Integrated Planning

and Reporting

Long Term Financial Plan Guidelines

September 2016

The Department of Local Government and Communities acknowledges and thanks the local

governments that attended the consultation workshops in March 2016. The comments provided in

the workshops were invaluable in revising the Integrated Reporting Framework and Guidelines,

Advisory Standard, Asset Management Guidelines and Long Term Financial Plan Guidelines.

The Department also wishes to thank those who reviewed various draft revised documents and

provided feedback. The final documents were significantly improved as a result.

Finally, the Department thanks Localise for designing and facilitating the workshops, and

preparing the draft and final revised suite of documents.

Contents

1. Introduction .......................................................................................................... 1

The Integrated Planning and Reporting Framework ............................................... 1

2. Purpose of Guidelines ......................................................................................... 3

3. Forecasting Issues ............................................................................................... 4

4. Financial Risk Assessments in the Long Term Financial Plan ........................ 5

5. Starting the Process: Assumptions Underpinning the Long Term Financial

Plan ............................................................................................................................ 6

A demographic analysis of the local government area ........................................... 7

Economic growth and development of the local government area.......................... 7

National and State economic factors ...................................................................... 8

Service delivery and service levels ......................................................................... 8

Major planned expenditure and capital works ......................................................... 8

Financial strategies ................................................................................................. 8

Workforce Planning ................................................................................................ 9

6. Revenue Projections ............................................................................................ 9

Rates and service charges ..................................................................................... 9

User charges and fees .......................................................................................... 10

Grants ................................................................................................................... 10

Contributions and donations ................................................................................. 11

Interest revenue .................................................................................................... 11

Net gain on disposal of assets .............................................................................. 11

Other revenue ....................................................................................................... 11

Extraordinary revenue .......................................................................................... 12

7. Expenditure Projections .................................................................................... 12

Workforce costs .................................................................................................... 12

Materials and contracts ......................................................................................... 12

Utilities .................................................................................................................. 12

Depreciation.......................................................................................................... 12

Interest expense ................................................................................................... 13

Insurance .............................................................................................................. 13

Net loss from disposal of assets ........................................................................... 13

Other expenditure ................................................................................................. 13

Extraordinary expenditure ..................................................................................... 14

8. Asset Management ............................................................................................. 14

9. Workforce Planning ........................................................................................... 15

10. Performance Measures .................................................................................... 17

11. Scenario Modelling and Sensitivity Analysis................................................. 19

12. Format of Long Term Financial Plan .............................................................. 20

Model format of Long Term Financial Plan ........................................................... 20

13. Review ............................................................................................................... 22

14. Glossary of Terms ............................................................................................ 22

15. References ........................................................................................................ 25

16. Contacts ............................................................................................................ 25

Long Term Financial Plan Guidelines - Page 1

1. Introduction

The Integrated Planning and Reporting Framework

Integrated Planning and Reporting (IPR) is a framework for local governments to:

Articulate the community’s vision, outcomes and priorities

Allocate resources to achieve the vision, striking a considered balance

between aspirations and affordability

Monitor and report progress

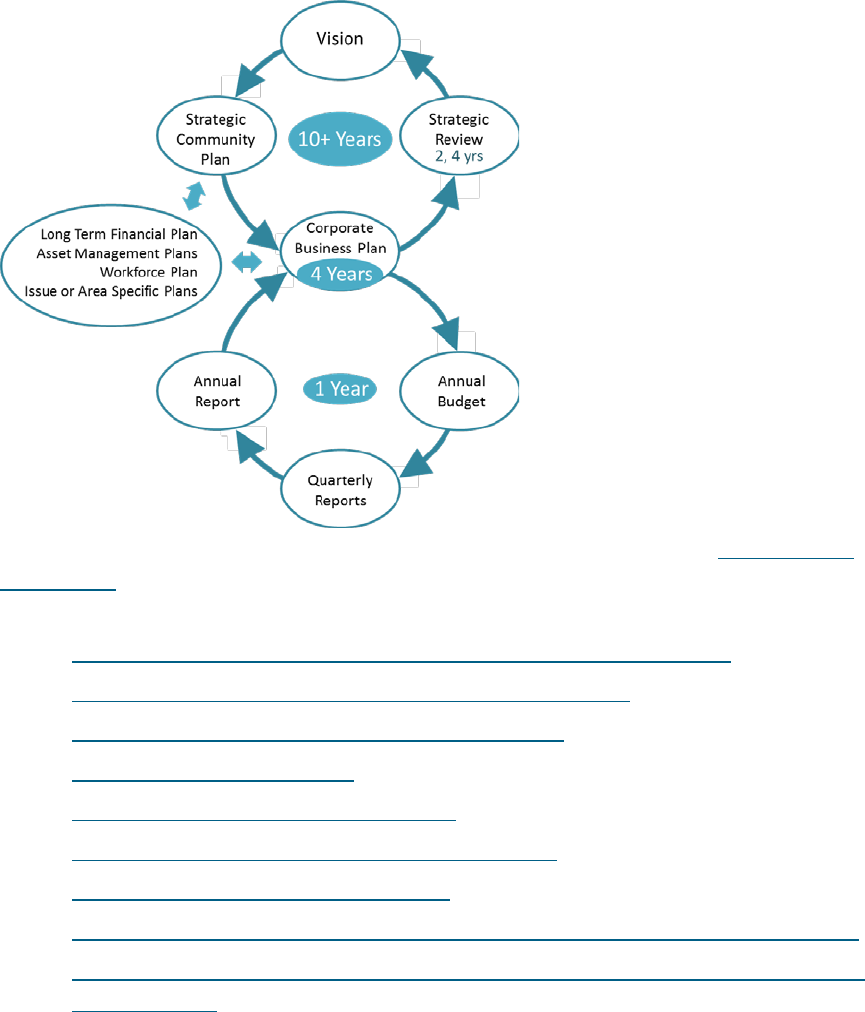

IPR consists of the following “suite” of plans (see figure 1 below):

A Strategic Community Plan that clearly shows the community vision,

strategic direction, long and medium term priorities and resourcing

implications with a horizon of 10+ years

A Corporate Business Plan which contains a four-year delivery program,

aligned to the Strategic Community Plan, and accompanied by four-year

financial projections

Informing Strategies, consisting of the core Informing Strategies (Long Term

Financial Plan, Asset Management Plan and Workforce Plan) and any other

issue or area specific council plans (e.g. Disability Access and Inclusion Plan)

that inform the Strategic Community Plan and Corporate Business Plan. The

core Informing Strategies play a vital role in prioritisation and integration.

The Long Term Financial Plan is a 10-year rolling plan that informs the Corporate

Business Plan in the activation of Strategic Community Plan priorities. The Long

Term Financial Plan includes robust forecast budgets for four years accompanying

the Corporate Business Plan. From these planning processes, annual budgets that

are aligned with strategic objectives can be developed.

The Long Term Financial Plan is therefore a key element of the Integrated Planning

and Reporting Framework that enables local governments to set priorities, based on

their resourcing capabilities, for the delivery of short, medium and long term

community priorities. It is also an indicator of a local government’s long term

financial sustainability and allows early identification of financial issues and their

longer term impacts. The Long Term Financial Plan highlights linkages between

specific plans and strategies and enhances the transparency and accountability of

the council to the community.

Long Term Financial Plan Guidelines - Page 2

Figure 1: Integrated Planning and Reporting Cycle

The Department of Local Government and Communities publishes a suite of other

documents to assist local governments and communities to develop competence in

IPR. Other information and resources will be added as they are developed:

Integrated Planning and Reporting Framework and Guidelines

Integrated Planning and Reporting Advisory Standard

Asset Management Framework and Guidelines

Workforce Planning Toolkit

Model Long Term Financial Planning

Abridged Model Long Term Financial Planning

Long Term Financial Planning Tools

Community Development: A Guide for Local Government Elected Members

Working Effectively with Local Governments: A Guide for Community Sector

Organisations

The Advisory Standard published by the Department of Local Government and

Communities refers to Achieving, Intermediate and Advanced Standards of IPR

performance. In the lead up to July 2013 when the IPR regulatory requirements

came into effect, and since, local governments have been steadily working towards

achieving the regulatory requirements and improving practice. Local Governments

should set achievement targets based on an appropriate pathway of continuous

improvement for their organisation.

Long Term Financial Plan Guidelines - Page 3

2. Purpose of Guidelines

The Long Term Financial Plan Guidelines outline a suggested methodology for local

governments to develop a Long Term Financial Plan to inform the Corporate

Business Plan and Annual Budget.

The Long Term Financial Plan should be a high-level document that can be easily

understood. The Long Term Financial Plan is often presented in two parts – a

narrative section followed by tables of financial projections covering the ten years of

the plan. The projections will be backed up by supporting documentation such as

detailed spreadsheets, schedules and working papers. The Long Term Financial

Plan should contain enough information to be useful and needs to be sufficiently

detailed to enable the calculation of statutory financial ratios.

Alternatives to the methodology and format suggested in these Guidelines can be

used. As a minimum the Long Term Financial Plan should incorporate10-year

financial forecasts including:

Forecast income and expenditure statement

Statement of cash flows

Rate setting statement

Statement of financial position

Equity statement

Loan Statement

Cash Reserves

These statements must be supported by:

Details of assumptions on which the plan has been developed

Projected income and expenditure

Methods of measuring performance - Key Performance Indicators (KPIs)

Scenario modelling and sensitivity analysis

Major capital works schedules

Financial risk assessments

To retain alignment with the Corporate Business Plan, the Long Term Financial Plan

needs to be a rolling and iterative document that is reviewed annually, and provides

robust financial projections for the current and following three years.

Long Term Financial Plan Guidelines - Page 4

A Model Long Term Financial Plan is available from the Integrated Planning and

Reporting pages of the Department of Local Government and Communities’ website:

https://www.dlgc.wa.gov.au/Publications/Pages/IPR-Model-Long-Term-Financial-

Planning.aspx

Other resources are available to assist local governments in long term financial

planning. It is recommended that practitioners obtain a copy of Practice Note 6

“Long Term Financial Planning”, a joint publication of the Institute of Public Works

Engineering Australasia (IPWEA) and the Australian Centre of Excellence for Local

Government (ACELG). This publication examines some of the issues in long term

financial planning in greater depth. It is available for hardcopy purchase or free

download from: http://www.ipwea.org/pn6

Some key points to note from Practice Note 6 include:

Local governments are typically asset rich and income poor

Local government assets are typically long lived and therefore demand long

term financial planning to deal with maintenance and eventual replacement

Local governments must become expert at financial and asset management

planning in order to remain financially viable

Long term financial planning is critical when managing a large stock of long

lived assets that generate service to the community

The Long Term Financial Plan must be underpinned by a financial strategy – it

must be taking the local government towards a goal.

3. Forecasting Issues

The Long Term Financial Plan is by its nature a forecasting document. Financial

forecasting aims to quantify the future impacts of current decisions and identify the

available options to close the gap between revenues and expenditure. It informs

decision making and priority setting and assists the local government to manage

community growth or contraction. It also assists management of cash flows and

funding requirements, community assets and risk.

To be useful, forecasting should use the most current information available.

Forecasting processes should be accurate, reliable and easily understood, and the

results regularly reviewed and updated. There should be particular attention to the

level of accuracy of the four years that accompany the Corporate Business Plan.

Years (5-10) will have a higher reliance on assumptions.

Long Term Financial Plan Guidelines - Page 5

Critical considerations in forecasting include:

The purpose of the forecast

The level of accuracy required

Who to involve in data gathering and preparing forecasts

The frequency of reviews to ensure currency of information

The internal systems required to bring processes together

Across-organisation reporting

Identification of data sources and indices

Inclusion of “whole-of-life” costing for major projects

A comprehensive Asset Management Plan

A comprehensive Workforce Plan showing workforce requirements and costs

The ability to interpret historical data and forecast financial ratios

4. Financial Risk Assessments in the Long Term

Financial Plan

Long term financial planning in a dynamic environment has to accommodate some

level of uncertainty. The ability to accurately forecast over a long period is likely to

be hampered by uncertainties such as the availability of grant funding; fluctuating

interest rates; economic trends; and demographic and political change.

At the project level, key risks usually occur around:

Approvals – where a future project may require environmental or planning

approvals

Land acquisition and construction costs – which can be subject to variability in

line with market forces

Funding – where a future project is dependent on uncertain grant funding

The timescale of a Long Term Financial Plan makes it impractical to attempt to

identify and manage all risks for all projects included in the plan. As the Long Term

Financial Plan is both rolling and iterative, the level of uncertainty reduces as the

timeframe shortens. Annual reviews lead to adjustments in the Long Term Financial

Plan as uncertainties start to firm up.

Long Term Financial Plan Guidelines - Page 6

The Long Term Financial Plan should include some commentary on where the most

significant financial risks are situated and how the local government is monitoring or

treating the risk. Some of the significant risks may be highlighted through scenario

modelling and sensitivity analysis. See how the hypothetical Town of Eagle Bay

dealt with the risk assessment requirements of the Long Term Financial Plan, on

page 17 of the Model Long Term Financial Plan, available here:

https://www.dlgc.wa.gov.au/Publications/Pages/IPR-Model-Long-Term-Financial-

Planning.aspx

5. Starting the Process: Assumptions

Underpinning the Long Term Financial Plan

In building the Long Term Financial Plan, it may be useful to refer to the Model Long

Term Financial Plan published in the Integrated Planning and Reporting pages of the

Department of Local Government and Communities’ website:

https://www.dlgc.wa.gov.au/Publications/Pages/IPR-Model-Long-Term-Financial-

Planning.aspx

Determine whether the Long Term Financial Plan will be developed based on a

detailed Chart of Accounts, or on an activity or program level. The choice should

allow modelling to test the local government’s ability to deliver community services

and assets under various scenarios.

Show in an initial model the local government’s position over the next 10 years without

any changes to current policy. Further models should explore alternative community

priority scenarios, so that the local government can determine and demonstrate if, and

how, those various community priority scenarios could be resourced. A number of

assumptions will need to be made and these will form a foundation for the

development of the plan.

Determine any changes in the internal and external environments which may impact

on the operations of a local government. A local government may be able to control

or influence most of the internal impacts, but has little influence over external factors.

Identify internal factors with the potential to influence the long term financial situation

including community expectations, financial capacity, service delivery areas and

levels, infrastructure needs, asset quality, workforce requirements and the local

government’s capabilities and resources.

Identify external factors with the potential to influence the long term financial situation

including changes in population and demographics such as age dispersion, income

Long Term Financial Plan Guidelines - Page 7

and unemployment levels, diversity of the local economy, economic growth,

legislative requirements and government policy.

Develop assumptions relating to internal and external influences and document and

explain these in the Plan.

Although a number of examples are detailed below, it is better for a local government

to thoroughly understand the key assumptions used in developing its Long Term

Financial Plan and to change these over time, than to expend resources and effort

analysing a range of variables for which accurate current information may not be

available. Assumptions could be based on the following factors.

A demographic analysis of the local government area

Examine past demographic trends and anticipate future changes that will impact the

Long Term Financial Plan. This may involve:

Examination of population data over the past 10 years, identifying any

demographic trends and reasons for these, and projecting likely trends over

the next 10 years or more

Determining the impact of an ageing population on future service needs

Identifying demographic changes occurring in neighbouring local governments

that could impact on the district

Economic growth and development of the local government

area

Identify economic growth and development issues that could impact in the future.

This may involve:

Analysis of economic growth over the past 10 years, identifying any trends

and reasons for these and projecting likely trends over the next 10 years

Analysis of any local government plans that will affect future economic growth

Analysis of the impacts of population and demographic changes on economic

growth

Identifying new industrial or business subdivisions or developments that will

affect economic growth.

Long Term Financial Plan Guidelines - Page 8

National and State economic factors

Identify national and state factors that will have impacts. Analysis could include:

Future inflation forecasts (Australian Bureau of Statistics or Treasury

forecasts)

Interest rate movements – over the past 10 years and forecasts for the next

10 years (Western Australian Treasury Corporation forecasts)

Any known state or federal government policies that will impact in future.

Service delivery and service levels

These are critical to any financial forecasts. They link the community needs to its

willingness to pay for the services to meet those needs. Increased service levels are

likely to involve increased costs. Considerations could include:

Will the existing services and level of service delivery be maintained?

Does the Strategic Community Plan or Asset Management Plan indicate a

change in service levels?

What is included in the Strategic Community Plan that may impact service

delivery?

Will new services be implemented (for example, services to seniors for an

ageing population)?

What is included in existing local government plans that could influence service

levels (for example: Recreation Plan, Active Ageing Plan and the like)?

Major planned expenditure and capital works

Major expenditures and capital works in the Strategic Community Plan and Asset

Management Plan should be included in the assumptions detailed in the Long Term

Financial Plan. For example - a Council may be planning to replace a library building

in 5 years’ time. In this case, assumptions regarding the financial outlays for the new

land and buildings including fit out, as well as any inflows of capital from the disposal

of the old asset, will need to be brought into the Long Term Financial Plan.

Financial strategies

A local government’s financial strategy will underpin the Long Term Financial Plan.

Valid financial strategies could include:

Long Term Financial Plan Guidelines - Page 9

Continuous improvement in the financial position of the local government

The achievement or maintenance of operating surpluses each year

The maintenance of a fair and equitable rating structure

Maintaining or improving service level standards

Reliance on debt to fund capital works

Maintenance of cash reserves for future commitments

Increasing reserves for asset maintenance and renewal

Achieving a specified proportion of cost recovery for services

Inter-generational equity

Revenue and expenditure forecasts can be developed based on the chosen strategy.

Workforce Planning

As an informing strategy within the Integrated Planning and Reporting Framework,

workforce planning has vital linkages to long term financial planning. Both current

and future workforce requirements will be identified by a local government in its

workforce planning process, with requirements and costs carried across from the

Workforce Plan to the Long Term Financial Plan. Associated asset management

requirements will also be included.

6. Revenue Projections

The principal sources of revenue for local governments are: rates; service charges;

user charges and fees; grants; contributions and donations; interest on investments;

net gains on the disposal of assets; and ‘other revenue’. To forecast future revenues

in the Long Term Financial Plan, each of these sources needs to be assessed in

light of the relevant assumptions and the Strategic Community Plan.

Rates and service charges

Matters to consider could include:

The impact of the local government’s rating policy

Is the basis of rates suitable (UV / GRV)?

Are there inequities to be addressed that will impact revenue levels (for example,

significant non-rural activities on rural land that should be rated on GRV)?

Long Term Financial Plan Guidelines - Page 10

Are there new or planned subdivisions or developments that will impact on

rate growth?

What annual increases should be applied?

Are there specific works, services or facilities to be provided for which special

area rates are likely to be introduced?

Will economic factors impact on rate collections (and hence cash flows) – for

example: industry downturns?

Should statutory service charges be introduced or reviewed?

Is the local government’s rate coverage ratio sufficient?

The Long Term Financial Plan should include details of how rates and service

charges have been calculated over the period and detail the assumptions applied.

User charges and fees

Matters to consider could include:

To what extent are user charges and fees based on user-pays and full cost

recovery?

Are new services proposed for which new fees can be introduced?

Are there existing services for which fees should be introduced?

Do existing fees need to be reviewed?

Do existing fees cover costs?

Grants

Matters to consider could include:

Are special grants programs likely to continue in the future (for example

Roads to Recovery)?

Are there capital or operating grants available for new services or planned

infrastructure?

What is the long term estimate for Financial Assistance Grants and untied

road grants? What is the likely impact if these are planned to reduce?

If existing grants are withdrawn, how would this impact the local government’s

service delivery?

Can the local government meet matching criteria that apply to particular grants?

Long Term Financial Plan Guidelines - Page 11

Contributions and donations

Matters to consider could include:

Are contributions and donations likely to increase or decrease?

Are there opportunities to introduce new developer contributions?

Interest revenue

Matters to consider could include:

How will the local government’s investment policy affect likely income from

investments?

Are there likely to be cash flow issues that will positively or negatively impact

on investment revenue (for example, an increase in outstanding rates debtors,

or a reduction in available cash reserves)?

What are forecast future interest rates?

Net gain on disposal of assets

The local government’s Asset Management Plans should detail assets it plans to sell.

Based on past experience of similar disposals, the gains could be estimated.

Other revenue

Matters to consider could include:

What other revenue sources exist?

Does the local government have the capacity to undertake private works to

increase revenue?

Can the local government provide services to neighbouring local governments?

Does the local government have underutilised assets (buildings) that can be

leased commercially?

Are there surplus road making materials that could be sold?

Long Term Financial Plan Guidelines - Page 12

Extraordinary revenue

Consider if there are any one-off extraordinary revenue events that might occur

during the life of the Long Term Financial Plan; for example, asset sales or special

grants.

7. Expenditure Projections

The local government will need to consider its regular and ongoing expenditure

commitments arising from existing services and operations. Asset Management

Plans, the Workforce Plan, loan repayments on existing borrowings (and proposed

new borrowings) and existing contractual commitments are useful sources of

information. New capital projects and additional services included in the Strategic

Community Plan will also need to be costed.

Workforce costs

Matters to consider are outlined in Section 9 - Workforce Planning.

Materials and contracts

Matters to consider could include:

New or proposed changes in service delivery.

Changes in the cost of materials and contract rates.

Utilities

Matters to consider could include:

New or proposed buildings, parks, street lighting and the like.

Impacts of proposed energy and water efficiency programs.

Depreciation

Depreciation costs should be sourced from the local government’s Asset

Management Plans. Note that depreciation expense could increase considerably

after asset revaluation events.

Long Term Financial Plan Guidelines - Page 13

Interest expense

Matters to consider could include:

The local government’s debt policy.

The local government’s debt ratio and debt service ratios – compared to

benchmarks.

Loan repayments on existing borrowings (and proposed new borrowings).

Proposed draw-down dates.

Loan terms.

Forecast future interest rates (WA Treasury Corp).

Insurance

Matters to consider could include:

Values of new insurable assets to be developed.

Revaluations of insurable assets.

Past claims experience that may affect future premiums.

Any new insurances planned.

Net loss from disposal of assets

The local government’s Asset Management Plans should detail assets that are

planned to be sold. Based on past experience, an estimate of losses on similar

assets disposed could be determined.

Other expenditure

Matters to consider could include:

Statutory fees including Emergency Services Levies.

Membership fees or levies.

Bad debts.

Donations and subsidies to community groups.

Long Term Financial Plan Guidelines - Page 14

Extraordinary expenditure

Consider if there are any one-off extraordinary expenditure events that might occur

during the life of the Long Term Financial Plan; for example, emergency flood repairs

to roads and bridges. Consider whether the expenditure will occur over a number of

financial years or a single financial year.

8. Asset Management

The Long Term Financial Plan should be developed in tandem with the Asset

Management Plans. The financial strategies in the former should be reflected in the

latter. The Long Term Financial Plan will be informed by material in the Asset

Management Plan. Where data from the Asset Management Plan is brought across to

the Long Term Financial Plan, the Long Term Financial Plan should include the relevant

assumptions and indications of funding sources. If information on funding sources is not

included, this information should be agreed between asset managers and finance

managers and reflected in both the Long Term Financial Plan and the Asset

Management Plan.

Asset management issues will need to be considered in both the Long Term

Financial Plan and the Asset Management Plan, but treated differently in each plan.

The Asset Management Guidelines and other explanatory material can be

downloaded from the Integrated Planning and Reporting pages of the Department of

Local Government and Communities’ website at this link:

https://www.dlgc.wa.gov.au/Publications/Pages/IPR-Asset-Management-

Framework.aspx

Practitioners should consult the Rate Setting, Asset Management and Financial

Sustainability guide downloadable from the following link:

https://www.dlgc.wa.gov.au/Publications/Pages/IPR-RateSetting-AssetManagement-

FinancialSustainability.aspx

Asset Management Plans should contain a complete record of a local government’s

infrastructure and other fixed assets and include “whole-of-life” costings that

incorporate operating, scheduled maintenance and depreciation costs, renewal costs,

replacement costs on asset retirement and costs involved in expanding the asset

base. It is important to keep the Long Term Financial Plan updated using this

information.

Asset Management Plans provide information on cost/value, depreciation, residual

value and useful life that is used in the accounting process for financial reporting.

Long Term Financial Plan Guidelines - Page 15

They also have an essential role in providing information for accurate and effective

long term financial planning.

For a local government to be financially sustainable, it needs to be able to maintain the

condition of its infrastructure and non-current assets at chosen levels in order to

deliver services to the community over the longer term. The consumption of assets

should not exceed asset renewal or replacement based on Fair Value. Investment in

new assets when existing assets are not being maintained adequately should be

avoided.

The Long Term Financial Plan is a critical instrument in weighing up the costs and

benefits of different options for ensuring both financial sustainability and responsible

asset stewardship. If assets are being efficiently managed, it may be that trade-offs

need to be made between service levels and rates increases. If this is the case, the

community engagement process should be designed to enable the community to

give meaningful input on the options.

9. Workforce Planning

Workforce planning is a continuous process of shaping the workforce to ensure that

it is capable of delivering the organisation’s objectives now and in the future. It is

therefore a strategic process with a focus on longer term workforce requirements of

a local government, taking into account Strategic Community Plan priorities.

Workforce planning links with all other elements of the Integrated Planning and

Reporting Framework, including long term financial planning and asset management

planning. Current and future workforce costs, including associated asset

requirements and costs, need to be incorporated into the Long Term Financial Plan.

A cost modelling process could include the following:

Determine the financial impact of proposed workforce strategies to address

workforce / skills gaps

Ensure that all employment related costs are identified

Assess the work force plan with historical financial data to determine

variables of workforce costs now and into the future

Test scenarios in the long term financial plan to determine affordability and

sustainability

Include such things as the cost of recruitment vs upskilling or outsourcing in

scenarios

Work closely with managers across the organisation and the finance team.

Long Term Financial Plan Guidelines - Page 16

Workforce planning and arrangements may have implications for a local

government’s assets and asset management. These may include requirements or

changes in regard to housing, equipment, vehicles, office location, office space and

fit-out, IT (hard and soft) and plant and tools. Changes in the use of certain assets

may be considered.

Employee-related areas with financial implications may include the following:

Workforce size and location, job characteristics and individual characteristics

Employment arrangements, including enterprise bargaining agreements,

workers’ compensation and superannuation

Government policy and legislative requirements

Recruitment, retention and retrenchment

Training and development.

Associated costs, including wider asset management considerations such as asset

condition, depreciation and maintenance, need to be identified and included in the

Long Term Financial Plan. The Workforce Plan requirements and costs should also

be included in the Asset Management Plan and Corporate Business Plan.

It should be recognised that there can be financial linkages from “informing plans”

that impact on the Workforce Plan, which in turn is reflected in the Long Term

Financial Plan. Informing Plans could include:

Equal Employment Opportunities Plan

Disability Access and Inclusion Plan (Outcome 7)

Reconciliation Action Plan

Information and Communications Technology Plan

Service specific plans

Others

For example, there may be commitments in the Disability Access and Inclusion Plan

that relate to the workforce. These are part of workforce solutions, so such

commitments and associated costs should also be reflected in the Workforce Plan.

Similarly, expenditure on computers and software may be linked to employee head

count in the Information and Communications Technology Plan, so the link needs to

be acknowledged in the Workforce Plan.

Further assistance is available by downloading the Workforce Planning Toolkit from

the Integrated Planning and Reporting pages of the Department of Local

Government and Communities’ website:

https://www.dlgc.wa.gov.au/Publications/Pages/IPR-Workforce-Planning-Toolkit.aspx

Long Term Financial Plan Guidelines - Page 17

10. Performance Measures

Local governments should develop key performance indicators (KPIs) to measure

performance against the Long Term Financial Plan and Annual Budget and to

assess their long term financial sustainability.

KPIs included in the Long Term Financial Plan provide performance measures

against which a local government can report its progress to the community.

A number of statutory KPIs focusing on financial and asset management performance

will be regulated. Other financial sustainability measures can also be developed by

individual local governments, however, these need to be simple, measurable and

understandable.

The Department of Local Government and Communities and Western Australian

Treasury Corporation have partnered to release long term financial planning tools for

local governments. The tools include the Financial Health Indicator calculator, which

enables a local government to project changes to its financial position over the

course of the long term financial plan. Local governments can use this to calculate

projections of their financial health using the Financial Health Indicator methodology.

If any KPIs are impacted by the particular circumstances of the local government, or

abnormal events, supporting commentary should be included in the Long Term

Financial Plan.

Practitioners can consult Local Government Operational Guideline Number 18 - June

2013 “Financial Ratios” for further guidance in this area, downloadable from here:

https://www.dlgc.wa.gov.au/Publications/Pages/LG-Operational-Guidelines-18.aspx

Table 1 outlines the statutory KPIs local governments are required to report on.

Long Term Financial Plan Guidelines - Page 18

Table 1: Statutory KPIs required to be reported by local governments

Ratio What It Measures Achieving

Standard

1. Operating Surplus

Ratio

An indicator of the extent to

which revenue raised not only

covers operational expenses, but

also provides for capital funding.

Ratio is between

0% and 15%.

2. Current Ratio A measure of a local government’s

liquidity and its ability to meet its

short term financial obligations

from unrestricted current assets.

Ratio is equal to an

expression of 1:1 or

greater (e.g. 100%

or 1.0).

3. Debt Service

Cover Ratio

An indicator of a local

government’s ability to generate

sufficient cash to cover its debt

payments.

Ratio is greater

than or equal to 2.

4. Own Source

Revenue

Coverage Ratio

An indicator of a local government’s

ability to cover its costs through

its own revenue efforts.

Ratio is between

40% and 90% (or

0.4 and 0.9).

5. Asset

Consumption

Ratio

This ratio highlights the aged

condition of a local government’s

physical assets.

Ratio data can be

identified and ratio

is 50% or greater.

6. Asset

Sustainability

Ratio

An indicator of the extent to

which assets managed by a local

government are being renewed

or replaced as they reach the

end of their useful lives.

Ratio data can be

calculated and

ratio is 90%.

7. Asset Renewal

Funding Ratio

Indicates whether the local

government has the financial

capacity to fund asset renewal at

existing revenue and service

levels.

Ratio data can be

identified and the

ratio is between

75% and 95%.

Long Term Financial Plan Guidelines - Page 19

11. Scenario Modelling and Sensitivity Analysis

The Long Term Financial Plan can be used as a proving ground and stress test for

financial strategies that may ultimately be used by the local government.

Scenario modelling will determine the level of flexibility in the Long Term Financial

Plan to inform the local government of the best strategy to meet community

expectations should variations occur in a range of factors or assumptions.

Modelling should be undertaken on the basis of optimistic, conservative and

worst-case scenarios to understand the impacts of variation.

This modelling could, for example, focus on population growth, where different

models can be compared for rapid, moderate, or minimal growth scenarios.

Sensitivity analysis can be used to test the financial impacts of variations in the

factors or assumptions underlying the plan.

Analysing the sensitivity of the Long Term Financial Plan to variations in

assumptions such as Consumer Price Index estimates, employee cost increments,

interest rates, annual rate increases, recurrent grants, and others, will identify the

assumptions that have the greatest impact when varied.

This will assist a local government to ensure that the assumptions on which its Long

Term Financial Plan is based are reasonable.

For an understanding of how to use the Long Term Financial Plan for scenario

modelling and sensitivity analysis, see how it is handled in the hypothetical Town of

Eagle Bay on page 11 of the Model Long Term Financial Plan, available here:

https://www.dlgc.wa.gov.au/Publications/Pages/IPR-Model-Long-Term-Financial-

Planning.aspx

Long Term Financial Plan Guidelines - Page 20

12. Format of Long Term Financial Plan

The following is a model format for a Long Term Financial Plan. The format is not

mandatory. As a minimum, the Long Term Financial Plan should include 10-year financial

forecasts consisting of:

Forecast income statement

Statement of cash flows

Rate setting statement

Statement of financial position

Equity statement.

These statements must be supported by:

Details of assumptions on which the plan has been developed

Projected income and expenditure

Methods of measuring performance - Key Performance Indicators (KPIs)

Sensitivity analysis and financial modelling scenarios

Major capital works schedules

Risk assessments of the impact of uncertainty on the Long Term Financial

Plan, especially out-years

Cash reserves and borrowings.

The Long Term Financial Plan should be updated annually and form the basis for the

preparation of the following year’s Annual Budget.

Model format of Long Term Financial Plan

1. Introduction

Key points of the plan

Where it fits into IPR

2. Context

A brief recap of the local government area, its size and location within the State,

demographics, industries (consistent with community and economic profile in the

Strategic Community Plan)

Local government assets and services

3. Strategic Alignment

Long Term Financial Plan Guidelines - Page 21

Significant points of linkage to the Strategic Community Plan, Corporate Business

Plan, Asset Management Plans, Workforce Plan and other informing strategies, and

Annual Budget (eg any change of focus on specific services reflected in the LTFP)

4. Assumptions

Assumptions underpinning the plan including financial policies and strategies

5. Financial Commentary

Comment on the asset and financial ratios over the life of the Plan

Summarise the financial strategies for rating structure, fees and charges, alternative revenue

sources, pursuit of grants, reserves, debt funding, asset disposal, investment policy

Comment on each of the financial statements

Comment on the supporting schedules including operating revenue, operating

expenditure and capital works schedules

6. Risk Management

7. Scenario Modelling and Sensitivity Analysis

8. Financial statements (forecasts)

Forecast income statement

Statement of cash flows

Rate setting statement

Statement of financial position

Equity statement

9. Supporting schedules

Schedule of new / capital works proposed

Schedule of assumptions underpinning financial forecasts

Schedule of income / expenditure estimates and assumptions used (e.g. CPI %)

Schedule of borrowings and payments

Schedule of reserve movements and balances

Schedule of asset and financial ratios and any other key performance indicators (KPIs)

Schedules and comments on scenario modelling and sensitivity analysis

An example Long Term Financial Plan is available on the Integrated Planning and

Reporting pages of the Department of Local Government and Communities’ website:

https://www.dlgc.wa.gov.au/Publications/Pages/IPR-Model-Long-Term-Financial-

Planning.aspx

Long Term Financial Plan Guidelines - Page 22

13. Review

To retain alignment with the Corporate Business Plan, the Long Term Financial Plan

needs to be a rolling and iterative document that is subject to annual review. More

substantial reviews occur in conjunction with the two-yearly Strategic Reviews,

alternating between the Minor Strategic Review and the Major Strategic Review.

14. Glossary of Terms

Terms that have been assigned a specific meaning within these Guidelines are

defined below. These definitions aim to best describe an Integrated Planning and

Reporting component or process in terms of its purpose, without restricting or

mandating terminology.

Table 2: Glossary of Terms

Term Definition

Annual Budget A statutory requirement outlining the financial

estimates for that year’s delivery of the Corporate

Business Plan.

Asset Management

Plan

A “whole of life” plan for the appropriate acquisition,

maintenance, renewal, replacement and disposal of

assets that balances aspirations with affordability.

Corporate Business

Plan

Four-year delivery program, aligned to the Strategic

Community Plan, and accompanied by four-year

financial projections.

Equity statement Equity is the net worth of a local government

measured as the difference between the total assets

and total liabilities as reported in the statement of

financial position. The equity statement details

equity by its various classes (retained surpluses,

cash-backed reserves and revaluation reserves) and

reconciles the opening and closing balances of each

class of the local government’s equity over the

reporting period. It also provides a summary of

changes in composition of the local government’s

equity and the causes of those changes.

Long Term Financial Plan Guidelines - Page 23

Term Definition

Financial capital

Refers to the funding capacity of the local

government as disclosed in the statement of financial

position. This is usually the net difference between

current assets and current liabilities.

Forecast income

statement

A statement that includes revenue and expenditure

projections over the 10-year life of the plan.

Infrastructure

Infrastructure assets are physical assets intended to

serve the community over a long time frame and

maintained indefinitely by the continuing replacement

and refurbishment of its components so that service

level standards are met. This includes the major

asset classes such as roads, drains, bridges,

footpaths, sewerage assets and public buildings.

Inter-generational

equity

Achieving a fair and ethical balance of costs and

benefits between present and future generations. In

the local government context this refers to the

expenditure on long-lived assets and infrastructure

and the revenue strategies required to pay for them.

Integrated Planning

and Reporting

Integrated Planning and Reporting (IPR) is a process

designed to:

Articulate the community’s vision, outcomes and

priorities

Allocate resources to achieve the vision, striking

a considered balance between aspirations and

affordability

Monitor and report progress

Rate setting statement

A statement that details budgeted expenditure and

revenue and shows how much rate revenue is

required to cover the budget deficit. It can be in a

format that includes rates as an income type based

on assumptions used in developing the Long Term

Financial Plan to show the extent to which planned

services and assets can be funded.

Scenario modelling

Preparation of forecasts or estimates in the Long

Term Financial Plan on optimistic, conservative and

Long Term Financial Plan Guidelines - Page 24

Term Definition

worst-case scenarios to understand the impact of

variations in factors or assumptions.

Sensitivity analysis

Determines those factors or assumptions that if

varied have greater impacts on the Long Term

Financial Plan.

Statement of cash

flows

A statement that shows how changes in a local

government’s expenses and income affect cash and

cash equivalents; and breaks the analysis down to

operating, investing and financing activities.

Statement of financial

position

A statement that reports the value of a local

government’s current and non-current assets, current

and non-current liabilities and equity as at a

particular date, usually the end of a financial

reporting period.

Strategic Community

Plan

The Strategic Community Plan is the Council’s

principal 10-year strategy and planning document. It

is the guiding document for the remainder of the IPR

suite. Community engagement to determine their

vision and priorities is central to the Plan.

Workforce Planning

A continuous process (not a one-off activity) of shaping

the workforce to ensure that it is capable of delivering

organisational objectives now and in the future.

Long Term Financial Plan Guidelines - Page 25

15. References

These Guidelines have been informed by and produced with reference to the following:

IPWEA Practice Note 6 Long Term Financial Planning, 2012

NSW Department of Premier and Cabinet, Division of Local Government:

Integrated Planning and Reporting Long Term Financial Plan, December 2010

QLD Department of Infrastructure and Planning: Financial management

(sustainability) guideline 2009

QLD Department of Infrastructure and Planning: A guide to asset accounting

in Local Governments, 2010

WA Department of Local Government: Integrated Planning and Reporting

Framework and Guidelines, 2016

Workforce Planning: The Essentials. A toolkit for Western Australian local

governments.

16. Contacts

For more information, please contact:

Department of Local Government and Communities

Gordon Stephenson House, 140 William Street, Perth WA 6000

GPO Box R1250, Perth WA 6844

Telephone: (08) 6551 8700 Fax: (08) 6552 1555

Freecall: 1800 620 511 (Country only)

Email: info@dlgc.wa.gov.au Website: www.dlgc.wa.gov.au

Translating and Interpreting Service (TIS) – Tel: 13 14 50