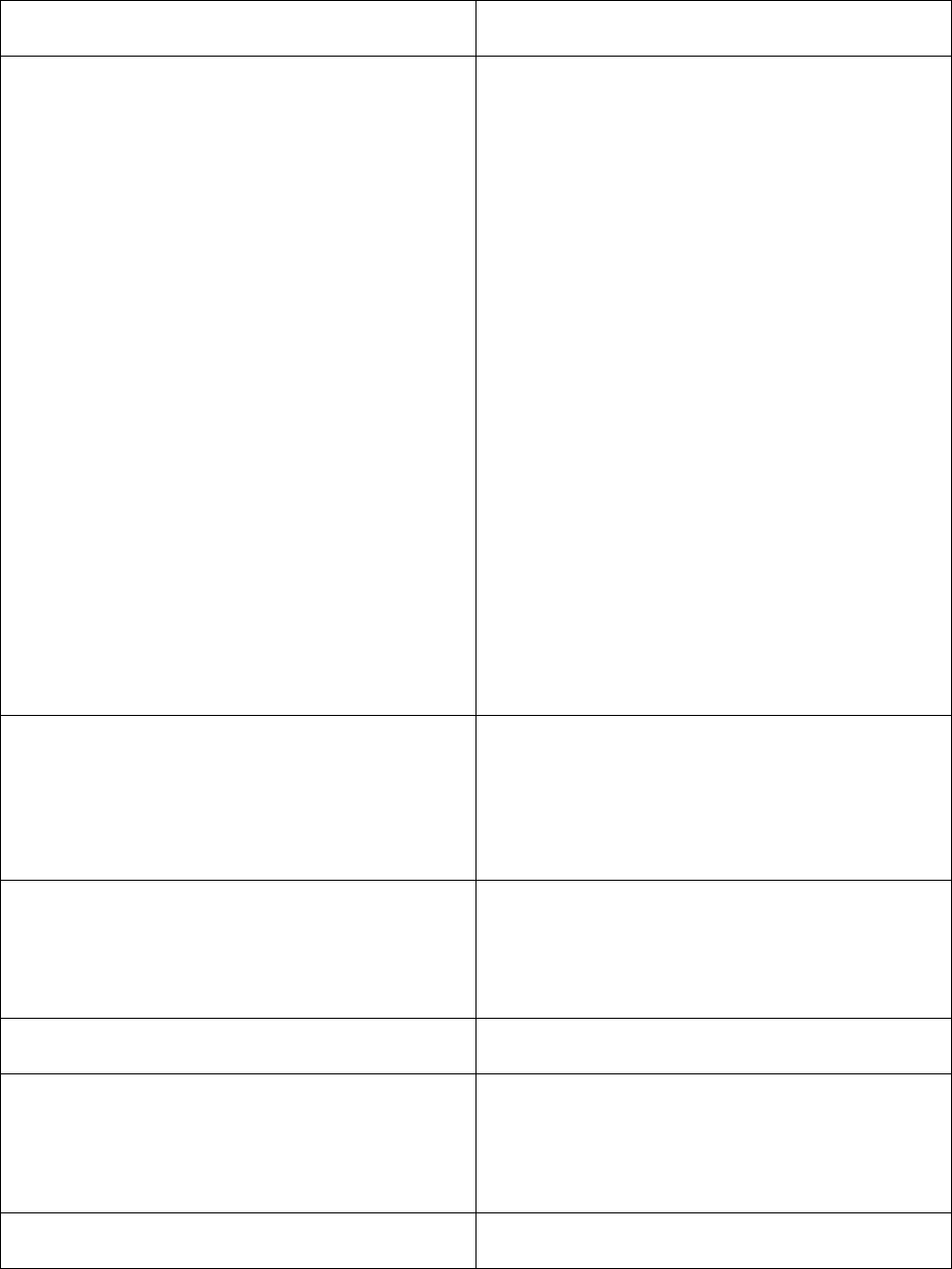

States may enforce the FCRA, and many states have their own consumer reporting laws. In

some cases, you may have more rights under state law. For more information, contact your

state or local consumer protection agency or your state Attorney General. For information

about your federal rights, contact:

TYPE OF BUSINESS:

CONTAC

T

:

1.a. Banks, savings associations, and credit

unions with total assets of over $10 billion and

their affiliates

b. Such affiliates that are not banks, savings

associations, or credit unions also should list,

a. Consumer Financial Protection Bureau

1700 G Street, N.W.

Washington, DC 20552

b. Federal Trade Commission: Consumer

Response Center – FCRA

in addition to the CFPB:

Washington, DC 20580

(877) 382-4357

2. To the extent not included in item 1 above:

a. National banks, federal savings associations,

and federal branches and federal agencies of

foreign banks

b. State member banks, branches and agencies

of foreign banks (other than federal branches,

federal agencies, and Insured State Branches of

Foreign Banks), commercial lending

companies owned or controlled by foreign

banks, and organizations operating under

section 25 or 25A of the Federal Reserve Act

c. Nonmember Insured Banks, Insured State

Branches of Foreign Banks, and insured state

savings associations

d. Federal Credit Unions

a. Office of the Comptroller of the Currency

Customer Assistance Group

1301 McKinney Street, Suite 3450

Houston, TX 77010-9050

b. Federal Reserve Consumer Help Center

P.O. Box. 1200

Minneapolis, MN 55480

c. FDIC Consumer Response Center

1100 Walnut Street, Box #11

Kansas City, MO 64106

d. National Credit Union Administration

Office of Consumer Protection (OCP)

Division of Consumer Compliance and

Outreach (DCCO)

1775 Duke Street

Alexandria, VA 22314

3. Air carriers

Asst. General Counsel for Aviation

Enforcement & Proceedings

Aviation Consumer Protection Division

Department of Transportation

1200 New Jersey Avenue, S.E.

Washington, DC 20590

4. Creditors Subject to the Surface

Transportation Board

Office of Proceedings, Surface Transportation

Board

Department of Transportation

395 E Street, S.W.

Washington, DC 20423

5. Creditors Subject to the Packers and

Stockyards Act, 1921

Nearest Packers and Stockyards

Administration area supervisor

6. Small Business Investment Companies

Associate Deputy Administrator for Capital

Access

United States Small Business Administration

409 Third Street, S.W., 8

th

Floor

Washington, DC 20416

7. Brokers and Dealers

Securities and Exchange Commission

100 F Street, N.E.

Washington, DC 20549

8. Federal Land Banks, Federal Land Bank

Associations, Federal Intermediate Credit

Banks, and Production Credit Associations

Farm Credit Administration

1501 Farm Credit Drive

McLean, VA 22102-5090

9. Retailers, Finance Companies, and All Other

Creditors Not Listed Above

FTC Regional Office for region in which the

creditor operates or Federal Trade

Commission: Consumer Response Center –

FCRA

Washington, DC 20580

(877) 382-4357