1

Roku Q4 and Full Year 2022 Shareholder Letter

February 15, 2023

Fellow Shareholders,

Despite a difficult macro environment in 2022, we made excellent progress building on our platform, brand, and

industry leadership with the addition of nearly 10 million net new active accounts – ending the year with 70 million

active accounts globally. We also drove strong Streaming Hour growth and delivered 20% YoY Platform revenue

growth for the full year. Importantly, we plan to continue to improve our operating expense profile to better

manage through the challenging macro environment, while building on our platform's monetization and

engagement tools and partnerships. Through a combination of operating expense control and revenue growth, we

are committed to a path that delivers positive adjusted EBITDA for full year 2024. Our platform and industry

leadership positions us well for reaccelerated revenue growth as the ad market recovers and the shift to TV

streaming continues.

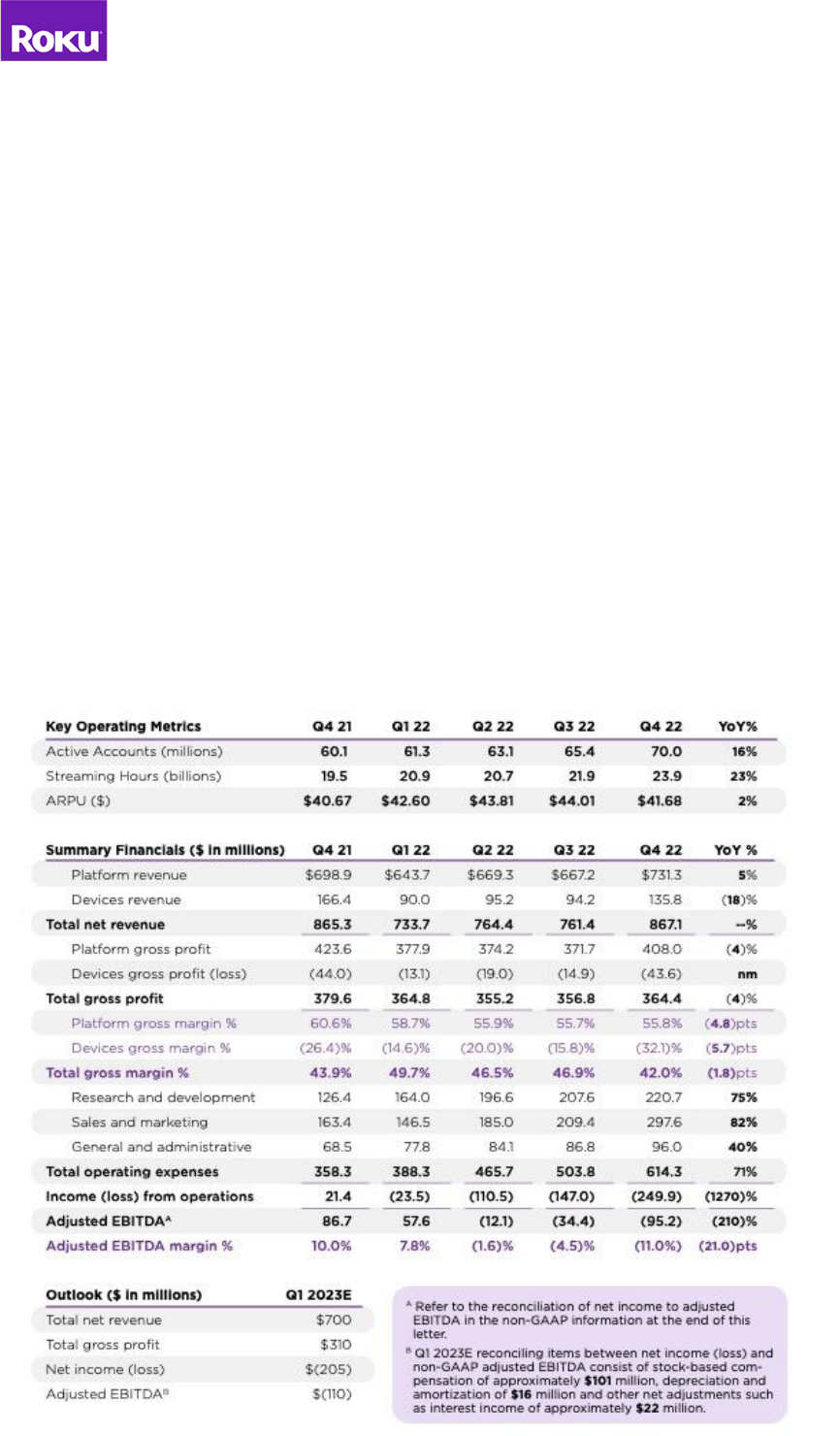

2022 Key Results

• Total net revenue grew 13% year over year (YoY) to $3.1 billion

• Platform revenue increased 20% YoY to $2.7 billion

• Gross profit was up 2% YoY to $1.4 billion

• Active Accounts reached 70.0 million, a net increase of 9.9 million active accounts from 2021

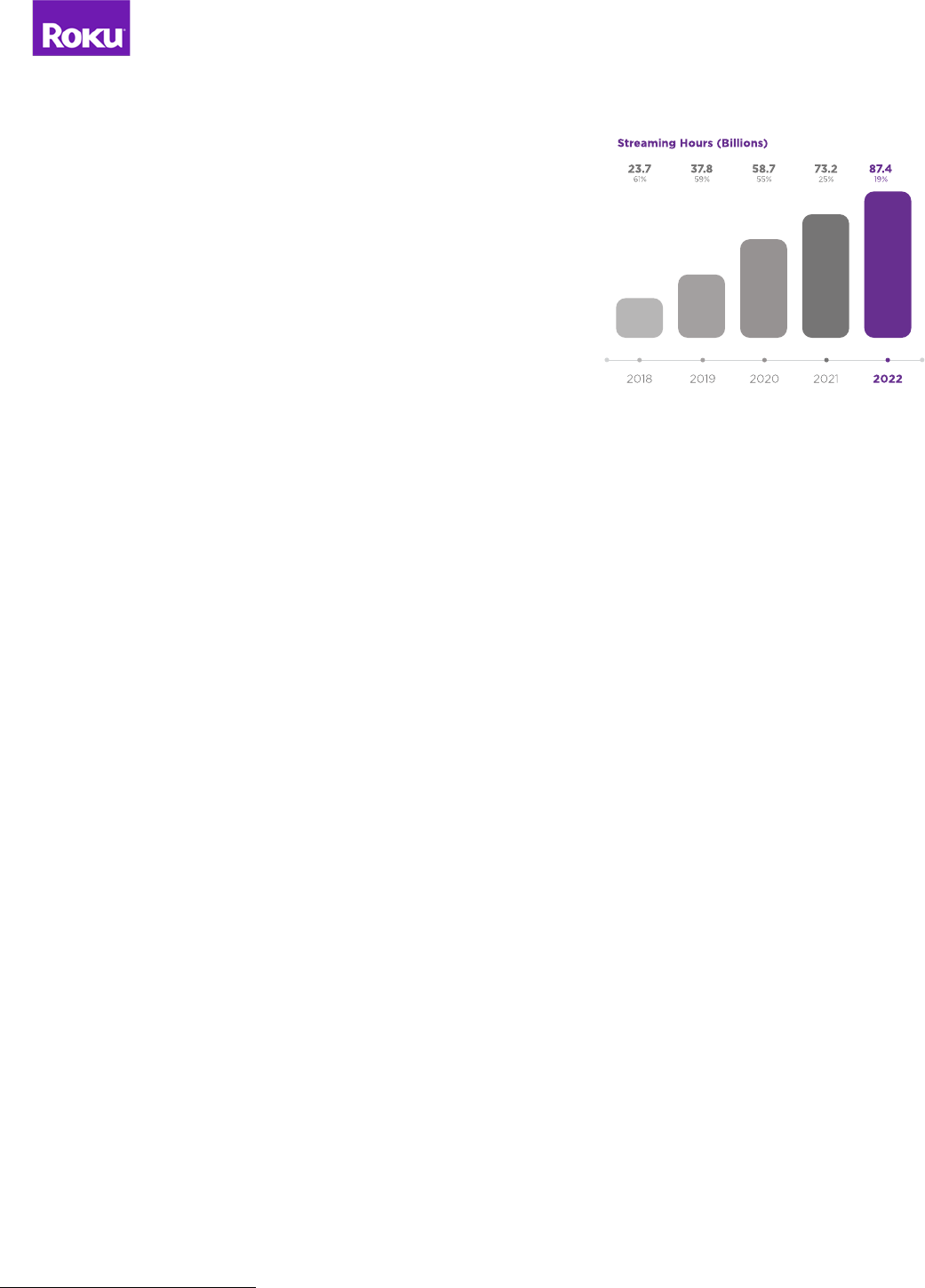

• Streaming Hours increased by 14.3 billion hours YoY to 87.4 billion

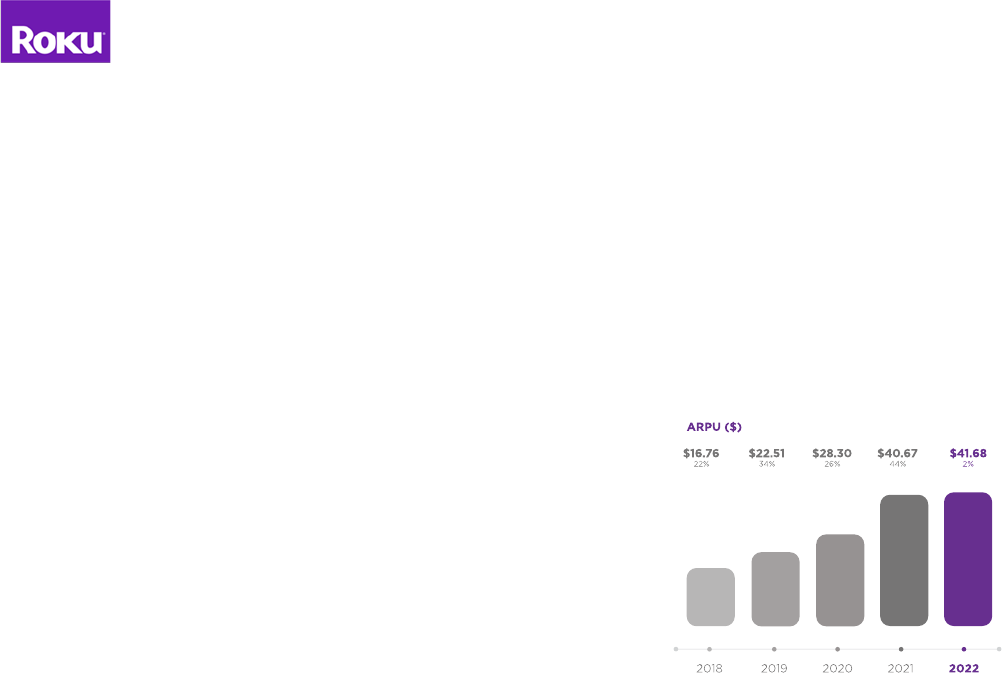

• Average Revenue Per User (ARPU) grew to $41.68 (trailing 12-month basis), up 2% YoY

• In Q4, The Roku Channel reached U.S. households with an estimated 100 million people

2

Roku Q4 and Full Year 2022 Shareholder Letter

Our Business Model

Our three-phased business model — grow scale, grow engagement, and grow monetization — drives our mission

as a global streaming platform that connects and benefits the entire TV ecosystem of consumers, content

publishers, and advertisers.

Market Leading Scale

Active Account net adds were 4.6 million in Q4 and 9.9 million in 2022,

ending the year with 70.0 million active accounts globally. Full year

net adds were above both 2019 and 2021 levels and driven primarily

by the Roku TV program in the U.S. and international markets. In the

U.S., our active accounts are approaching half of broadband

households

1

, and we believe this share will continue to grow.

The shift to TV streaming continues with cord cutting accelerating in

the U.S. in 2022. Four of the five biggest U.S. pay TV operators

reported 2022 subscriber losses that were 60% higher than 2021. In a

recent survey, Cord Cutter News found that more than 70% of U.S.

cord-cutters use a Roku device and stated, “Roku is the clear leader in

the world of cord cutting and is almost twice as popular as its next

competitor.”

While the holiday season is typically the strongest period for most consumer businesses, as expected, this past Q4

was different. Macro uncertainties and inflationary pressures negatively affected the consumer electronics

category. However, in Q4 overall, U.S. smart TV unit sales were better than expected, benefiting from lower TV

panel prices and freight costs. Unit sales of Roku TV models in the U.S. outperformed the overall market due to

consumers’ focus on value. International Roku TV unit sales also benefited from this same Q4 trend.

Roku TV

In Q4, Roku TV gained share, and we extended our leadership in the U.S., Canada, and Mexico. According to NPD,

the Roku operating system (OS) was the No. 1 selling smart TV OS in the U.S., and our 38% share of units sold in Q4

was more than the next two largest TV operating systems combined. The Roku OS was also the No. 1 selling smart

TV OS in Canada and No. 1 in Mexico, where we grew to 30% of units sold.

We have continued to expand our successful Roku TV licensing program. In the U.S., the new TCL Roku TV 6-Series

won the CNET Editor’s Choice award in 2022 and was described as the “best TV for the money” for the fifth year in

1

US broadband households, Statista

3

Roku Q4 and Full Year 2022 Shareholder Letter

a row. In Canada, we extended our Walmart partnership with onn Roku TV models. In Mexico, we added three new

Roku TV licensees for a total of 12 partners that now offer a broad lineup of Roku TV models. In Brazil, AOC launched

a new lineup of 4K Roku TV models, and Semp TCL launched six new Roku TV models. In the UK, RCA entered the

market with new Roku TV models, and TCL launched the U.K.’s first-ever QLED Roku TV model. And we expanded

our Roku TV program with TCL and Metz in Germany, and with TCL in Australia.

Roku-branded TV

We recently announced the first TVs designed and made by Roku: the Roku Select and Roku Plus Series TVs. These

TVs will complement our successful Roku TV licensing program and enable us to further grow our leadership

position and expand into the higher-end spectrum of performance TVs. Roku-branded TVs will also help us innovate

more quickly in all aspects of hardware and software and test directly with consumers, improving the product and

consumer experience and strengthening all TVs powered by Roku OS. The Roku Select and Plus Series TVs will be

available in the U.S. in spring 2023 with retail prices ranging from $119 to $999 for the full lineup of 24” - 75”

models.

Roku Plus Series TV

Streaming Players

Our streaming players enable consumers to easily and affordably turn any TV into an outstanding streaming

experience, and our players continue to be recognized within the industry. The Roku® Streaming Stick® 4K has

received accolades from Consumer Reports, Tom’s Guide, and Forbes. And the Roku® Streambar® Pro has been

recognized by Consumer Reports, CNET, Yahoo, Rolling Stone, and Popular Science.

Roku Smart Home

In Q4, we launched new smart home products to build new service revenue streams. This product offering includes

cameras and video doorbells that offer subscription plans enabling users to view cloud recordings of the videos,

along with AI-based alerts (e.g., person, package, vehicle, pet). Similar to our TV streaming model, we plan to build

scale with our devices, then monetize through smart home services, which we expect to become a very large

market.

4

Roku Q4 and Full Year 2022 Shareholder Letter

Driving Engagement

We are the No. 1 TV streaming platform by hours streamed in the U.S.,

Canada, and Mexico

2

. Globally, our users streamed a record 23.9

billion hours in Q4 and 87.4 billion hours in 2022.

The shift from traditional TV to TV streaming continues. In Q4, hours

on traditional TV in the U.S. fell 5% YoY, while global Streaming Hours

on the Roku platform grew 23% YoY. We also grew engagement per

user globally, with Streaming Hours per Active Account per day of 3.8

hours in Q4, up from 3.6 hours in Q4 2021.

Roku OS

The Roku OS is the foundation of our platform, powering Roku-branded TVs, Roku TV models, and our streaming

players. As the only OS purpose-built for TV, it is a key differentiator vs other TV streaming operating systems. We

are continuously updating the Roku OS with new features and capabilities to enhance the overall experience for

viewers, streaming services, and advertisers.

Home Screen Menu

With the significant growth in content across a growing number of streaming services, U.S. TV streaming viewers

in October 2022 took 52% longer to decide what to watch than they did in March 2019 (Nielsen). A key competitive

advantage for Roku is our position as the TV streaming platform — our home screen is the first thing a viewer sees

when they turn on their TV. From this position, we can help the viewer decide what to watch across the vast range

of options available to them on our platform. We innovate and build features to support this critical role in the

viewer journey, and it is a key driver of our monetization.

Our Home Screen Menu (left-hand navigation bar) contains features including a powerful, universal Search that

returns results across channels and a Live TV function that aggregates live/linear channels in a single destination.

In 2022, we created a new row on the Home Screen Menu called What to Watch, which provides personalized

recommendations of movie and TV titles and contains convenient features like Continue Watching and Save List.

As consumers continue to spend more TV time streaming, more sports programming will be available to stream.

However, the experience is fragmented, and it is increasingly difficult for viewers to find the games and events that

they want to watch. In Q4, we added a new row on the Home Screen Menu called Sports, to aggregate sporting

events in a single, centralized location. We also enhanced search capabilities to allow the viewer to easily find

games by team, league, sport, and matchups. In Q4, Streaming Hours originating from the Home Screen Menu

grew twice as fast as overall platform hours over the prior quarter, demonstrating the significant value the menu

provides our users. We believe there is significant opportunity to continue to grow our relevance to viewers, to

help them find and discover great content, and to use our innovation to grow both the engagement and

monetization of our platform.

2

Dec 2022, Hypothesis Group

5

Roku Q4 and Full Year 2022 Shareholder Letter

Roku Sports experience

The Roku Channel

The Roku Channel benefits from its integration with our platform, which has massive scale, deep engagement, and

the ability to surface content to viewers throughout the Roku OS experience. These unique advantages have helped

drive The Roku Channel’s incredible growth: In Q4, it was a top 5 channel on the Roku platform by Active Account

reach and Streaming Hour engagement. We grew engagement over 85% YoY, and it reached U.S. households with

an estimated 100 million people – positioning us strongly when the ad market rebounds.

FAST

3

channels were a significant area of growth in Q4: The Roku Channel’s FAST offering was the #1 FAST service

by reach and engagement on the Roku platform in the U.S. We are able to drive viewers to our FAST channels not

only through The Roku Channel app, but also through the Live TV and What to Watch features on the Home Screen

Menu. The Roku Channel is a partner of choice for publishers that want to maximize the value of their content, and

this is expanding our high-quality programming. In Q4, we added FAST channels from NBCUniversal and the

National Hockey League, and an exclusive AMC channel featuring its signature drama “Mad Men.” In January,

Warner Bros. Discovery entered their first FAST deal, bringing new channels that will feature fan favorites

“Westworld” and “The Bachelor,” in addition to 2,000 hours of on-demand content.

Roku Originals create content exclusivity that both viewers and advertisers value. “The Great American Baking

Show Celebrity Holiday” had the biggest premiere day of any unscripted Roku Original, and our feature film “Weird:

The Al Yankovic Story” drove the most reach of any on-demand program in The Roku Channel’s history. The film

has also received industry recognition, winning the Critics Choice Award for Best Movie Made for Television and

scoring nominations from industry guilds including the WGA, PGA, and DGA. The success of our programming, both

3

FAST: free ad-supported linear streaming TV does not include on-demand content

6

Roku Q4 and Full Year 2022 Shareholder Letter

scripted and unscripted, is attracting marquee brands, such as T-Mobile's sponsorship of “Weird.” TurboTax

sponsored “Emeril Tailgates” around the Big Game in Arizona on February 12, providing a way for us to engage

viewers and advertisers around this key cultural event.

The strong foundation we have built with The Roku Channel allows us to continue to drive growth in new areas.

Last June, we launched Spanish-language programming in the U.S. with Espacio Latino, followed by Kids & Family

en Español. In Q4, we built on this content and these capabilities to bring The Roku Channel to Mexico, where it

has become the channel’s largest international market. With strong scale and engagement, and the launch of our

video ad business earlier in the year, we are beginning to monetize in Mexico.

Monetization

In 2022, we grew Platform revenue through increased advertising sales,

the distribution of streaming services, the distribution of FAST channels,

Roku Pay, and our Media & Entertainment (M&E) promotional

capabilities. Our Platform revenue was $2.7 billion in 2022, up 20% YoY,

and $731 million in Q4, up 5% YoY. ARPU was $41.68 in Q4 (on a trailing

12-month basis), up 2% YoY.

Inflation and macro-economic uncertainty continued to pressure

consumers and advertisers in Q4. The total U.S. ad market weakened

throughout the quarter, declining 12% YoY in December, after decreases

of 2% and 6% in October and November, respectively (according to SMI).

While Roku continues to benefit from the shift of advertisers from

traditional TV to TV streaming, that was largely offset in Q4 by the

pullback in overall ad spend.

Streaming Service Distribution and Promotion

M&E spend on the Roku platform was up YoY in Q4, though this growth was pressured by overall ad market

weakness, in addition to a tough YoY comparison caused by last year’s launch of new streaming services. Our

unique platform and home screen contain powerful tools to attract, engage, and retain audiences, and we often

collaborate closely with streaming service partners on bespoke campaigns on the Roku platform. For example, we

created a first-ever Sponsored Search Zone for Paramount+ to engage streamers searching for a specific film. The

curated zone enabled users to quickly find the promoted film on Paramount+, browse similar content, and more.

As a result, Roku users who engaged with the Sponsored Search Zone were more likely to sign up for Paramount+

and streamed more hours than users who did not.

Roku Pay, our Roku OS payment solution, is also a powerful acquisition tool. With Roku Pay, publishers can enable

an easy, "one-click" signup within their app, and we believe this key benefit simplifies subscription signups for our

users and drives purchase and retention for our content publishers. Premium video streaming services on Roku

Pay have the highest retention across third-party billing platforms (Jan 2020 - Sept 2022, Antenna). We also

leverage the advantages of Roku Pay for our Premium Subscriptions offering in The Roku Channel.

Advertising

Our industry leadership positions us well as the market recovers and the shift from traditional TV to TV streaming

continues. Despite tightening advertising budgets in Q4, ad spend on the Roku platform outperformed the overall

ad and traditional TV markets in the U.S. We remain focused on innovation, building on our differentiated ad tech,

and crafting one-of-a-kind ad opportunities and partnerships. We are also developing relationships with more

third-party platforms (retail media networks, demand side platforms, and other strategic partners) to meet

7

Roku Q4 and Full Year 2022 Shareholder Letter

marketers where they currently are buying programmatic advertising. At the same time, our first-party and ACR

data, along with our specialized ad products (such as Shoppable Ads, the Kroger Shopper Program, and our

audience guarantees), will continue to be accessible only on the Roku advertising platform. This overall approach

protects our strategic assets, while creating additional demand opportunities for Roku ad inventory.

We have been building our ad platform for nearly a decade — ad serving, data management, programmatic

infrastructure, artificial intelligence, attribution toolkits, and more. Our targeting, measurement, and optimization

enable us to deliver innovative ad concepts that are compelling for both advertisers and consumers. We recently

partnered with DoorDash to allow their merchants to place click-to-order offers within their Roku ads. For the first

time, restaurant advertisers can achieve full funnel attribution on Roku, another example of the differentiation of

our ad capabilities.

Outlook

Looking ahead, although macro uncertainty seems likely to persist in 2023, our unmatched scale and engagement,

along with our competitive advantages, give us conviction in our ability to navigate and execute in challenging

times.

While the overall ad market was muted in Q4, ad spend among verticals such as restaurants, travel, consumer

packaged goods, and health and wellness appear to be improving thus far in Q1. However, other verticals including

financial services and M&E remain pressured. We expect this continued weakness in M&E spend to compress

Platform margins in the near term due to a higher mix shift toward video advertising. Importantly, we have been

adjusting our operations and operating expense profile to better manage through the challenging macro

environment. As a result, we expect operating expense YoY growth to significantly decline over the course of the

year, from approximately 40% in Q1 (a 30-point sequential improvement from Q4 2022) to single-digit YoY growth

by Q4 2023.

Accordingly, our Q1 outlook reflects normal seasonality with total net revenue of roughly $700 million, total gross

profit of roughly $310 million, and adjusted EBITDA of negative $110 million. Given our ongoing work to carefully

manage expenditures, we are committed to a path that delivers positive adjusted EBITDA for full year 2024.

Conclusion

We have built our business on the fundamental belief that all TV will be streamed, and all audiences, content, and

advertising spend will follow. The investments we have made in people, technology, and products and services are

furthering our competitive advantages. While cyclical economic pressures are affecting our business, two things

remain true: the secular trend supporting our business remains intact, and the combination of our scale,

engagement, and innovation position Roku exceptionally well to benefit when the market rebounds.

Thank you for your support, and Happy Streaming™!

Anthony Wood, Founder and CEO; and Steve Louden, CFO

8

Roku Q4 and Full Year 2022 Shareholder Letter

Conference Call Webcast – February 15, 2023 at 2 p.m. PT

The Company will host a webcast of its conference call to discuss the Q4 and fiscal year 2022 results at 2 p.m. Pacific

Time / 5 p.m. Eastern Time on February 15, 2023. Participants may access the live webcast in listen-only mode on

the Roku investor relations website at www.roku.com/investor. An archived webcast of the conference call will also

be available at www.roku.com/investor after the call.

Segment Reporting Change

Effective as of the fourth quarter of fiscal 2022, we reorganized reportable segments to better align with

management’s reporting of information reviewed by our Chief Operating Decision Maker, our CEO, for each

segment. Our segment and related financial information is recast to reflect the following changes; we renamed the

Player segment to the Devices segment, which now includes licensing arrangements with service operators and TV

brands in addition to sales of streaming players, audio products, smart home products, and starting in 2023, Roku-

branded TV sales. All financial information, current and historical, is recast based on the reorganized segments.

About Roku, Inc.

Roku pioneered streaming to the TV. We connect users to the streaming content they love, enable content

publishers to build and monetize large audiences, and provide advertisers with unique capabilities to engage

consumers. Roku streaming players and TV-related audio devices are available in the U.S. and in select countries

through direct retail sales and licensing arrangements with service operators. Roku TV™ models are available in the

U.S. and in select countries through licensing arrangements with TV OEM brands. Roku Smart Home products,

including cameras, video doorbells, lighting, plugs, and more are available in the U.S. Roku is headquartered in San

Jose, Calif. U.S.A.

Roku, the Roku logo and other trade names, trademarks or service marks of Roku appearing in this shareholder

letter are the property of Roku. Trade names, trademarks and service marks of other companies appearing in this

shareholder letter are the property of their respective holders.

Investor Relations

Conrad Grodd

cgrodd@roku.com

9

Roku Q4 and Full Year 2022 Shareholder Letter

Use of Non-GAAP Measures

In addition to financial information prepared in accordance with generally accepted accounting principles in the

United States (GAAP), this shareholder letter includes certain non-GAAP financial measures. These non-GAAP

measures include Adjusted EBITDA. In order for our investors to be better able to compare our current results with

those of previous periods, we have included a reconciliation of GAAP to non-GAAP financial measures in the tables

at the end of this letter. The Adjusted EBITDA reconciliation adjusts the related GAAP financial measures to exclude

other income (expense), net, stock-based compensation expense, depreciation and amortization, restructuring

charges, and income tax (benefit)/expense where applicable. We believe these non-GAAP financial measures are

useful as a supplement in evaluating our ongoing operational performance and enhancing an overall understanding

of our past financial performance. However, these non-GAAP financial measures have limitations, and should not

be considered in isolation or as a substitute for our GAAP financial information.

Forward-Looking Statements

This shareholder letter contains “forward-looking” statements that are based on our beliefs and assumptions and

on information currently available to us. Forward-looking statements include all statements that are not historical

facts and can be identified by terms such as “anticipate,” “believe,” “continue,” “could,” “design,” “estimate,”

“expect,” “may,” ‘plan,” “seek,” “should,” “will,” “would” or similar expressions and the negatives of those terms.

Forward-looking statements involve known and unknown risks, uncertainties and other factors that may cause our

actual results, performance or achievements to be materially different from any future results, performance or

achievements expressed or implied by the forward-looking statements. Forward-looking statements represent our

beliefs and assumptions only as of the date of this letter. These statements include those related to our ability to

innovate, build and launch new products and services, including the Roku Select and Roku Plus Series TVs and smart

home products; the size of the smart home products market; changes in the ad market; our belief that the current

conditions in the ad market are temporary; the shift of TV and TV advertising to streaming; our ability to continue

leading the shift to streaming; our ability to grow our Active Accounts; the effect that our production of first-party

TVs will have on our growth and expansion and the entire Roku ecosystem; our room for growth in engagement;

our ability to promote content effectively to produce value for our content partners; our international expansion;

our strategic plan; the strength, features and value of the Roku brand, OS and platform; our ability to continue to

update the Roku OS with new features and capabilities; the availability of sports programming streaming; our ability

to deliver growth in platform monetization; our positioning to capture media & entertainment spend; the growth

and monetization of and investment in The Roku Channel; the growth of FAST; our content offering in The Roku

Channel; our ability to create value for advertisers in The Roku Channel; our ability to innovate our ad tech; our

relationships with third-party advertising platforms; our ability to navigate through macroeconomic headwinds and

to succeed when the general market recovers; our belief that the current macro environment is temporary; our

financial outlook for the first quarter of 2023, our plans to improve our operating expenses profile in 2023 and to

achieve positive adjusted EBITDA for full year 2024, and our qualitative color on our business in 2023 and beyond;

our investments; and our overall business trajectory. Except as required by law, we assume no obligation to update

these forward-looking statements publicly, or to update the reasons actual results could differ materially from those

anticipated in the forward-looking statements, even if new information becomes available in the future. Further

information on factors that could cause actual results to differ materially from the results anticipated by our

forward-looking statements is included in the reports we have filed with the Securities and Exchange Commission,

including our Annual Report on Form 10-K for the year ended December 31, 2021 and our Quarterly Report on Form

10-Q for the quarter ended September 30, 2022. Additional information also will be available in our Annual Report

on Form 10-K for the year ended December 31, 2022. All information provided in this shareholder letter and in the

tables attached hereto is as of February 15, 2023, and we undertake no duty to update this information unless

required by law.

Roku Q4 and Full Year 2022 Shareholder Letter

10

ROKU, INC.

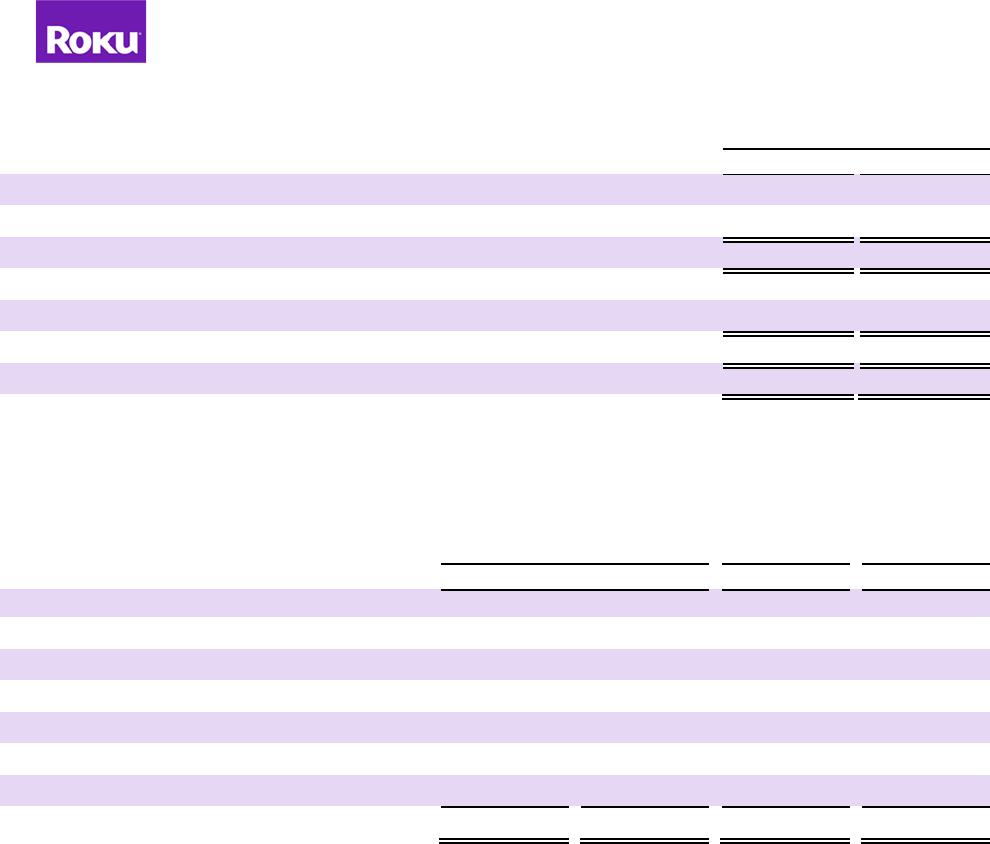

CONSOLIDATED STATEMENTS OF OPERATIONS (in thousands, except per share data)

(unaudited)

Three Months Ended December 31,

Years Ended December 31,

2022

2021

2022

2021

Net Revenue:

Platform

$ 731,261

$ 698,887

$ 2,711,441

$ 2,264,920

Devices

135,795

166,442

415,093

499,664

Total net revenue

867,056

865,329

3,126,534

2,764,584

Cost of Revenue:

Platform (1)

323,279

275,260

1,179,675

818,506

Devices (1)

179,400

210,425

505,737

537,478

Total cost of revenue

502,679

485,685

1,685,412

1,355,984

Gross Profit (Loss):

Platform

407,982

423,627

1,531,766

1,446,414

Devices

(43,605)

(43,983)

(90,644)

(37,814)

Total gross profit

364,377

379,644

1,441,122

1,408,600

Operating Expenses:

Research and development (1)

220,670

126,438

788,913

461,602

Sales and marketing (1)

297,562

163,350

838,419

455,601

General and administrative (1)

96,043

68,492

344,678

256,297

Total operating expenses

614,275

358,280

1,972,010

1,173,500

Income (Loss) from Operations

(249,898)

21,364

(530,888)

235,100

Other Income (Expense), Net:

Interest expense

(1,888)

(749)

(5,161)

(2,980)

Other income (expense), net

13,614

2,006

43,766

4,467

Total other income (expense), net

11,726

1,257

38,605

1,487

Income (Loss) Before Income Taxes

(238,172)

22,621

(492,283)

236,587

Income tax expense (benefit)

(975)

(1,066)

5,722

(5,798)

Net Income (Loss)

$ (237,197)

$ 23,687

$ (498,005)

$ 242,385

Net income (loss) per share — basic

$ (1.70)

$ 0.18

$ (3.62)

$ 1.83

Net income (loss) per share — diluted

$ (1.70)

$ 0.17

$ (3.62)

$ 1.71

Weighted-average common shares outstanding —

basic

139,658

134,711

137,668

132,710

Weighted-average common shares outstanding —

diluted

139,658

141,869

137,668

141,668

(1) Stock-based compensation was allocated as follows:

Cost of revenue, platform

$ 347

$ 263

$ 1,229

$ 827

Cost of revenue, devices

621

687

2,440

2,035

Research and development

40,523

21,746

147,653

77,770

Sales and marketing

37,638

19,274

123,946

63,503

General and administrative

25,148

12,083

84,663

43,397

Total stock-based compensation

$ 104,277

$ 54,053

$ 359,931

$ 187,532

Roku Q4 and Full Year 2022 Shareholder Letter

11

ROKU, INC.

CONSOLIDATED BALANCE SHEETS (in thousands, except par value data)

(unaudited)

As of December 31,

2022

2021

Assets

Current Assets:

Cash and cash equivalents

$ 1,961,956

$ 2,146,043

Accounts receivable, net of allowances of $40,191 and $56,827 as of

760,793

752,393

December 31, 2022 and 2021, respectively

Inventories

106,747

50,276

Prepaid expenses and other current assets

135,383

105,795

Total current assets

2,964,879

3,054,507

Property and equipment, net

335,031

177,567

Operating lease right-of-use assets

521,695

345,660

Content assets, net

292,766

223,713

Intangible assets, net

58,881

84,126

Goodwill

161,519

161,519

Other non-current assets

77,830

35,053

Total Assets

$ 4,412,601

$ 4,082,145

Liabilities and Stockholders’ Equity

Current Liabilities:

Accounts payable

$ 164,800

$ 124,921

Accrued liabilities

750,810

549,055

Current portion of long-term debt

79,985

9,883

Deferred revenue, current portion

87,678

45,760

Total current liabilities

1,083,273

729,619

Long-term debt, non-current portion

—

79,985

Deferred revenue, non-current portion

28,210

28,726

Operating lease liability, non-current portion

584,651

394,724

Other long-term liabilities

69,911

82,485

Total Liabilities

1,766,045

1,315,539

Stockholders’ Equity:

Common stock, $0.0001 par value;

14

14

Additional paid-in capital

3,234,860

2,856,572

Accumulated other comprehensive income (loss)

(292)

41

Accumulated deficit

(588,026)

(90,021)

Total stockholders’ equity

2,646,556

2,766,606

Total Liabilities and Stockholders’ Equity

$ 4,412,601

$ 4,082,145

Roku Q4 and Full Year 2022 Shareholder Letter

12

ROKU, INC.

CONSOLIDATED STATEMENTS OF CASH FLOWS (in thousands)

(unaudited)

Years Ended December 31,

2022

2021

Cash flows from operating activities:

Net income (loss)

$ (498,005)

$ 242,385

Adjustments to reconcile net income (loss) to net cash provided by operating

activities:

Depreciation and amortization

48,651

42,621

Stock-based compensation expense

359,931

187,532

Amortization of right-of-use assets

55,507

31,024

Amortization of content assets

234,355

95,570

Foreign currency remeasurement (gains) losses

(8,230)

—

Change in fair value of strategic investment

532

—

Impairment of intangible assets

7,500

—

Provision for (recoveries of) doubtful accounts

2,081

(904)

Other items, net

(190)

(101)

Changes in operating assets and liabilities:

Accounts receivable

(10,887)

(221,768)

Inventories

(56,471)

3,619

Prepaid expenses and other current assets

(15,941)

(48,074)

Content assets and liabilities, net

(313,204)

(193,440)

Other non-current assets

(7,304)

(19,335)

Accounts payable

14,190

8,428

Accrued liabilities

167,526

128,931

Operating lease liabilities

(9,245)

(20,083)

Other long-term liabilities

(403)

(1,100)

Deferred revenue

41,402

(7,224)

Net cash provided by operating activities

11,795

228,081

Cash flows from investing activities:

Purchases of property and equipment

(161,696)

(40,041)

Acquisition of businesses, net of cash acquired

—

(136,778)

Purchase of strategic investment

(40,000)

—

Net cash used in investing activities

(201,696)

(176,819)

Cash flows from financing activities:

Repayments of borrowings

(10,000)

(5,000)

Proceeds from equity issued under incentive plans

18,357

18,532

Proceeds from equity issued under at-the-market offerings, net of offering costs

—

989,615

Net cash provided by financing activities

8,357

1,003,147

Net increase (decrease) in cash, cash equivalents and restricted cash

(181,544)

1,054,409

Effect of exchange rate changes on cash, cash equivalents and restricted cash

(4,170)

12

Cash, cash equivalents and restricted cash —Beginning of period

2,147,670

1,093,249

Cash, cash equivalents and restricted cash —End of period

$ 1,961,956

$ 2,147,670

Cash, cash equivalents and restricted cash at end of period:

Cash and cash equivalents

1,961,956

2,146,043

Restricted cash, non-current

—

1,627

Cash, cash equivalents and restricted cash —End of period

$ 1,961,956

$ 2,147,670

Roku Q4 and Full Year 2022 Shareholder Letter

13

Years Ended December 31,

2022

2021

Supplemental disclosures of cash flow information:

Cash paid for interest

$ 3,894

$ 2,578

Cash paid for income taxes

$ 7,016

$ 1,363

Supplemental disclosures of non-cash investing and financing activities:

Non-cash consideration for business combination

$ —

$ 21,400

Services to be received as part of a business combination

$ —

$ 6,500

Unpaid portion of property and equipment purchases

$ 28,503

$ 3,073

NON-GAAP INFORMATION (in thousands)

(unaudited)

Three Months Ended December 31,

Years Ended December 31,

2022

2021

2022

2021

Reconciliation of Net Income (Loss) to Adjusted EBITDA:

Net income (loss)

$ (237,197)

$ 23,687

$ (498,005)

$ 242,385

Other income (expense), net

(11,726)

(1,257)

(38,605)

(1,487)

Stock-based compensation

104,277

54,053

359,931

187,532

Depreciation and amortization

12,254

11,317

48,651

42,621

Restructuring charges (1)

38,140

—

38,140

—

Income tax expense (benefit)

(975)

(1,066)

5,722

(5,798)

Adjusted EBITDA

$ (95,227)

$ 86,734

$ (84,166)

$ 465,253

(1) Restructuring charges of $38.1 million in the fourth quarter of 2022 were composed primarily of severance and related charges of

$30.6 million and an impairment charge of $7.5 million for the abandonment of certain technology intangible assets.