Building a Financially Resilient Government

through Long-Term Financial Planning

The Government Finance Officers Association

www.gfoa.org • 312-977-9700

By Shayne Kavanagh, GFOA senior manager of research

The concept of “sustainability” has captured the attention of local government leaders across the United States

and Canada over the past few years. This includes finance officers, as the term “financial sustainability” has come

to signify practices such as directing one-time revenues away from recurring sources of expenditure and taking into

account long-term maintenance and operating costs when planning and evaluating capital projects.

However, the current recession has taught us that sustainability is a necessary but insufficient condition to ensure

the ongoing financial health of local government. A sustainable system is balanced, but an external shock (like a

severe economic downturn) can unbalance the system and perhaps even collapse it. Local governments will contin-

ue to face serious challenges from outside, including but not limited to economic adjustments, natural disasters,

and important policy changes by other levels of government. As such, finance officers must strive to help their

organizations go beyond sustainability to a system that is adaptable and regenerative – in a word: resilient.

Jamais Cascio, a fellow at the Institute for Ethics and Emerging Technologies, identifies eight essential characteris-

tics of a resilient system:

1

• Diversity: Avoid a single point of failure or reliance

on a single solution.

• Redundancy: Have more than one path of escape.

• Decentralization: Centralized systems look strong,

but when they fail, the failure is catastrophic.

• Transparency: Don’t hide your systems.

Transparency makes it easier to figure out where a problem may lie. Share your plans and preparations, and

listen when people point out flaws.

• Collaboration: Work together to become stronger.

• Fail Gracefully: Failure happens. Make sure a failure state won’t make things worse.

• Flexibility: Be ready to change when plans aren’t working. Don’t count on stability.

• Foresight: You can’t predict the future, but you can hear its footsteps approaching. Think and prepare.

This article explores these characteristics as they relate to creating a financially resilient government and the central role

that long-term financial planning plays in financial resiliency. You can use these characteristics to evaluate your own

financial planning process and prepare a road map for its evolution. The Government Finance Officers Association

(GFOA) interviewed officials at several local governments that have been practicing long-term financial planning for a

number of years (some as long as 15 or 20) and that have, as a consequence, achieved financial resiliency. Below are

some examples of how these governments are not just surviving the current economic downturn, but thriving in it.

Building a Financially Resilient Government

through Long-Term Financial Planning

A sustainable system is balanced but

potentially brittle. A resilient system not

only survives shocks, it thrives even under

conditions of adversity.

page 1

AAA Bond Ratings Achieved. Several of our research subjects have had their bond ratings recently upgraded to

AAA, and one had its existing AAA reaffirmed. The rating agencies pointed to long-term financial planning as evi-

dence of management’s dedication to the practices that maintain long-term financial health. This is a stark illustra-

tion of the “flight to quality” that has been occurring in all investment markets.

Making Believers Out of Skeptics. One government recently had a new chief operating officer who was skeptical

of the value of long-term financial planning in the current economy. “What use are multi-year forecasts and strate-

gies under conditions of such volatility?” the COO reasoned. However, the COO was soon converted when she

witnessed how the fund balances built up in the good times could be used to buffer shocks, how the governing

board was highly engaged in serving as an effective steward over long-term financial health, and how the govern-

ment was spared the need to suddenly and reflexively resort to the same wrenching retrenchment tactics as many

of its neighbors. Of course, receiving an AAA bond rating played no small role in the COO’s change of opinion.

Preparing for the Future. Our resiliency research subjects have not only been able to avoid the most painful

retrenchment tactics, but have been able to make sound investments in their futures. For example, while many state

governments have been using stimulus funds to backfill their operating budgets and thereby defer tough budget

decisions, the City of Coral Springs, Florida, has been using stimulus funding to invest in labor-saving technolo-

gies. The city’s managers and officials believe that the economy is entering a “new normal” where former levels of

revenue can’t be expected to return. While long-term planning and financial reserves have bought the city some

time, this doesn’t mean the city can continue on indefinitely as it has. Therefore, officials have been supportive of

long-term technology investments that will allow the city to maintain its current service levels with fewer employ-

ees, as well as many other program and staffing adjustments that,

while not immediately necessary, will reduce the cost of city govern-

ment over the long term.

Saving Jobs. One of the most feared consequences of any reces-

sion is job loss. Our research subjects for this paper have been able

to avoid layoffs so far. Hanover County, Virginia, is particularly

enthusiastic about the potential of long-term planning to help to

preserve jobs. In Hanover County’s experience, the organization-wide perspective provided by a financial plan has

been instrumental in encouraging departments to shift underutilized employees to areas of greater need. For exam-

ple, the recession has reduced construction and the demand for building inspectors, so the county has been able to

use them for in-house construction projects and similar tasks where a contractor may have otherwise been used.

Hence, the county has been able to shift

building inspectors across tasks, thereby filling a real need while preserving jobs.

The rest of this paper will describe how long-term financial planning supports each of the eight essential charac-

teristics of a resilient system.

Building a Financially Resilient Government

through Long-Term Financial Planning

Our Featured Local Governments

City of San Clemente, California

City of Sunnyvale, California

City of Coral Springs, Florida

County of Hanover, Virginia

Mentor Public Schools, Ohio

page 2

Diversity. Avoiding a single point of failure or reliance on a single solution.

Keep a multi-faceted perspective on financial health.

Maintain a diversity of funds to reduce reliance on the general fund.

Enlarge the base of supportive constituents.

The most fundamental aspect of “diversity” in financial planning is a multi-faceted perspective on financial health.

The planners’ viewpoint should not be limited to focusing on revenues and expenditures. Land-use patterns,

demographic trends, and long-term liabilities (such as pensions) must all be carefully monitored. For example,

long-term financial planning has highlighted the connection between land-use policy and financial condition for

many of our research subjects, thereby directly influencing land-use policies. In Florida, the state distributes sales

taxes on a per-capita basis, rather than the point-of-sale method found in many other states. As a result, cities in

Florida don’t have the same powerful incentive for commercial development that many other cities have. Coral

Springs, though, has recognized that commercial properties are not subject to the same property tax restrictions as

residential properties, so commercial properties remain impor-

tant as net contributors to financial health.

2

This nuance has led

Coral Springs to emphasize diversity in local land use, while

many other cities in the area are primarily residential.

In another example, the City of Sunnyvale, California, like many

cities in the state, is part of the California Public Employees’

Retirement System (CalPERS). Warned by CalPERS about

potential rate increases, the city performed an independent

analysis and discovered that it may experience a 35 to 45 percent

increase in required contributions in the future. This has allowed

the city to begin planning now to mitigate and absorb this risk.

Another common theme among our research subjects is diversity in the funds maintained. Different funds can be

used to account for non-current liabilities such as OPEB, workers’ compensation, depreciation, and replacement of

assets. Self-supporting internal service funds contribute to efficient overhead services. These practices reduce the

burden on the general fund and keep it from becoming a single point of failure.

Finally, Mentor Public Schools in Ohio has consciously cultivated constituent diversity. For a school district, par-

ents are the most engaged constituents. However, district taxpayers who don’t have children are an indispensible

source of funding. Therefore, Mentor Schools takes special care to demonstrate its financial responsibility to par-

ents and non-parents alike, and to find out what non-parents think of the school district’s performance. For exam-

ple, Mentor Schools has an important use fee component to its extracurricular activities (it is not 100 percent tax-

supported) and has been mindful of keeping its asset portfolio consistent with future service demands – for exam-

ple, two properties were recently sold, thereby eliminating maintenance costs, generating a one-time revenue, and

placing the property back on the tax rolls. Enhancing financial management credibility by taking highly visible

actions like these enlarges Mentor Schools’ base of supporters.

Building a Financially Resilient Government

through Long-Term Financial Planning

page 3

Redundancy. Avoid having only one path of escape or rescue.

Maintain a reserve policy to prevent use for recurring expenditures and to specify the purpose

of reserves.

Institutionalize financial planning through governance practices like financial policies and

citizen engagement.

Pursue multiple strategies for long-term financial health.

Fund balances, or reserves, are the key to redundancy. Focusing on reserve levels across multiple funds helps make

sure each fund has appropriate backup. Our subjects agreed that the basis of strong reserves is good financial poli-

cy on reserves. A policy should prohibit fund balances from being used for recurring expenditures, save notable

exceptions like working capital, or providing temporary budgetary stabilization in an economic downturn. Reserves

must be taken very seriously by all managers and officials, so prohibiting unsustainable uses of fund balance

emphasizes the preservation of fund balance as the means of rescue from crisis situations.

Our subjects also agreed that it is important to create

reserves for specific purposes and to record these purposes

in a policy. This preserves the credibility of the reserve sys-

tem – the reserves are there for a widely understood and

agreed-upon reason, not as a slush fund. This, in turn, pro-

tects the integrity of the reserve – people see the restriction

as important and are less likely to propose inappropriate uses

and such proposals, even if made, are unlikely to receive

support. The City of San Clemente, California, for example, recently created a reserve for asset maintenance, an

activity that has been widely underfunded in many local governments.

Financially resilient governments are distinguished by the adoption of a policy supporting a financial planning

process that assesses the long-term financial implications of current and proposed operating and capital budgets,

financial policies, and service policies. In financially resilient governments, long-term financial planning is institu-

tionalized in the governance of the organization. This leads to consistent decisions. Financial policies are the cor-

nerstone of redundancy because they help preserve good practices through changes in elected officials and top

management personnel. The GFOA Best Practice, Adoption of Financial Policies, describes many of the most impor-

tant policies.

3

In addition to formal policies, community engagement can help assure the continuity of financial planning and

related practices. For example, Mentor Schools has a special citizen subcommittee focused on financial planning.

While the school board fully supports financial planning, it is subject to a variety of pressures and must address a

plethora of issues. However, the subcommittee never lets the school board forget the importance of Mentor

School’s long-term financial health. In Sunnyvale, citizens took a powerful step to institutionalize financial plan-

ning. The city’s charter study committee (made up of citizens) recently recommended amending the city charter to

require 10-year financial plans.

Building a Financially Resilient Government

through Long-Term Financial Planning

page 4

Reserves must be taken seriously by all

managers and officials, so prohibiting

unsustainable uses of fund balance

emphasizes the preservation of fund

balance as the means of rescue from

crisis situations.

Citizen engagement can also create more grassroots or viral support for financial planning in the community. Coral

Springs has an extensive citizen volunteer program, where citizens help with special projects, like canal clean-up, as

well as ongoing services like police patrol and call-center staffing. In addition to reducing staffing costs for the gov-

ernment, the volunteer program gives the city the opportunity to educate and fully engage citizens in the Coral

Springs business and financial planning model. The city has found that volunteers take accurate information about

the city’s financial condition and practices back to their friends and neighbors and often become advocates for these

practices. Thus, citizens come to expect a long-term, strategic approach to financial problems from the city.

Finally, resilient governments don’t bank on just one strategy to remain financial-

ly healthy – they rely on a combination of strategies: short- and long-term rev-

enue enhancement and expenditure reduction. For example, Sunnyvale has mod-

eled a combination of expenditure reductions, revenue enhancements, and draw-

downs on the city’s budget stabilization reserve to cope with the economic

downturn. While the short-term pressure is the most immediate concern for

many in Sunnyvale, the financial strategy also includes a two-tiered retirement

system (i.e., reduced benefits for new employees) that doesn’t save much right

away but saves $1.5 million annually by the eighth year of the plan, and a total of $44 million in the general fund

over a 20-year period – in a general fund operating budget of about $125 million.

Decentralization. Centralized systems look strong, but failure is catastrophic.

Make managers manage their cost and revenue structures.

Engage departments in identifying issues, analyzing them, and developing strategies.

Engage departments in financial modeling and forecasting.

Develop an organization-wide strategic framework that departments can innovate within.

Decentralization is about engaging operating departments in financial planning so that all departments think more

strategically about finance, rather than long-term financial health relying solely on the efforts of central administration.

The bedrock of decentralization is for all departments to be responsible for their own budgets. For instance, a

large county in the western United States made departments more responsible for program revenues by directly

linking their budget allocations to program revenue income. In one large Midwestern city, budget analysts had been

assigned to each department in order to monitor budget compliance and, where necessary, cajole the department

into compliance. In search of a better approach, the analysts were withdrawn and re-assigned to other tasks, while

department heads who exceeded their budgets were called in front of the board’s finance subcommittee, in a pub-

lic meeting, to explain the negative variances and what is being done to correct the situation. The department head

must then return to these meetings until the problem is corrected and for a period afterward to guard against

relapse. Needless to say, department heads prefer to avoid these meetings and are therefore much more rigorous in

managing their budgets than before.

Building a Financially Resilient Government

through Long-Term Financial Planning

page 5

Sunnyvale goes beyond these fundamental steps by making departments fully responsible for their long-term cost

and revenue structure, including the operating impact of proposed capital projects. In fact, there was recently a

high level of interest in a new park in the community, and the recreation director was one of the most vocal advo-

cates for having a long-term funding strategy for maintenance in place before committing to building the park.

With this basic ethos of making managers manage their budget in place, it

becomes possible to take a decentralized approach to financial plan devel-

opment. Through its financial planning process, the finance and operating

staff at the City of San Clemente identifies a number of “critical issues”

that could affect the future financial health of the city. A number of

cross-functional “issue teams” are then formed to analyze each issue and

suggest strategies. San Clemente has found that staff members are eager

to participate on the teams (some even requesting a spot a year in

advance) because they know that the decisions made during the planning

process are important and that positive involvement is a key to advance-

ment at the city. The consistent and meaningful involvement of depart-

ments in identifying issues, analyzing them, and developing strategies is a

consistent theme in financially resilient governments.

Involving departments in financial forecasting and modeling hones their

understanding of financial condition, and, hence, their perception of the

need for a solid, long-term financial strategy. It also improves the quality

of the forecast. Hanover County realized that in the new economic reality,

historical data was not as useful as it had been in making projections.

Qualitative judgment was more important than ever. The county formed cross-departmental teams to examine

major revenue sources and develop key forecast assumptions. For example, community development, economic

development, and assessor personnel were all involved in analyzing the property tax.

Finally, and perhaps most importantly, long-term planning fosters a strategic framework for creating value for the

public through government programs. The long-term plan articulates the service objectives the government is

striving for and defines the parameters within which the government will pursue these objectives. Departments can

then develop their own plans and budgets, yet remain aligned with the big picture. A plan drives action and pre-

vents paralysis by analysis or inertia. The plan grants permission to try new things to further the plan’s objectives.

All of these characteristics promote the innovation that is needed to adapt to changing financial conditions. When

it is accepted that everyone is working toward the same objective, innovation is more likely because commonality

of purpose makes new ideas that diverge from the established order permissible – if the innovation is intended to

achieve a high-priority strategic goal, then the effort is respected.

As an illustration of how planning can create shared goals, Hanover County has found that its planning process

has been very important in creating a widely held acceptance of the value of teamwork across departmental lines.

Building a Financially Resilient Government

through Long-Term Financial Planning

page 6

In Hanover, objectives are established through the planning process, and reliable information relative to the objec-

tives and financial condition is disseminated. The county then reinforces the importance of inter-departmental

information sharing by creating communication channels across departmental lines. For example, training and pro-

fessional development is often one of the first expenditures to come under pressure during a revenue downturn,

yet training is a primary source of the innovations that are needed to improve cost-effectiveness. Hanover has used

its planning process to establish and support an objective for high-quality professional development across the

organization, including encouraging joint training opportunities across departments.

Transparency. Make it easier to figure out where a problem may lie. Share plans and listen when

people point out flaws.

Promote transparency in key areas like goals and objectives, forecast assumptions, and

reserve standards.

Use full-cost (direct and indirect) accounting for programs.

Transparency implies openness, communication, and accountability Transparency pervades the financial planning

practices of financially resilient governments. Following is some of the most important information to make trans-

parent.

• The Organization’s Goals and Objectives. Make sure everyone knows what the goals are, how they were

arrived at, and what activities will be undertaken in pursuit of the goals.

• Forecast Assumptions. The assumptions that drive revenue and expenditure trends should be available for

examination. Some key assumptions include population/enrollment trends, employee headcount, changes in

property values, and changes in consumer behavior.

• Reserve Standards. What amounts will the government endeavor to hold in reserve, and why? What

amounts are actually being held? Are these amounts too much or too little? Clarity on these questions (espe-

cially when the amounts held are high) is essential to maintaining the credibility and integrity of the reserve

system.

The GFOA’s research subjects have also found that full-cost accounting for services (direct and indirect costs) is

essential to resiliency. Full-cost accounting makes the cost of doing business transparent. Transparency leads to

trust, as everyone can see what the true cost of doing business is for all services, including support services such

as budgeting and finance. Transparency and trust leads to better-informed discussions about the relevance and

contribution of services, and to opportunities for enhancing revenues, for increasing operational efficiencies, and

for enhancing the credibility of the financial management system among management, elected officials, and the

public.

4

Building a Financially Resilient Government

through Long-Term Financial Planning

page 7

Collaboration. Working together to become stronger.

Build elected officials’ service priorities into the plan.

Provide elected officials a role in that planning process – a role they can thrive in.

Orient elected officials to the planning process.

Use key indicators to help elected officials stay abreast of financial condition.

Elected officials have an incalculable impact on financial health because they have the final say over tax policies and

budgets. Therefore, resilient governments foster close collaboration between elected officials and staff to help both

groups become more savvy financial decision makers, better recognize problems, and enact appropriate solutions.

The first step is to engage elected officials by building their service priorities into the financial plan. In addition to

demonstrating that the plan is relevant to their service goals, this step provides a common basis for participation in

the planning process – although not every official will be comfortable discussing financial issues, all can discuss

and appreciate service issues.

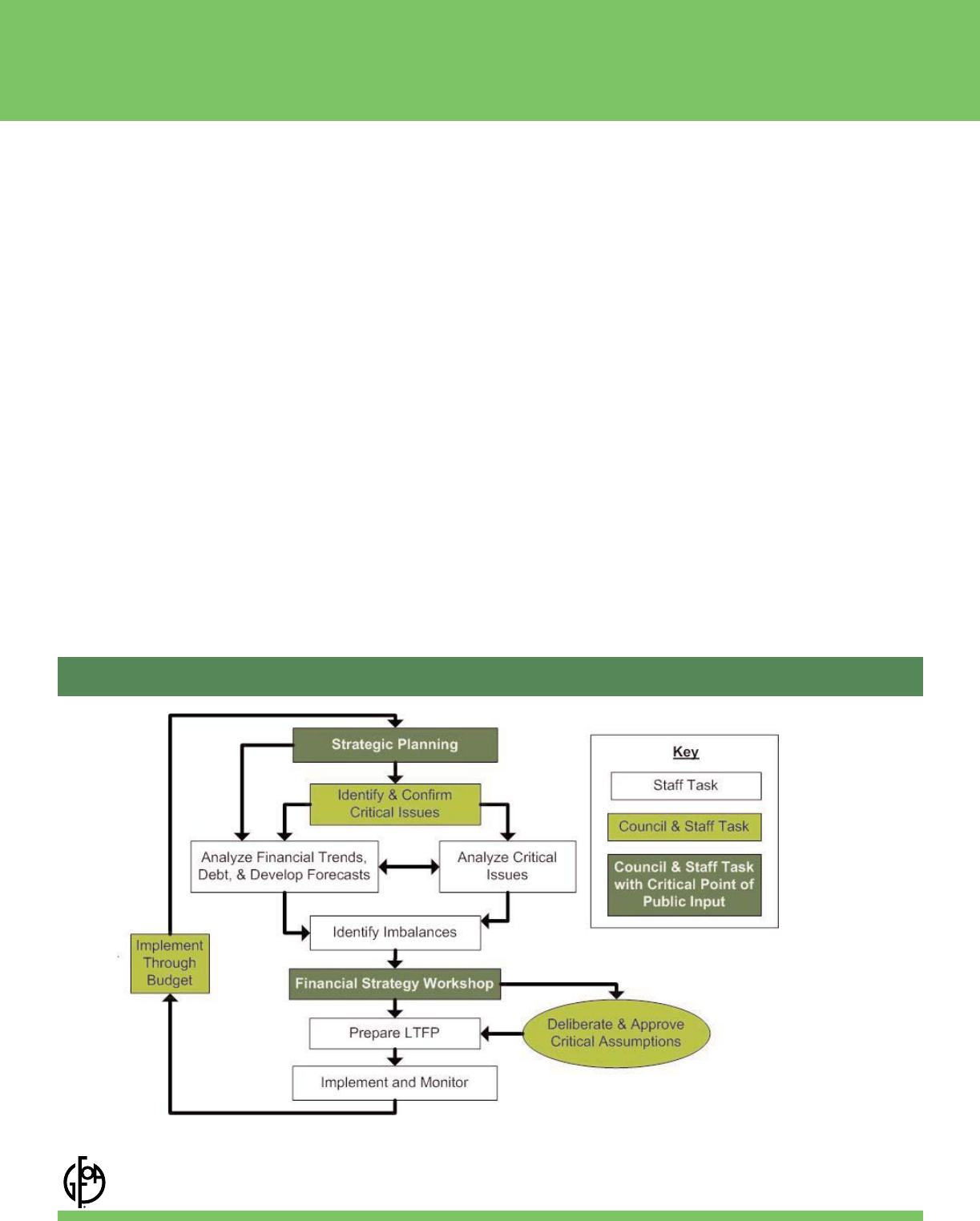

The next step is to provide elected officials with a role in the planning. Exhibit 1 provides an overview of the City

of San Clemente’s planning process and how elected officials are engaged. The shaded boxes are crucial points of

involvement. The Council sets service goals through strategic planning, helps to identify issues that affect the

Building a Financially Resilient Government

through Long-Term Financial Planning

page 8

Exhibit 1: Council Involvement in San Clemente’s Planning Process

financial health of the city, and reviews and approves the critical assumptions behind the staff ’s suggested financial

strategies – assumptions that will shape how the annual budget is developed.

When new officials are elected, they must be introduced and acclimated to planning process. Resilient governments

have a formal orientation program and periodic refreshers. San Clemente, for example, has an annual financial poli-

cy compliance self-review of its policy portfolio. San Clemente has found this is a

good way to keep elected officials engaged with financial policies. In addition to

these formal mechanisms, regular one-on-one meetings on financial issues give

officials a chance to ask questions that they may not be comfortable asking in a

public meeting. The impact of all of these efforts is to create a culture on the gov-

erning board in favor of financially resilient decisions. Once in place, the culture

can become self-sustaining as new officials are subject to peer pressure and exist-

ing officials take their own actions to promote resiliency (such as Sunnyvale’s

aforementioned charter amendment, which was driven by public rather than staff

action).

Finally, key indicators of financial condition should be established and communi-

cated to help elected officials remain confident that they have a handle on financial

condition. Mentor Public Schools, for example, keeps its board up-to-date on

three key indicators:

• Percent of budget spent on personnel (with 85 percent as an upper threshold).

• Recurring revenue versus expenditures (including biannual forecast updates).

• Enrollment trends versus staffing (keeping student to staff ratios consistent).

Fail Gracefully. Failure happens. Make sure failure won’t make things worse.

Recognize changing conditions to make a soft landing.

Promote credibility and open dialogue to learn from and correct failure.

Financially resilient governments recognize, through forecasts and environmental scanning, changing conditions in

order to make a soft landing. When Sunnyvale adopted its fiscal year 08/09 budget in June of 2008, staff had pre-

dicted an economic downturn, but had not yet seen any evidence in their revenues because city revenues typically

lag the economy. By August 2008, the city began to see slight indications, but economic information (from con-

stant scanning of the environment) led them to believe that things were going to be substantially worse. Hence,

they began to plan for a serious fiscal challenge and were therefore better able to cope with the economic crisis

that finally manifested. In 2004, Coral Springs recognized that politics in the state were headed toward major resi-

dential property tax reform, including austere restrictions on local tax autonomy. At that point, the city started

making changes such as diversifying its tax base and streamlining operations to make sure its workforce didn’t

expand beyond the city’s means. When reform eventually came in 2007, Coral Springs was prepared.

Building a Financially Resilient Government

through Long-Term Financial Planning

page 9

Few, however, predicted the full breadth and severity of the current economic downturn. When caught in a finan-

cial decline, resilient governments quickly recognize it and react by updating forecasts, modeling new scenarios to

define the financial parameters within which they must develop strategies, continually monitoring the environment

for change, and maintaining open communication with departments so they can take corrective action. Hanover

County has found it particularly

important to maintain open commu-

nication with the board. If news of

failure is attenuated in an effort to

reduce political fallout, the board will

not fully appreciate the gravity of the

situation, thereby lessening their sup-

port for retrenchment and recovery

strategies, eventually making the situ-

ation even worse.

Financially resilient governments use long-term planning to enhance the credibility of the financial management sys-

tem and promote open dialogue about financial condition. A projected imbalance isn’t cause for recrimination – it is

an opportunity to take preventative action to avoid crisis. Financially resilient governments are careful not to posi-

tion forecasts as a “prediction” of future financial position, but rather as a tool to: 1) recognize longer-term issues

that require a strategic approach; and 2) establish financial parameters within which service strategies must operate.

Resilient governments are also skilled at setting and managing to measurable financial goals. Communication of

these goals (including deviations from planned performance) is essential for credibility and encouraging fact-based,

data-driven financial decision making. For example, Hanover County’s financial goals include protecting its AAA

bond rating and getting through the financial downturn without layoffs – two very measurable goals, the impor-

tance of which are easy to communicate.

Flexibility. Be ready to change when plans aren't working. Don’t expect stability.

Regularly diagnose the strategic environment to know when flexibility may be required.

Create financial models to show the impact of changes.

Evolve and adapt the financial planning process itself.

Financially resilient governments are constantly monitoring their environment and financial condition to see if

financial strategies are working and to learn of conditions that might call for a change in approach. Regular plan

updates are a formal tool all the GFOA’s research subjects use, but they have also all developed an institutional

habit of taking time to look beyond the day-to-day business of government for issues that could affect financial

health. These “strategic diagnosis” exercises are important for strengthening this critical capacity.

Resilient governments also have financial modeling and scenario analysis capabilities to determine the impact of

changes in assumptions and financial strategies. For example, Hanover County used its models to show how

Building a Financially Resilient Government

through Long-Term Financial Planning

page 10

deferred maintenance would affect the life cycle of capital assets. This allowed the county to make informed deci-

sions on deferment, including the long-term cost required to make up the impact of these deferments later.

Finally, resilient governments evolve their planning process as needed to address new issues, accommodate new

stakeholders, keep up with best practices, and otherwise adapt to the changing needs of the organization. For

example, the diagram in Exhibit 1 was developed by San Clemente a few years ago as part of a redesign of its

financial planning process to improve the elected officials’ involvement in planning. San Clemente also designates a

special “theme” for each planning cycle to capture the issues that are driving planning that year. For example, the

theme for most recent planning cycle was “Fiscal Tune-Up,” acknowledging the need to reaffirm fundamental

good financial management practices in a time of financial pressure.

Building a Financially Resilient Government

through Long-Term Financial Planning

page 11

Exhibit 2: Don’t Expect Stability

VIX is the ticker symbol for the Chicago Board Options Exchange Volatility Index, a popular measure of the implied

volatility of S&P 500 index options. A high value corresponds to a more volatile market. Sometimes referred to as the

“fear index,” it represents one measure of the market's expectation of volatility over the next 30-day period.

5

Unsurprisingly the VIX reached all-time highs in the fall of 2008 and has been well above historical levels over the past

12 months.

6

Foresight. Think and prepare.

Develop effective forecasting techniques.

Build capacity among staff and elected officials for strategic diagnosis.

Complement financial planning with other long-term plans.

Financial forecasts are at the crux of foresight. Our research subjects suggest:

• Using forecasts to identify the parameters within which to develop and execute strategies, rather than to try to

“predict” the future.

• Involve others in forecasting. Operating departments can improve the qualitative judgment applied to the

forecast. Elected officials can review critical assumptions.

• Develop capacity for flexible scenario modeling to show the impact of different possible futures.

Regular review of the environment is essential for diagnosing strategic issues. Elected officials and executive manage-

ment should be involved in strategic diagnosis to promote informed and realistic financial decision making. Coral

Springs found that its strategic diagnosis helped officials and management accept that a return to the halcyon condi-

tions of the early 2000s was unlikely and that the city should begin positioning itself early to operate effectively under

new fiscal realities – this included opening union contracts, revising

personnel schedules and deployment, and automating work processes.

Other departments outside of finance often put a great deal of effort

into their own long-term plans. These plans can be a source of fore-

sight into financial condition. Resilient governments connect their

long-term financial planning process to these other plans to increase the quality of their forecasting and strategic diag-

nosis. For example, a comprehensive land use plan might suggest long-range facility requirements.

Resilient governments have also found that successful long-term financial planning builds interest in better long-

term planning in other areas. Mentor Public Schools, for instance, has seen improvement in its long-term plans and

studies for capital, maintenance, technology, instruction, equipment replacement, and enrollment trending as a

result of the interest in the long term generated by financial planning. These plans improve the quality of the fore-

cast and help identify possible points of future fiscal failure.

Conclusion

Financial resiliency is essential to continuing a consistent program of public services despite the current volatile

economic environment. A number of local governments from across the country have achieved financial resiliency

and realized benefits such as AAA bond ratings and a soft landing in the current recession. Most importantly,

though, these governments have been able to maintain the trust and confidence of their constituents and continue

to create value for the public through government action.

Building a Financially Resilient Government

through Long-Term Financial Planning

page 12

Successful long-term financial

planning builds interest in better

long-term planning in other areas.

Notes

1

Jamais Cascio, “The Next Big Thing: Resilience,” Foreign Policy, May/June 2009.

2

“Net contributor” means that a constituent contributes more in tax revenues that are used in services.

3

All GFOA best practices are available at www.gfoa.org.

4

Jon Johnson and Chris Fabian, “Leading the Way to Fiscal Health,” Government Finance Review, December 2008, pp. 16-26.

5

Description of VIX taken from Wikipedia.

6

Graph from Yahoo.com.

Shayne Kavanagh is the senior manager of research for GFOA. He has written GFOA publications including

Financing the Future: Long-Term Financial Planning for Local Government and Financial Policies: Design and Implementation.

Mr. Kavanagh has worked directly on a number of long-term financial planning projects and served as the project

manager for projects at the City of Montclair, California; the City of Gresham, Oregon; the City of San Juan

Capistrano, California; and Wayne County, Michigan. He has spoken on the topic of financial planning and policies

at the California Society of Municipal Finance Officers, the New England States GFOA, the Michigan GFOA, the

International City/County Management Association, National League of Cities, and the GFOA annual conference.

Mr. Kavanagh has written articles on financial planning that have appeared in journals such as Government Finance

Review, Public Management, and School Business Affairs. Prior to joining the GFOA, he was the assistant village manag-

er for the Village of Palos Park, Illinois. Mr. Kavanagh has an MPA degree from Northern Illinois University.

For more information about the GFOA Research and Consulting Center, e-mail [email protected].

Acknowledgements

The author would like to thank the following people for their generous assistance:

Mary Bradley, Finance Director, City of Sunnyvale, California

Joe Casey, Deputy County Administrator, County of Hanover, Virginia

Robert Goehrig, Budget and Strategic Planning Manager, City of Coral Springs, Florida

Pall Gudgeirsson, Assistant City Manager/Treasurer, City of San Clemente, California

Anne Kinney, Director of Research and Consulting, GFOA

Vivian McGettigan, Director of Finance, County of Hanover, Virginia

Daniel Wilson, Chief Financial Officer, Mentor Public Schools, Ohio

Building a Financially Resilient Government

through Long-Term Financial Planning

page 13