UBS Investor Watch

Switzerland insights: What’s on investors’ minds / 2019 Volume 1

Own your

worth

Why women should take

control of their wealth

to achieve nancial well-being

UBS Investor Watch2 of 16

For our latest UBS Investor Watch, we conducted

extensive research to study how women around

the world engage with their nances. We

surveyed nearly 3,700 married women, widows

and divorcees in Brazil, Germany, Hong Kong,

Italy, Mexico, Singapore, Switzerland, the UK

and the US.

We wanted to know: How do women around

the world approach their nancial well-being?

Are they fully engaged in the nancial decisions

that aect them? And if not, why not?

3 of 16

The answers are surprising.

Conventional wisdom oen says that women don’t

participate much in their nancial well-being, letting

their spouses take the lead instead. That wisdom is only

partly true. In fact, more than 80% of women globally

are highly involved in their short-term nances, such as

daily expenses, budgeting and cash ow.

Surprisingly, however, almost 60% of women do not

engage in the most important aspects of their nancial

well-being: investing, insurance, retirement and other

long-term planning.

Why do so many women focus on the present but ignore

the future?

The reasons dier, oen dramatically, across markets.

For example, women in the US and Singapore opt out of

long-term nancial decisions because they believe their

spouses know more. Women in Italy and Brazil say they

have more urgent responsibilities. Women in Switzerland

and Germany say their spouses never encouraged their

involvement.

Regardless of the rationale, failing to plan for the future

carries risk. As women around the world live longer, the

likelihood of becoming widowed or divorced increases.

Inevitably, women who plan for these possibilities will

be better prepared.

But women don’t need to do it alone.

In fact, women who approach long-term decisions in

partnership with their spouses report soaring levels

of satisfaction. Nearly all have high condence in the

future, feel less anxious about money and make fewer

nancial mistakes.

By sharing decisions jointly, both women and men can

face the future with optimism—and set an example of

nancial partnership for generations to come.

UBS Investor Watch4 of 16

1

Increasing lifespans bring women’s long-term

nancial needs to the forefront...

Women are expecting a long future, as lifespans continue to increase in the majority of the

world, and experts predict that women in several countries will likely live into their nineties on

average. In fact, 68% of women believe they will outlive their spouse.

With this in mind, women place particular importance on their long-term nancial needs. For

example, three-quarters (76%) say retirement planning is a top concern. Seven in 10 say long-

term care and insurance planning are highly important as well.

Women’s top long-term nancial needs

Percentage of women who cite each as highly important

retirement

planning

long-term care

planning

76%

72%

Women are aware of their increasing longevity

believe they will outlive

their spouse

68%

Insurance

68%

I’m really concerned with the rising costs

of healthcare and whether I can aord

my current lifestyle aer retirement.

“

“

I know that at some point in time I will

have to manage my nances alone and

I am denitely concerned about it.

“

– Switzerland, Female, 50 – Singapore, Female, 43

“

5 of 16

...but many women focus disproportionately on

short-term nancial needs

Though women are aware of their increasing longevity and the nancial needs associated with it,

most tend to focus their eorts on short-term nancial responsibilities. Eight in 10 women, for

example, are highly involved in managing the household’s day-to-day expenses and paying the

bills.

In contrast, only 23% of women take charge of long-term nancial decisions, such as investing,

nancial planning and insurance—which can have far more impact on their future than balancing

a checkbook. Only 19% of women share long-term nancial decisions with their spouses. Instead,

the majority of women (58%) defer to their husbands.

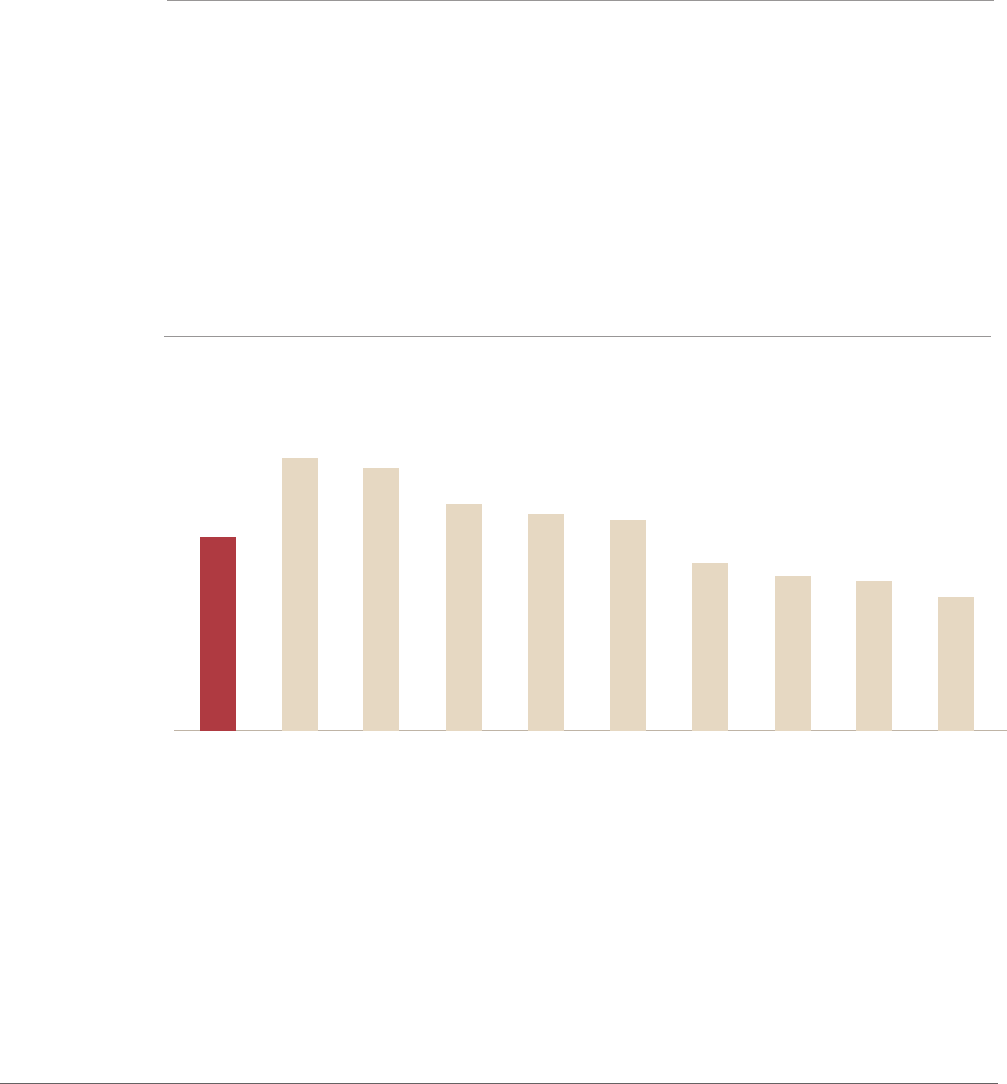

...but many opt out of long-term nances

Role in long-term investment and nancial planning decisions

Most women are highly involved in short-term nances...

Women who are equally or more involved than their spouses

manage day-to-day

expenses

85%

participate in large

purchase decisions

83%

pay bills

80%

58%

“My spouse

takes the lead.”

23%

“I take

the lead.”

19%

“We share

decisions equally.”

– UK, Female, 48

– Singapore, Female, 48

Leading the household, paying the bills and

all other day-to-day expenses fall under me,

whereas investing is under him.

“

“

I am responsible for paying all the bills,

shopping and handling bank accounts while

my spouse is responsible for major things

like investing in the stock market.

“

“

UBS Investor Watch6 of 16

2

Many women defer long-term nancial decisions

to spouses...

Though most women defer to their spouses on long-term nancial decisions, there are signicant

dierences across markets. For example, women in Singapore, Hong Kong and Switzerland are

the most likely to defer. Women in the UK and Germany also defer, though to a lesser degree.

Just over half of women in Italy (52%) and the US (54%) defer.

Notably, women in Mexico and Brazil are the least likely to defer to their spouses. More than half

of these women either make long-term nancial decisions jointly or take the lead themselves, the

highest among all the markets surveyed.

How women defer nancial decisions around the world

US

54%

21%

25%

UK

62%

22%

15%

Switzerland

69%

22%

9%

Germany

60%

21%

20%

Hong Kong

71%

20%

9%

Mexico

39%

30%

32%

Brazil

45%

33%

22%

Italy

52%

19%

29%

Singapore

72%

20%

8%

Spouse lead

Women lead

Shared

My spouse takes the lead on investment

decisions as he has more knowledge

and experience.

“

– Hong Kong, Female, 42

“

I was good with managing my money

and not spending more than I had, but

I wasn’t inclined to want to learn about

investing. I just sort of repelled from it.

“

– US, Female, 65

“

Figures may not add to 100% due to rounding.

7 of 16

...because they believe men know more about

investing and planning

Women who defer to their spouses have many reasons for doing so, such as more

urgent responsibilities, a lack of interest in long-term nances and even discouragement

from their spouses.

However, the main reason has to do with women’s assumptions about who knows

more. A full 82% of women think their spouses know more about long-term nances,

citing this belief as their top reason for deferring.

Reasons why women abdicate long-term investing decisions

Percentage of women who cite the following as reasons they defer to their spouse

“I think my spouse knows more

about this topic than I do.”

82%

“We take a divide-and-conquer approach;

I focus on other responsibilities.”

79%

“My spouse is the primary

breadwinner in the family.”

78%

“I’m not interested in

planning and investing.”

68%

“My spouse had more assets than

I did when we got married.”

67%

“Truth be told, I feel like

it’s my spouse’s money.”

64%

“My spouse never encouraged or

invited me to be more involved.”

58%

“My spouse discouraged me

from being more involved.”

56%

I want to be more involved in making the

investment decisions so I can learn, but

my partner thinks I’m not that capable.

“

– Italy, Female, 44

“

From the day I married him, he was the one

who always managed the nances, so I think

it’s a matter of experience. He’s gained all

the knowledge with regard to investments.

“

– Mexico, Female, 52

“

UBS Investor Watch8 of 16

3

Across markets, women reveal stark dierences in

why they defer to spouses

When comparing markets, it is clear that women have dierent reasons for deferring to their

husbands. For example, Brazilian women are most likely to defer because they believe their

husbands have more nancial knowledge, compared to 57% of German women who feel the

same. Women in Italy and Singapore are likely to say they have more pressing responsibilities,

while Swiss women are most likely to say their spouse never encouraged them to be involved.

Reasons women defer, by market

Percentage of women who defer to their spouses agree

“My spouse never encouraged

or invited me to be involved.”

64%

74%

74%

49%

37%

66%

81%

59%

22%

Brazil

Italy

Germany

Hong Kong

Mexico

Singapore

Switzerland

UK

US

“It’s a divide-and-conquer

approach. I have other

responsibilities to take care of.”

86%

87%

79%

80%

70%

86%

81%

75%

69%

Brazil

Italy

Germany

Hong Kong

Mexico

Singapore

Switzerland

UK

US

“I think my spouse knows more

about this topic than I do.”

93%

78%

57%

79%

83%

90%

81%

85%

88%

Brazil

Italy

Germany

Hong Kong

Mexico

Singapore

Switzerland

UK

US

“

– Hong Kong, Female, 42

The nancial world feels like a mystery

and I don’t feel like I have a good handle

on it. I always wanted someone else

to do it so I wouldn’t have to.

“

– US, Female, 65

“

My husband is the primary breadwinner

in my family, so he takes care of the

major nancial responsibilities.

“

9 of 16

Women who participate with spouses equally enjoy

the benets of shared decisions

Women who participate in long-term nancial decisions with their spouses not only increase

their chances of nancial security, but they feel more positive about the future.

For example, nine in 10 women who make joint decisions feel less anxious and more condent

about their nancial security. Nearly all feel more prepared to manage their nances if

something happens to their spouse.

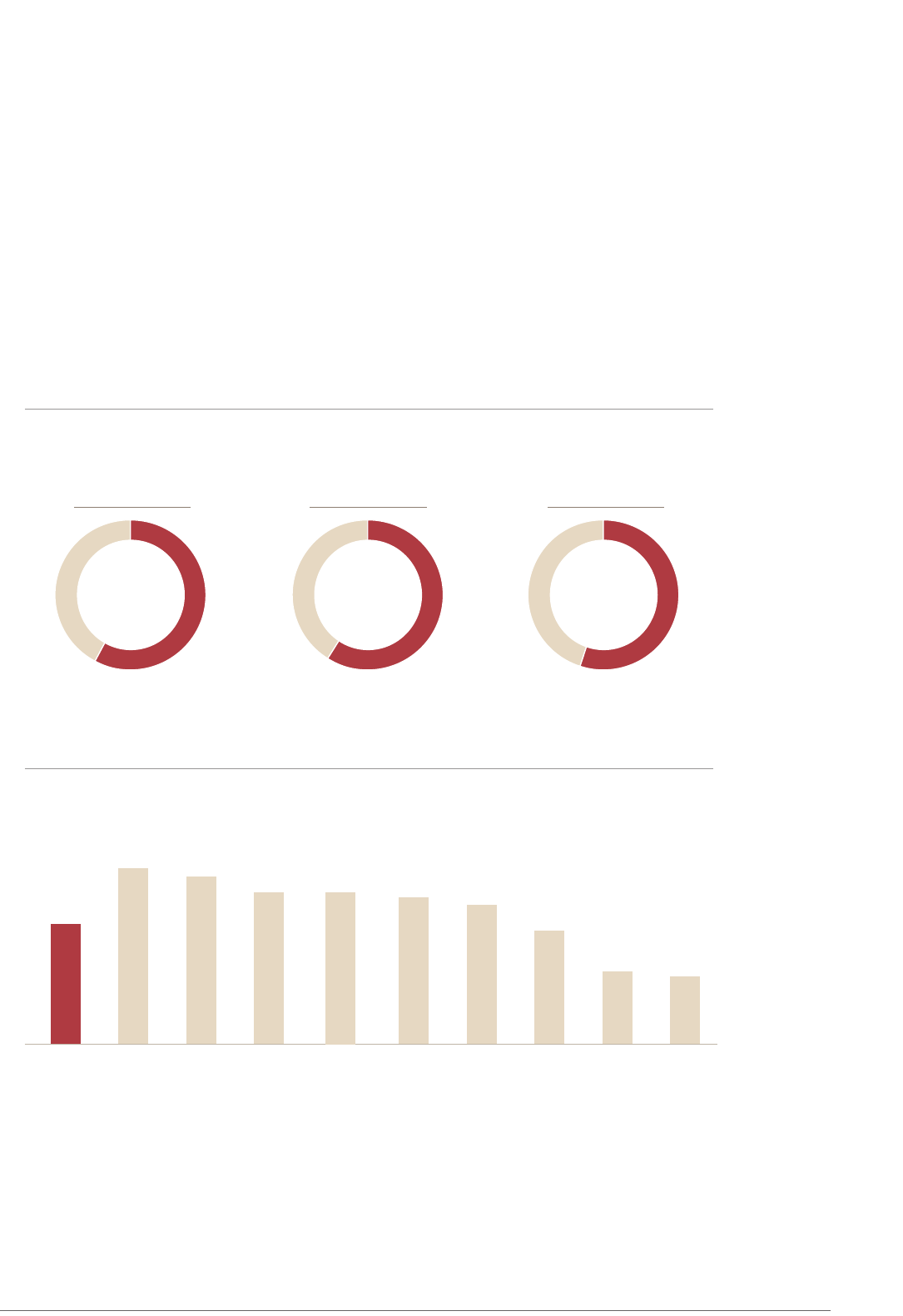

The benets of shared decisions

Percentage of women who share in long-term nancial decisions agree

95%

“ If something

happens to my

spouse, I will

already know

all about our

nances.”

94%

“ I’m more

condent

about our

nancial

future.”

93%

“ We make

fewer

mistakes with

both of us

involved.”

91%

“ I am less

stressed about

our nances.”

“

– Brazil, Female, 55

Equally participating in the investment

decisions helps us to maintain transparency.

It also reduces the chance of making any

wrong decisions related to such crucial

matters of investment.

“

– Mexico, Female, 50

“

Sharing the responsibilities really

distributes the nancial pressure

and we make equal contributions

to our living standards.

“

UBS Investor Watch10 of 16

4

Many women learn the costs of deferring when

marriages end

Few women realize the consequences of deferring until aer a divorce or the death of a spouse.

Some widows and divorcees were disappointed to discover hidden debt and inadequate savings

that compromised their lifestyle.

With the wisdom of hindsight, 76% of widows and divorcees wish they had been more involved

in long-term nancial decisions while they were married. Nearly eight in 10 (77%) urge other

women to take a more active role. Women in Mexico and the US feel most strongly about

encouraging women to take action.

Widows and divorcees advise greater nancial engagement

discover negative

nancial surprises

74%

encourage other

women to take a

more active role

in their nances

77%

wish they had been

more involved in

long-term nancial

decisions

76%

Call to action

Widows and divorcees who urge greater involvement, by market

84%

Brazil

62%

Switzerland

88%

Italy

61%

Hong Kong

81%

UK

57%

Singapore

99%

Mexico

98%

US

64%

Germany

77%

Overall

Most of the time I took no interest

in nancial decisions, which is why

we were not equipped for this awful

situation.

“

– Germany, Female, widow

“

My regret is that I didn’t learn as much

as I should have during my marriage.

I was too preoccupied with my work,

the house and the children.

“

– UK, Female, divorcee

“

11 of 16

Younger women are perpetuating the status quo

In a counterintuitive twist, younger women are even more willing than older women to leave

investing and nancial planning decisions to their spouses. Nearly 60% of women under 50

defer to their spouses, compared to 55% of women over age 50.

Younger women are most likely to say they have more urgent responsibilities than investing

and nancial planning. They are also most likely to believe their spouses know more about

long-term nances than they do. Rates of deferral among young women are highest in

Singapore and lowest in Brazil.

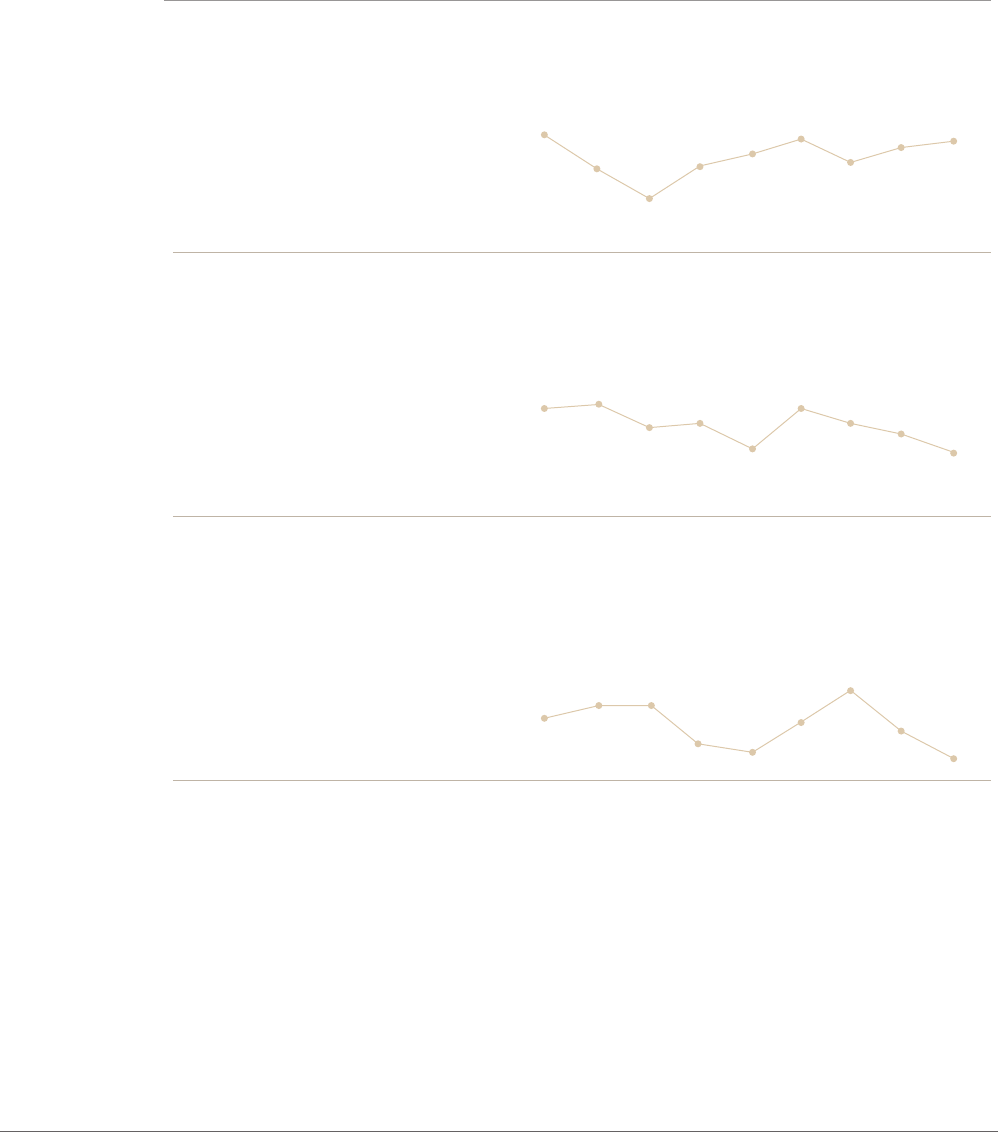

Younger women defer at higher rates

Women who defer to spouses, by age group

59%

20–34

59%

35–50

55%

51+

Rates of deferral among younger women

Women age 20–34 who defer, by market

59%

73%

69%

65%

63%

61%

56%

41%

40%

Overall

Singapore

UK

Hong Kong

Germany

Switzerland

US

Mexico

Brazil

Italy

65%

Generation spotlight

With my husband taking the lead on

investment decisions, it allows me to

concentrate on my children more.

“

– Germany, Female, 41

I’m exhausted with running around with

the toddler and have fears about my own

lack of investing knowledge.

“

– US, Female, 38

““

UBS Investor Watch12 of 16

5

Increasing lifespans bring long-term nancial needs

to the forefront…

With increasing life expectancy come new nancial challenges to consider, particularly regarding

retirement. At present, 76% of Swiss women rate retirement planning as their most important

long-term nancial need, while 75% rate long-term care planning as the most pressing issue.

However, although women are aware of these challenges, many are happier focusing on short-

term nancial responsibilities, such as handling day-to-day expenses (87%) and paying bills

(83%). 69% of Swiss women still say they opt out of long-term nancial decisions.

One key reason for this deferral is a perceived lack of knowledge. More than two thirds (68%)

of married women think that a high level of knowledge is needed in order to make good

investment decisions and 81% believe that their spouse knows more about it.

Nevertheless, most women (88%) would feel more condent about their nancial future if they

were equally involved in making long-term nancial decisions and 91% believe they would make

fewer mistakes with both of them involved.

Many women opt out of long-term nances...

Roles in long-term investment and nancial planning decisions

76%

see retirement

planning as their most

important long-term

nancial need

75%

believe long-term

care planning is

the most pressing

issue

69%

22%

9%

Spouse takes

the lead

Woman takes

the lead

Decisions

equally shared

13 of 16

My role in the nancial decision making

is not that big. It’s my spouse who takes

the nancial decisions and manages the

nance aspect of our lives.

“

– Switzerland, Female, 58

“

I’m concerned about retirement. I

feel that saving for good health care

options is an important matter.

“

– Switzerland, Female, 50

“

… because they believe a high level of knowledge is needed

Percentage of women who agree

…althoug the benets of shared nancial decisions are numerous

Percentage of women who agree on the important benets of being equally involved in long-

term nancial decisions

Switzerland spotlight

believe a high level of knowledge is

needed to make good investment decisions

68%

believe their spouse knows more about

long-term investing decisions

81%

88%

feel more

condent about

their nancial

future

91%

believe they will

make fewer

nancial mistakes

with both of us

involved

UBS Investor Watch14 of 16

…and many women learn the costs of deferring

when marriages end

In the event of a divorce or the death of their spouse, 91% of Swiss women were confronted

with nancial surprises. In light of this, 70% of widows and divorcees wish they had been

more involved in long-term nancial decisions and 62% would encourage other women to

take an active role in their nances.

Taking steps to educate themselves about nances (59%), insisting on full transparency of

all accounts (55%) and talking more about nances with their spouse (54%) is some of the

advice these women would give to married women.

Women advocate for taking a more active role in nances

Percentage of widows and divorcees that recommend the following to married women

were confronted

with nancial

surprises upon their

divorce or the death

of their spouse

91%

encourage other

women to take an

active role in their

nances

62%

wish they had

been more

involved in

long-term

nancial decisions

70%

“Take steps to educate yourself about nances.”

“Insist on full transparency of all accounts.”

“Talk more about nances with your spouse.”

59%

55%

54%

Switzerland spotlight

15 of 16

Taking control

6

Our research revealed that many women delegate long-term nancial decisions – like

investments, pensions and insurance – to their spouses when they get married.

That’s risky. As life moves on, dierent circumstances and events can force women to take

control of their nances – when they’re least prepared to do so.

But it’s a dierent story for women who share decisions with their partners about long-term

nances. They feel condent about the future and their money today, because they’re better

prepared for whatever might happen tomorrow.

Own your worth

Understanding your nancial situation at every stage of your life is key to being prepared for all

of life’s challenges and opportunities. At UBS, we provide expertise and best-in-class nancial

solutions for every stage in our clients’ lives. Our aim is to be a reliable partner for our clients,

who need more than just a bank, by:

• Better serving women by providing tailored holistic advice along their lifecycle

• Delivering opportunities for women to connect and get more involved in nancial decisions

• Oering advice beyond investing and access to specialists around the world

Take the rst steps today to take charge of your nancial well-being and visit

ubs.com/womenswealth

This document has been prepared by UBS AG, its subsidiary or affiliate (“UBS”). This document and the information contained herein are

provided solely for information purposes. It is not to be regarded as investment research, a sales prospectus, an offer or solicitation of an offer to

enter in any investment activity. UBS makes no representation or warranty relating to any information herein which is derived from independent

sources.

UBS does not provide legal or tax advice and this document does not constitute such advice.

Approved and issued by UBS, this document may not be reproduced or copies circulated without prior written permission of UBS. Neither UBS

nor any of its directors, officers, employees or agents accepts any liability for any loss or damage arising out of the use of all or any part of this

document.

© UBS 2019. The key symbol and UBS are among the registered and unregistered trademarks of UBS. All rights reserved.

650830

Explore more insights at ubs.com/investorwatch-ch-en

About the survey: As women’s life expectancies increase and divorce rates remain high, more women may nd

themselves solely responsible for their own nances. UBS Global Wealth Management embarked on research to

gauge women’s level of and satisfaction with their nancial involvement. From September 2017 to January 2019, UBS

surveyed 3,652 women. Of these women, 2,251 were married with at least $1m in investable assets. Others (1,401)

were either divorced or widowed. These women had at least $250k in investable assets. UBS also conducted in-depth

interviews with 71 female respondents. The entire global sample was split across nine markets: Brazil, Germany, Hong

Kong, Mexico, Singapore, Switzerland, Italy, the UK and the US.