Connected TV advertising

market dynamics

November 2020

Report for Ofcom

CTV advertising market dynamics | © Spark Ninety 2020

Contents

2

1. Introduction

2. Market size and growth

3. Value chain

4. Market dynamics

CTV advertising market dynamics | © Spark Ninety 2020

Ofcom commissioned Spark Ninety to conduct a targeted project exploring the

connected TV (CTV) value chain, technology and market dynamics

3

Introduction

•

Spark Ninety are advisors to the media and technology sectors, providing growth and market entry strategy, research, organisational development and due diligence

services. Our clients include major media owners, technology providers, publishers, government, regulators and investors.

• Ofcom commissioned Spark Ninety to conduct a targeted project exploring the CTV value chain, technology and market dynamics in the UK - with the main objectives of:

○ Providing a high-level overview of the UK CTV advertising market

○ Highlighting key market dynamics relating to global technology companies, but not limited to big tech

○ Laying the ground for future Ofcom work on CTV advertising by identifying areas for further exploration

• The project involved a review of information from public and proprietary sources, and interviews with senior managers at the following stakeholders. Interviews were

conducted off-the-record and the quotes included in this report are anonymised.

○ Broadcasters: ITV, Channel 4, Sky Media

○ Ad tech: FreeWheel, SpotX, Smart Adserver, The Trade Desk

○ Platforms: Roku, a major global platform

○ Agencies: GroupM, Finecast

• The project was small scale, involving 2 weeks of work. Consequently, the findings set out in this report provide a top-level overview of a highly complex market. The

research was conducted in October and November 2020

DISCLAIMER. This report has been produced by Spark Ninety Limited, a limited company registered in England and Wales with registered number 11248585, in accordance with an engagement agreement for

professional services with Ofcom. This report contains information about the connected TV advertising market based on sources believed to be reliable. The information is not advice and should not be treated as

such. To the fullest extent permitted by law, Spark Ninety Limited and its employees do not accept or assume any responsibility or liability in respect of this report, or decisions based on it, to any reader of the

report. Should such readers choose to rely on this report, then they do so at their own risk. Any views or opinions expressed in this report are those of Spark Ninety and may not reflect Ofcom’s views.

CTV advertising market dynamics | © Spark Ninety 2020

Contents

4

1. Introduction

3. Value chain

4. Market dynamics

2. Market size and growth

CTV advertising market dynamics | © Spark Ninety 2020

An increasing proportion of the UK population has an internet connected TV set at

home. There is a range of CTV devices

5

Sources: (1) Ofcom technology tracker, 2020. Fieldwork conducted from 9th January to 7th March 2020. (2) https://www.emarketer.com/content/uk-digital-video-2020

Notes: (3) These categories are not mutually exclusive.

• 63% of people surveyed for Ofcom’s Technology Tracker in Q1 2020 had an

internet-connected TV set at home

(1)

• There are four main categories of connected TV device: smart TV sets, standalone

streaming devices, connected games consoles, and internet-connected operator

set-top boxes

• These categories overlap - a household may have more than one device

connecting a TV set to the internet, or use different devices on different TV sets

• The device landscape is relatively fragmented, in Q1 2020:

○ 41% had an internet connected games console

(1)

○ 11% had a streaming stick

(1)

○ Data for other categories is not available

• Connected TV adoption is forecast to grow over the next few years, from 40.9

million users in 2020 to 44.4 million users in 2025

(2)

Categories of connected TV device

(3)

Smart TV sets

• Samsung

• LG

• Panasonic

• HiSense

Streaming devices

• Amazon Fire TV

• Roku

• AppleTV

• Google Chromecast

• GoogleTV

Games consoles

• Playstation

• XBox

• Nintendo

Operator set-top boxes

• Sky

• Virgin

• NOWTV

Connected TV penetration and categorisation

CTV advertising market dynamics | © Spark Ninety 2020

CTV devices enable three main categories of addressable advertising on TV screens

6

Notes: (1) Simplification of IAB UK and IAB Europe definitions. (2) Excluding VSP and BVOD services viewed on mobile or desktop devices. (3) Adsmart use a proprietary system of ad delivery - in some cases, addressable ads may be distributed

via broadcast in advance of ad insertion. Excludes AdSmart on OTT services. (4) User interface advertising is an area of innovation and new ad formats are likely to emerge over the next few years. (5)

https://www.samsung.com/us/business/samsungads/resources/first-screen-ad/ (6) https://www.tremorvideo.com/creative/ad-specs/home-launcher/

Taxonomy of addressable advertising on TV screens

CTV advertising

Video sharing platforms (VSPs)

Broadcast TV channels CTV device user interfaces

Addressable ads on broadcast TV Ads on CTV device user interfaces2 31

Broadcaster VOD

Other AVOD

Category

Service

Ad formats

• Video

• Display (overlays)

• Video

• Display, video

• Search

(4)

Description

• Generally defined as advertising served in

an internet-delivered video service viewed

on a TV set

(1)

• Addressable ads that replace broadcast

ads, with ad insertion enabled by a CTV

device

• Emerging category of ads placed in device

user interfaces, such as home screen, EPG,

or search results

Examples

• YouTube video and display ads

(2)

• ITV Hub

• All 4

• My5 (2)

• PlutoTV

• RokuTV

• SkyAdSmart dynamic ad replacement

(DAR) on broadcast TV - enabled by Sky or

Virgin set-top boxes

(3)

• Potentially, in the future, DAR on other CTV

devices such as smart TV sets

• Samsung First Screen Ads

(5)

served on the

smart TV home screen prior to a VOD app

initiating

• LG Home Launcher Ads

(6)

- static banner

ads on LG Smart TV home screen, which

can click to video, a browser or an app

CTV advertising market dynamics | © Spark Ninety 2020

From a media trading perspective, CTV advertising is not a well-defined market - it

overlaps both the TV and digital trading environments

7

Notes: (1) Trading of ad inventory in the CTV user interface (not shown) is likely to form part of the digital trading environment.

Main characteristics of TV and digital video advertising trading

• TV buyers in media agencies

• Very few other buyers

Connected

TV ad

‘market’

OTT video (BVOD, YouTube) Outstream videoBroadcast TV DAR in broadcast TV Digital display

Buyers

• ‘Share of broadcast’ deals

• TV parameters e.g. ‘XX% in peak’

• c.12 TV trading audiences

• Cost per thousand impacts (CPTs)

• TV impacts + impressions

• BARB-measured

• Publicly reported

• Partially elective schedules

• Linear TV 1st...plus BVOD

• TV audited separately

• AV buyers in media agencies

• Long tail of SME buyers

• Volume spend agency deals

• Digital trading parameters

• Data-based audiences

• Cost per mille (CPMs)

• Sold impressions

• Vendor measured

• Privately reported

• Programmatic trading

• Automated ad serving

• Video part of digital display

• Audited within ‘digital’

Trading and

metrics

Processes

Media

TV trading arena

Digital trading arena

• The interaction of agencies (buy side) and media companies (sell side) creates traded markets. Agencies compete for, and retain, advertisers by buying well versus pricing

norms. TV and digital are usually bought separately, by different teams. The emergence of CTV is disrupting existing models, and its status is in contention: is it TV, or

digital, or a new media sector?

CTV advertising market dynamics | © Spark Ninety 2020

UK expenditure on addressable ads seen on TV screens was about £515m in 2019,

concentrated on BVOD and YouTube, and is likely to grow strongly

8

Estimated UK market for addressable advertising on TV screens, 2019 - Indicative

£300m

YouTube

BVOD

£20m Other AVOD

£110m

Device UI

£85m

DAR in

broadcast TV

c.£515m

• BVOD viewing is growing strongly, with a step-change in 2020, creating an increased supply of ad inventory.

About 70% of UK BVOD viewing is on CTV

(2)

• Linear TV budgets will be more easily diverted to BVOD as TV+ BVOD measurement and campaign metrics

improve

• Increasing programmatic sales capability (e.g. C4’s deal with The Trade Desk

(4)

) opens the market non-traditional

TV buyers (e.g. digital)

• YouTube likely to grow strongly and increase CTV audiences (currently, the majority of YouTube’s UK audience is

on mobile). CTV may attract more AV ad buyers willing to pay for a premium for the TV format

• AVOD is likely to grow strongly from a low base, driven by growing content distribution on services such as

PlutoTV and the probable launch of new services, such as IMDB TV

• DAR in broadcast TV will expand via better distribution with Sky AdSmart’s C4 and Virgin Media deals

(3)

, and

growth in Sky’s DAR-compatible estate of set-top boxes (e.g. Sky Q, NOW TV)

• UI ad market is nascent. Stakeholders see UI ads as a way to reach heavy SVOD viewers who see few video ads.

Attractive to entertainment brands promoting SVOD/TVOD. Limited by lack of format standardisation at present

Source: (1) 2019 expenditure estimates based on Spark Ninety analysis of public sources (e.g. CMA) crossed checked with industry participants. 2024 forecasts are highly indicative estimates based on observations made by industry

stakeholders. (2) Thinkbox.tv (3) Sky AdSmart’s Virgin Media deal was announced in March 2019; 4Sales deal in September 2019. The former is active, the latter isn’t yet (4) 4Sales.com 20

th

July 2020.

CTV advertising market dynamics | © Spark Ninety 2020

In the long term, CTV advertising is likely to account for the majority of broadcaster

ad revenue - and support a range of new services

9

Long-term growth prospects for CTV advertising

CTV advertising market drivers

Ad budgets following audiences to CTV services

Media owners focusing on growing CTV audiences

and ad inventories

Growing demand for data-driven targeting

Expansion of the market of CTV buyers to include

digital buyers / SME advertisers

Confluence of innovation, investment, land-grab,

opportunities and FOMO

Long-term outlook

By 2024, we estimate that approximately 20% to

30% of broadcaster ad revenue will be CTV

advertising or DAR on broadcast TV - all delivered

on CTV platforms

In the longer term, most broadcaster advertising

will be addressable ads enabled by CTV platforms

In consequence, CTV ad revenues will be critical to

the health of the commercial PSBs

CTV advertising may also provide revenues for

various new entrant AVOD services, such as

publisher apps

CTV advertising market dynamics | © Spark Ninety 2020

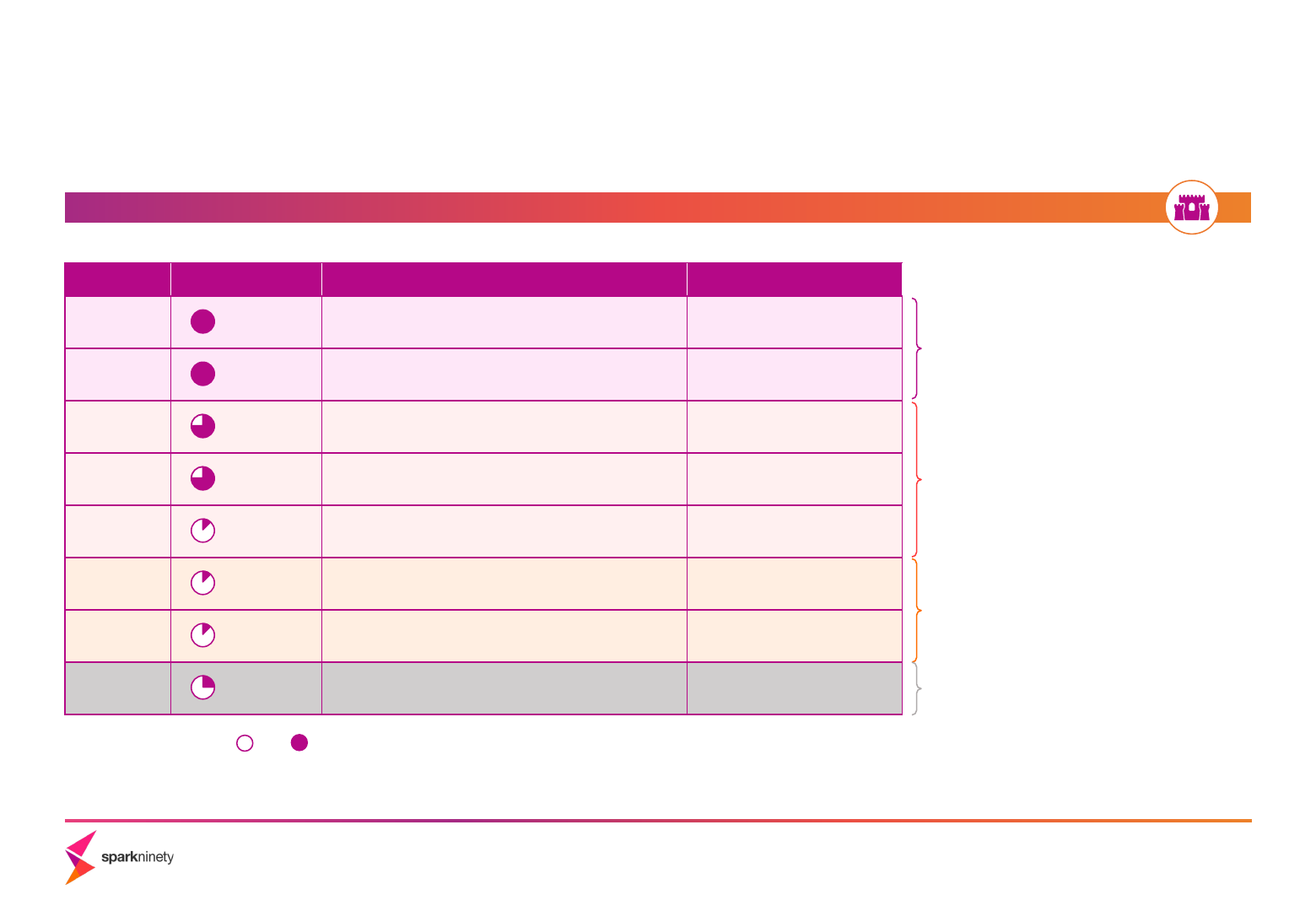

CTV advertising is increasingly traded programmatically, part of a migration to

automated data-driven trading of video advertising across platforms

10

CTV advertising sales methods

Broadcasters

Other AVOD

YouTube

Proprietary buying platform Programmatic guaranteed Programmatic biddableDirect

✔

✔

(1)

✔

(1)

✔

✔

(2)

✔

(3)

✔ ✔

✔

= main sales methods at present

Notes: (1) Limited to DV360. (2) Only ITV’s Planet V at present. (3) Limited programmatic integrations available at present.

CTV advertising market dynamics | © Spark Ninety 2020

Contents

11

1. Introduction

4. Market dynamics

2. Market size and growth

3. Value chain

CTV advertising market dynamics | © Spark Ninety 2020

The CTV advertising value chain is relatively complex, involving media owners,

buyers, ad tech and gateway platforms

12

CTV advertising value chain - simplified

Buyers Media owners Gateway platforms

(4,5)

• Pay to serve ads

to consumers in

order to

influence brand

perceptions

(brand ads) or

initiate an action

(response or

performance

ads)

• Provide media

strategy and

planning

services

• Buy advertising

from supply

sources and

optimise

campaign

performance

• Tech that

aggregates

supply from

SSPs

• Provide tools to

manage and

execute

campaigns and

to activate

targeting data

• Tech used by

content services

to automate the

sale of

advertising

• Connect content

services to

sources of

demand (DSPs)

• Manage ad

inventory, serve

ads and manage

creative tags

• Decide which

ads to serve

given bids and

the order book

of direct deals

• Sell CTV

advertising (and

TV advertising)

on behalf of

affiliated and/or

third-party

content services

• Publish content

or facilitate

content sharing

- generally by

providing a CTV

app

• Attract

audiences and

generate ad

inventory

• Distribute and

promote apps

• Set the rules for

apps (e.g. ad

formats, ad

content)

• Generally tied to

the OS

• Smart TV set or

other CTV

device -

hardware,

software and a

UI - that enables

services and

advertising

• Generate ad

inventory in the

UI

• Software that

supports basic

functions of CTV

devices

• May provide

access to ad

enablers such as

device ID or ad

insertion tech

Ad tech

Device / UI

Operating

system

App store

Content

service

Ad sales houseAd serverMedia agencyAdvertiser

SSP

(2)

DSP

(1)

Direct buying platform

(3)

Targeting data

(6)

VerificationMeasurementAnalytics ID solutions

Ad clearance

Data, analytics and support services

Monetise owned ads and data; share of content service ads in return

for access to audiences or enabling tech

Monetise owned ads

and data

Commission on

third-party sales

Fees for

software usage

Intermediation - take share of media spend

and/or tech fees

Service fees or % of

media

Advertising

revenue model:

• Analyse audiences exposed to

ads and estimate ad impact

• Measure audiences to inform

media planning and settlement

• Process and provide data to

enable targeting of audiences

or contexts

• Verify whether ads are non-

fraudulent and in brand safe

environments

• Match users/households across

different services and

platforms

• Clear ads against the CAP and

BCAP codes prior to

distribution

Notes: (1) DSP = demand-side platform. (2) SSP = supply-side platform. (3) DSPs and SSPs enable programmatic trading. In many cases, CTV ad inventory is sold direct (involving manual orders) or on a direct buying platform. (4) This

segmentation of gateway roles is an evolution of the taxonomy proposed by Mediatique (consumer product, OS, UI) - Mediatique, Connected TV gateways: review of market dynamics, August 2020. (5) Closely related and overlapping

roles. App stores are generally tied to an OS. Device UI may be controlled, to some extent, by the OS provider. (6) Ad targeting may be done using advertiser or publisher first party data and/or third-party data. Data processing may be

enabled by a data management platform (DMP) or other solutions, either standalone or integrated with other ad tech services, such as a DSPs.

CTV advertising market dynamics | © Spark Ninety 2020

In terms of tech, CTV ad serving involves client (gateway platform) and server based

technologies - and ad serving models differ between services

13

CTV ad serving and trading (simplified) in three different ad-serving models

Ad serving into VOD

Ad serving into a linear TV OTT stream

Publisher ad server requests

bids and relevant orders

from the publisher SSP

Publisher ad server evaluates

SSP orders and bids, and any

direct orders, selects and

notifies the successful buyer

DSPs evaluate ad inventory

based on data and make a

bid

Advertiser ad server sends ad

creative to device or ad

insertion server

SSP issues a bid request to

demand partners, if biddable

is enabled, and sends

winning bid to the ad server

End user

watches VOD

on an app

(publisher code

running on

device OS)

App / device

plays the ad

and reports ad

delivery to the

ad server

Ad break ends

and CDN

content

streaming

resumes

Media content

is streamed via

a CDN

Ad break is

reached; app

sends a call to

the publisher

ad server

Advertiser ad

server delivers

ad content to

the device/app

End user

watches linear

OTT TV on an

app

Media content

is streamed via

a CDN

Ad break is

reached; ad

insertion server

sends call to

the publisher

ad server

Ad insertion

server stitches

together ad

content and

media content

Ad insertion

server sends

stitched

content to user

via the CDN

and reports

Ad break ends

and CDN

content

streaming

resumes

End user

watches linear

TV on a TV set

Media content

is broadcast via

satellite or

cable to a set-

top box

Ad break is

reached; set-

top box

software

selects an

addressable ad

to show

Operator ad system selects in

advance ads to show each

user, based on demand and

user profile, and sends

instructions and ad creative

to the set-top box in advance

Operator ad system forecasts

supply and matches to

demand

Buyers submit direct orders

for targeted ads

Set-top box ad

software

stitches

together ad

content and

media content

Set-top box

plays stitched

content to the

user and

reports ad

delivery

Ad break ends

and broadcast

TV resumes

Addressable ad serving into broadcast TV

(2)

Key: = Client-side process - takes place on a gateway platform. = Ad decisioning and trading process.

Sources: (1) Spark Ninety analysis based on Pixalate (Server-Side Ad Insertion (SSAI): The hidden driver of ad fraud in Connected TV/OTT) and discussions with industry stakeholders

Notes: (2) Generalised ad serving model. Alternative approaches may be used depending on set-top box capabilities. In the future, smart TV sets could be used to perform ad replacement in the UK.

CTV advertising market dynamics | © Spark Ninety 2020

Gateway platforms control or host certain enabling technologies, with control points

over ad-tech within apps

14

CTV advertising technology - Key characteristics

DAR in

broadcast TV

Video ad

serving tech

• Video advertising uses standards, such as VAST (video ad serving template)

(1)

, an IAB

(2)

standard for video ad tags

• IAB RTB (real-time bidding) standards cover programmatic trading of video ad inventory, as well as other ad formats

Broadcast TV

ad tech

• Broadcasters require ad tech to accommodate specific UK requirements, such as Clearcast clock numbers (denote that ads have been cleared) and management of ad placements to

comply with UK regulations

• Insertion of ads into linear OTT TV streams requires dynamic ad insertion (DAI) technology

Apps

• Content services are apps written for a specific OS (analogous to mobile), with ad tech vendor code integrated into apps

• There is no cookie equivalent to track users across services

ACR

• Some smart TVs use automated content recognition (ACR) technology to collect “glass level” viewing data that may be used in advertising

• ACR matches the audio and/or video of content viewed on a smart TV screen to a library of content signatures - identifying the programmes and ads viewed on broadcast TV and VOD

Access to

device IDs

• Each device/OS has its own IDs which may be used for advertising

• Gateway platforms control whether or not these IDs are provided for use in advertising and under what terms

Apps

• Content service apps run on gateway platform OSs, providing platforms with control over app access to computing resources

• Gateway platform app stores set or agree terms for content service apps, including terms relating to advertising and ad tech. They generally review and certify apps before distribution

App-based ecosystem

(1)

Ad tech standards established in some areas, but limited in other areas

Gateway platforms control certain enabling technologies

Notes: (1) https://www.iab.com/guidelines/vast/ (2) Internet Advertising Bureau, an industry body. (3) https://projectoar.org/

• Replacement of broadcast TV ads with addressable ads requires dynamic ad replacement (DAR) technology that operates on the CTV device

• In the UK, Sky AdSmart inserts ads on operator set-top boxes. Alternative technologies are emerging that insert ads on smart TV sets, such as project OAR - a consortium of US

stakeholders

(3)

CTV advertising market dynamics | © Spark Ninety 2020

Ownership of key ad inventory, data and enabling technology is generally split

across different market participants

15

Notes: (1) This list is not exhaustive. (2) Google owned and operated buying platforms (DV360, Google Ads) provide access to YouTube ad inventory with the exception of advertising on YouTube that is sold directly by content owners under

“carve out” agreements. (3) YouTube supports third-party content creators/media owners that receive a revenue share on advertising on their content sold by YouTube. (4) ITV Hub is available exclusively via direct sales and Planet V, a

buying platform developed by ITV using technology licensed from Amobee. (5) Other UK broadcasters generally contract with one of a range of ad servers and SSPs.

CTV advertising market participants - Examples

(1)

Buyers

• Unilever

• Tesco

• Lloyds

• BMW

• BA

• John Lewis

• SMEs

• Finecast

• GroupM

• MG OMD

• Dentsu

• Zenith

• DV360/Google

Ads

• Planet V

• Google DV360

• The Trade Desk

• Amobee

• Roku

• Samsung Ads

• Tremor Video

• SpotX

• Google Ad

Manager

• Magnite

• FreeWheel

• Amobee

• Amazon

Publisher

Services

• Freewheel

• Google Ad

Manager

• SpotX

• Smart

Adserver

• Amobee

• ITV Media

• 4Sales

• Sky Media

• Google Play

Store

• Amazon

• Roku Channel

Store

• iTunes

• LG Content

Store

• Samsung

Smart Hub

• Amazon Fire

TV

• Google TV

• Roku

• Apple TV

• Samsung

• LG

• Panasonic

• Sony

• Android TV

• Amazon Fire

• Roku

• WebOS TV

• Tizen

• XBox One

• PS OS

Media agencyAdvertiser

Enabling technology | DataMain assets Ad inventory at scale | Data Enabling tech | Distribution | Data | UI ads

ModerateMarket concentration High Low

• FreeWheel and SpotX are widely adopted by

broadcasters internationally. Google is less widely used

in CTV than the comparable internet display advertising

intermediation market.

• Ownership of CTV ad inventory is

currently concentrated amongst a

small number of major broadcasters

and YouTube.

• FreeWheel and SpotX are widely adopted by broadcasters

internationally. Google is less widely used in CTV than the

comparable internet display advertising intermediation

market.

• ITV Hub

(4)

• All4

(5)

• My5

• DPlay

• Roku TV

• Samsung TV

Media owners Gateway platforms

(4,5)

Ad tech

Device / UI

Operating

system

App store

Content

service

Ad sales houseAd server

SSPDSP

Direct buying platform

• YouTube

(2,3)

CTV advertising market dynamics | © Spark Ninety 2020

Some global technology companies operate at multiple levels of the CTV advertising

value chain, owning gateway platforms, media and ad tech

16

Notes: (1) In most cases, there is not exclusive vertical integration between the component parts of global technology companies’ operations. For example, Roku Advertising buys ad inventory on Roku TV and third-party SSPs. (2) IMDB TV is

not yet available in the UK, but in October 2020 it was

reported that Amazon was recruiting for a project lead, indicating that a UK launch is planned. (3) NBCU’s streaming service Peacock is not yet available in the UK. (4) The X1 OS is

used on Comcast Xfinity set-top boxes in the US. It is not used on devices available in the UK at present. (5) Google, Amazon and Microsoft also operate in various adjacent markets such` as cloud computing. (6) Various other

technology companies operate more narrowly across the CTV advertising value chain, such as ad tech vendors - The Trade Desk (DSP), SpotX (SSP, ad server), Amobee (DSP, SSP, ad server) - and TV set manufacturers (device/UI).

Global technology company CTV advertising operations

(1)

Media owners Gateway platforms

(4,5)

Ad tech

Device / UI

Operating

system

App store

Content

service

Ad sales houseAd server

SSPDSP

Direct buying platform

Apple

Apple TViTunes iOS

Google

Chromecast,

Google TV

Google Play StoreYouTube

Google Ad

Manager

Google Ad

Manager

DV360,

Google Ads

Android TV

Amazon

Amazon DSP Sizmek

Prime video,

IMDB TV

(2)

Fire TV stick,

TV set

Amazon

Amazon Publisher

Services

Fire TV

Roku

Roku

Advertising

Roku TV Roku

Roku Channel

Store

Roku OS

Comcast

FreeWheel FreeWheel Sky Media

Sky and NBCU

services

(3)

SkyQ, NowTV

X1 Entertainment

(Xfinity)

(4)

Samsung

Samsung DSP Samsung TV Plus

Samsung

Smart TV

Samsung Smart

Hub

Tizen

Microsoft

Xbox OneXboxMicrosoft Store

CTV advertising market dynamics | © Spark Ninety 2020

There are four main global tech companies that operate CTV gateway platforms and

have a clear ambition to grow their CTV ad businesses

17

Global technology company CTV advertising activities

Sources: (1) Google reported YouTube revenues for the first time in 2020. (2) Interviewees noted that FreeWheel is the most widely adopted ad server among major broadcasters, though Google Ad Manager has been adopted by various

players, such as DAZN. (3)

Forbes - Is Amazon about to takeover online advertising? (4) NextTV - Roku unveils Advanced Ad Platform . (5) Business Telegraph - Inside Samsung’s connected TV ads push in Europe.

• Samsung has been actively scaling up its advertising business over the last year, using data as a differentiator - Samsung is reportedly pitching itself to advertisers as having access to a

large source of data and insights from its connected TVs on what and how audiences are watching - using this data for targeting

• CTV ads are part of a longer-term vision to monetise data from across the Samsung device ecosystem. “Samsung sells everything, from TVs to smartphones to washing machines. Samsung

Ads is the start of an infrastructure they’re building that will allow them to sell ads across several connected devices in the home.”

(5)

• Microsoft, Apple and Sony are established at the gateway platform level of the CTV ad value chain, with their respective assets including Microsoft Xbox, a possible Xbox streaming stick,

and the search engine Bing; Apple TV, iTunes and iOS; Sony Playstation and Smart TVs.

• However, they do not yet operate CTV ad businesses at scale and have not yet demonstrated a strong interest in growing a connected TV ad business. However, this position could change

- for example M&A of an independent player such as Roku could allow them to rapidly establish themselves in the CTV ad market, acquiring ad inventory and ad tech.

• Google has a large and diversified advertising business. In CTV advertising, YouTube has a strong market position, reportedly generating $15bn in global revenue in 2019 from advertising

(1)

of which CTV is a part. Google also provides comprehensive ad tech, including a DSP, SSP and ad server, but Google ad server and SSP adoption rates are lower among major

broadcasters than publishers in the display advertising market, with FreeWheel ad server used by some major broadcasters

(2)

.

• At the gateway platforms layer, many smart TVs use Android TV, and this OS is used by Google TV. Google is well positioned to build out from this footprint.

• Although growing rapidly and forecast to reach $10bn in 2020

(3)

, advertising revenues represent only a small fraction of total Amazon turnover at present

• Amazon’s OTT ad inventory is growing through its Fire TV platform (recently extending into the auto space), its Amazon Publisher Services (APS) network, live sporting events on Prime

Video and the ad-supported streaming video channel IMDb TV. This inventory and Amazon’s ability to power attribution and measurement should enable it to differentiate its offering

and gain traction. Some interviewees expect Amazon to be one of the leading forces in CTV advertising

• Amazon also has access to demand from Amazon Marketplace sellers, who may value the integration of a sales and advertising platform, as well as major brands that it can reach via its

buying platform and SSP.

• Advertising is one of two main pillars of the Roku platforms business, the other part being subscriptions. Roku also generates revenues from selling boxes and OEM OS, though this activity

essentially drives the main platforms business.

• Roku has stated its intention to become the preferred choice of advertisers in the connected TV landscape. “Our goal is to help advertisers and content partners invest for a world where

all TV is streamed,” said Scott Rosenberg, senior VP and GM of Roku’s platform business. “OneView provides the data and scale across the entire TV landscape so marketers can plan, buy

and measure TV advertising and ultimately shift spend to streaming more quickly.”

(4)

Google

Amazon

Roku

Samsung

Apple

Sony

Other TV set

manufacturers

• Most other TV set manufacturers participate mainly as sellers of UI ads (e.g. LG) or sellers of data to aggregators. They are not yet building out ad tech or services. The exception is Vizio

which operates a CTV ad business in the US, but has not developed a footprint in the UK.

Microsoft

CTV advertising market dynamics | © Spark Ninety 2020

Contents

18

1. Introduction

2. Market size and growth

3. Value chain

4. Market dynamics

CTV advertising market dynamics | © Spark Ninety 2020

There are several CTV advertising market dynamics involving gateway platforms and

their competition and cooperation with media owners

19

Summary of CTV advertising market dynamics

Competition and cooperation between media owners, who control CTV ad inventory at scale, and gateway platforms who provide tech and data to enable advanced

advertising, own growing ad inventory, and wish to grow their ad businesses

1. Gateway platforms, and some media owners, operating vertically integrated walled gardens or partial walled gardens to control monetisation of their ad

inventory and data

2. Gateway platforms setting or negotiating terms with media owners that involve platforms taking a share of ad inventory and/or mandating use of their ad

tech

3. Gateway platforms using data collected on CTV devices and across their wider operations to support their CTV ad businesses

4. Gateway platforms, especially Google and Amazon, developing synergies between their CTV ad businesses and their operations in other areas

5. Gateway platforms limiting use of CTV device IDs for advertising to protect user privacy

6. Gateway platforms leveraging CTV device technology to enable addressable advertising in broadcast TV in return for a revenue share

CTV advertising market dynamics | © Spark Ninety 2020

The CTV ad market is structured around propositions that combine ad inventory,

data and, in some cases, a proprietary buying platform

20

Main CTV advertising propositions in the UK 1. Walled gardens

Sources: Interviews with industry stakeholders. Trade media.

Notes: (1) In some cases, competitors overlay non-exclusive third-party data sources to create targeting segments and/or allow advertisers to activate their first-party data. (2) Refers to YouTube-sold inventory. In some cases, media owners

that distribute content on YouTube have negotiated the right to sell their own inventory, with YouTube backfilling.

Media owner CTV ad inventory Proprietary data

(1)

Proprietary buying platform(s)

Google YouTube

(2)

Data from multiple Google services e.g. search Google Ads; DV360

Walled gardens - Ad inventory and targeting segments

are available only through proprietary self-serve

buying platforms and/or direct sales

ITV ITV Hub User registration data; viewing data Platform V

Channel 4 All4 User registration data; viewing data -

Open broadcaster/platform propositions - Ad

inventory and targeting segments are available

through direct sales and selected third-party DSP

integrations. Certain custom data services (e.g.

advertiser first-party data activation) may be limited to

direct sales.

Sky Media Sky User registration data; viewing data -

Samsung Samsung TV User data; smart TV usage and viewing data Samsung DSP

Amazon Prime Video User data; device usage and viewing data; shopper data Amazon DSP

Gateway platform partial walled gardens - Ad

inventory is available via direct sales, buying platforms

and selected DSP integrations, but proprietary data

segments are exclusive to direct sales/buying

platforms.

Roku Roku TV User data; device usage and viewing data Roku Advertising

Others Various apps Varies by service -

Open programmatic market - Long-tail ad inventory

available via various DSPs

Indicative volume of ad inventory: = low, = high.

CTV advertising market dynamics | © Spark Ninety 2020

In some cases, gateway platforms and broadcasters operate walled gardens -

creating multiple data silos

21

Development of CTV advertising walled gardens 1. Walled gardens

“Media owners don't want to release their

data directly to the buy side due to data

leakage. So a lot of media owners

[internationally] are buying a DSP, or building a

DSP. And then they say, my data is only

available through my DSP. ”

“There'll be a tipping point where the

money being commanded by the

advertisers and the agencies will demand

that more platforms [DSPs] are involved

for access, which ultimately is going to be

better for everyone.”

“Vizio [in the US] is building a very strong advertising

marketplace, a closed environment with some open doors to

integrate with other monetization platforms. They really

want to own the space and the data .... To a certain extent

Samsung seems to be adopting a similar path. Roku is also a

very controlled environment.”

Sources: (1) CMA (2) https://www.planet-v.co.uk (3) https://www.v-net.tv/2020/10/05/planet-v-goes-live-at-itv-combining-progressive-ad-tech-with-full-broadcaster-sovereignty/

• YouTube operates a “walled garden” business model in which YouTube ad inventory and Google targeting segments are available only on Google owned and operated

buying platforms (DV360 and GoogleAds)

(1)

• Roku, Amazon and Samsung have emulated this approach, building or acquiring DSPs that have access to their inventory and data. They also supply ad inventory to

certain third-party DSPs, though some interviewees expect platforms to limit this practice in the future in order to strengthen their own DSPs

• ITV has also developed a walled garden - Planet V

(2)

, a self-service buying and data management platform based on technology licensed from Amobee. Planet V will

become the exclusive way to buy ITV Hub ad inventory. It offers a range of targeting options including segments based on ITV first-party data augmented with Experian

data, and the ability to match advertiser first-party data. ITV has invited other broadcasters to use the platform

(3)

• The benefits of a walled garden approach include limiting disintermediation by third-party ad tech vendors, preventing data leakage, and limiting exposure to risk in the

open programmatic advertising ecosystem, such as ad fraud and discrepancies. However, walled gardens limit access to certain demand sources, such as DSPs like

DV360 and The Trade Desk that may reach advertisers who do not have a direct relationship with a walled garden, such as DTC brands. Interviewees were divided over

whether this factor will stimulate walled gardens to open up to third-party DSPs in the future

CTV advertising market dynamics | © Spark Ninety 2020

Gateway platforms have the ability to set terms and conditions for CTV app ad

monetisation, ad tech, ad content and user tracking

22

App store terms and conditions 2. Distribution terms

•

App stores or platforms generally set standard terms and conditions for

apps they distribute, covering ad monetisation, ad tech partners, ad

content, ad IDs and tracking

• In many cases, major broadcasters have been able to negotiate

variations from the standard ad terms - as part of wider distribution

deals involving agreement on prominence and other factors

• Some platform terms and conditions help to ensure a good user

experience by prohibiting excessive, intrusive or inappropriate

advertising and protecting user privacy

• Other terms and conditions relate to commercial arrangements between

gateway platforms and content services, such as the right to sell ad

inventory and to choose third-party ad tech vendors

Aspect Examples of standard terms and conditions

Ad monetisation

• The Roku Distribution Agreement requires that channels send 30% of

ad inventory to Roku for which Roku keeps 100% of revenue, or that

Roku sells 100% of inventory with a 60% revenue share to the

publisher

(1)

Ad tech partners

• Amazon Fire TV Ad-Enabled Apps must disclose, upon Amazon’s

request, which third-party ad networks they use and within six

months of Amazon’s request, Fire TV Ad-Enabled Apps must remove

all third-party ad network monetization software and may only access

third-party ad networks through Amazon Publisher Services (Amazon’s

own SSP)

(2)

Ad content

• LG In-App Advertising Content Guidelines forbid unacceptable ad

content, including a range of categories such as adult content,

gambling, lotteries, and ‘competitor product promotion ads that is

defined by LG internal policy’

(3)

Ad IDs / tracking

• Amazon’s Advertising ID Policy states that ‘If you collect information

about a user’s behavior to display interest-based ads, or to generate

analytics, you must use the Advertising ID; no other identifier or

tracking method may be used. Users can reset the Advertising ID or

opt out of interest-based ads altogether.’

(4)

Sources: (1) Roku Developers - Advertisements, Roku Distribution Agreement (2) https://developer.amazon.com/docs/policy-center/fire-tv-advertising.html Third-party ad networks might include SSPs, DSPs and ad exchanges, though the term

is not defined in the Amazon Fire TV Policies document. (3) Part of LG Smart TV Seller terms and conditions http://seller.lgappstv.com/seller/footer/terms.lge?lang=en - accessed 6 November 2020. (4) The Advertising ID is a user-

resettable, unique identifier that helps protect the privacy of the user. https://developer.amazon.com/docs/policy-center/advertising-id.html

CTV advertising market dynamics | © Spark Ninety 2020

Amazon and Roku request a share of third-party CTV app ad inventory to sell - a

practice which is established in the US market

23

Gateway platform ad monetisation terms 2. Distribution terms

•

In the US, gateway platforms such as Amazon and Roku commonly take a

share of the ad inventory of services distributed on their platforms. They

sell this inventory enhanced with proprietary data

• Even major studio groups share inventory or revenue. In September

2020, NBCU agreed to a revenue share with Roku as part of a distribution

agreement for Peacock, its streaming service

(1)

• This inventory sharing practice has developed in the US due to:

○ A precedent of broadcasters providing MVPDs (cable operators) with

avails (a certain number of minutes of advertising per hour) to sell -

third-party aggregation of TV ad inventory is accepted

○ Roku and Amazon Fire having a relatively high market penetration

(according to interviewees)

• The UK market does not have a system of avails and Roku and Amazon

have relatively low market penetration at present

• In the UK, Roku default terms require apps to provide 30% of their ad

inventory to Roku. Amazon may also ask for 30% of inventory

• However, according to industry interviewees, major UK broadcasters

have not agreed to share inventory under current negotiated distribution

agreements with gateway platforms

Gateway Standard monetisation terms

Roku

• "Inventory Split" model, whereby the channel sets up its own ad

server and must send 30% of inventory to Roku. Roku retains 100% of

revenue from this inventory

• Also option of Roku Sales Representation Program - Roku sells 100%

of inventory with a 60% revenue share to the publisher

(2)

Amazon Fire TV • Under Amazon’s Inventory Optimization Policy, Fire TV Ad- Enabled

Apps must provide 30% of total advertising impressions in the app to

Amazon

• Apps will not receive payment for the 30% of impressions provided to

Amazon

• Apps directed at children under 13 and apps located outside the US or

with <50,000 monthly viewing hours, and who have not been

contacted directly for inventory by Amazon, are exempt

• Amazon reserves the right to enforce the Inventory Optimization

Policy for all Fire TV Ad-Enabled Apps, at a later date, at its sole

discretion

(3)

Google Play Store • Google Play policies do not require apps to share ad inventory with

Google

(4)

Sources: (1) https://www.bloomberg.com/news/articles/2020-09-18/nbc-threatens-to-black-out-apps-on-roku-in-dispute-over-peacock (2) Roku Developers - Advertisements, Roku Distribution Agreement

(3) https://developer.amazon.com/docs/policy-center/fire-tv-advertising.html (4) https://support.google.com/googleplay/android-developer/answer/9857753?hl=en&ref_topic=9857752

CTV advertising market dynamics | © Spark Ninety 2020

UK broadcasters have resisted sharing ad inventory with gateway platforms, but

some stakeholders expect this situation to evolve

24

Evolution of gateway platform - broadcaster ad agreements 2. Distribution terms

Current situation: UK broadcasters generally do not share ad inventory with

gateway platforms

Potential future trend: Platforms leverage increased scale to gain the right to

sell third-party ad inventory

“They are the hard negotiating

points… it's not the most

conventional approach for platforms

that more often than not want to

take over the ad sales piece. But

broadcasters have a very strong

position in the UK.”

• Broadcaster agreements with gateway platforms are relatively short term -

frequent renewal negotiations provide opportunities for gateway platforms to

change the terms of these agreements

• As certain gateway platforms increase market penetration, their bargaining

power will grow

• There is a also risk that gateway platforms will mandate certain terms globally,

regardless of local UK market dynamics

“When a Roku or an Amazon comes

in and wants to do some kind of

advertising share deal, I think

broadcasters’ natural reaction is

‘why would we do that? We have

100% control of our inventory and

understand control of our yield and

our data, why would we ever give

that up?’”

“It's a slippery slope, to start

relinquishing control to big tech

platforms that start off with, I don't

know, a 20% share of your

inventory. That suddenly puts a

noose around your neck where that

share can then be increased as

reliance on a platform grows.”

“There will be a reckoning about the

extent to which the very biggest

broadcasters start to change the

terms that they work with for

streaming platforms.”

• Major UK broadcasters have generally pushed back on gateway platform

requests to take a share of CTV ad inventory and/or to mandate use of certain

ad tech

• This position is supported by current power dynamics: the three main

broadcast sales houses (ITV Media, 4Sales, Sky Media) control a large share of

CTV ad inventory, while CTV gateway platforms are relatively fragmented at

present

CTV advertising market dynamics | © Spark Ninety 2020

Gateway platforms collect data on CTV devices and services, and on any services

they operate in adjacent markets

25

Examples of data collected by selected gateway platforms 3. Data leverage

Sources: (1) https://www.amazon.co.uk/gp/help/customer/display.html?nodeId=GQFYXZHZB2H629WN (2) https://docs.roku.com/published/userprivacypolicy/en/gb (3) Mediatique, Connected TV gateways: review of market dynamics,

August 2020. (4) https://www.samsung.com/uk/business/samsungads/ (5) CMA digital markets Appendix F: The role of data in digital advertising. (6)

https://www.amazon.co.uk/gp/help/customer/display.html?nodeId=GSXETHUPY4UM7CRD (7) https://www.samsung.com/uk/info/privacy/.

Notes: This list of data is not comprehensive.

Google Amazon Roku Samsung

CTV devices

and services

• On YouTube, activity, ad, device,

and location

• On Chromecast, usage data

• On Android TV - Google does not

publish specific privacy policy for

Android TV. The CMA found that

Android collects data on mobile

devices

(5)

• User information (e.g. name, age,

contact details)

• On Fire TV and Fire TV Edition

(smart TV), device usage, such as

navigation of the home screen,

and open, close and duration of

use of third-party apps

• On Fire TV Edition devices, use of

live broadcast TV content

(1)

• User information (e.g. name, age,

contact details)

• Device information, IP address

• User activity on Roku Channels

and Roku Direct Publisher

Channels

• On Roku Smart TV sets, content

and ad viewing across live TV and

other services (enabled by ACR)

and TV guide usage

(2)

• User information (e.g. name, age,

contact details)

• Collected information (e.g. IP

address, location)

(3)

• On opted in smart TV sets,

household-level content and ad

viewing across TV channels and

programmes, commercials,

device usage, set-top boxes and

gaming consoles - using ACR

(4)

Other devices

and services

• Data from >53 consumer-facing

services and products in the UK,

including user information (e.g.

name, age), user activity (e.g.

search history, Google Pay

transactions), location data when

using Google services

• Data from mobile devices running

Android

• Data collected from third parties

(e.g. ad data)

(5)

• User information (e.g. name,

address, age, payment

information)

• User shopping activity (e.g.

search history, orders,

• User media activity (e.g.

downloading, streaming, viewing)

• Interactions with Alexa voice

assistant

(6)

• Information is collected on

mobiles, tablets, home

appliances and online services,

including:

○ User information

○ Device information

○ Location information

○ Use of services such as apps

and websites

○ Voice information in the case

of voice control

(6)

CTV advertising market dynamics | © Spark Ninety 2020

Gateway platforms use proprietary data to strengthen their CTV advertising

propositions, though these offers are fragmented in the UK

26

Use cases for gateway platform proprietary data 3. Data leverage

Notes: (1) We did not see evidence that gateway platforms are currently offering this targeting capability, but ACR data could in theory support it.

ACR data

“The sort of data that Amazon, for

example, knows about a subscriber:

where they live, probably their age,

gender, what they spend every month on

shopping. I'd put that in the highly

valuable bucket, because it's obviously

verified information, it's extremely

accurate, it's got a billing relationship. For

an advertiser that's about as good as it

gets in terms of quality of data.”

“Individually, these platforms offer some

really interesting datasets. The challenge

is, obviously, that they don't scale across

the system.”

“ACR data can be quite useful to target

light, medium, heavy TV viewers or heavy

SVOD viewers. That's interesting... But the

whole space is very poorly audited and

verified... That area has a long way to go

and certainly we haven't seen it really

gain traction with clients for that reason.”

“Part of this market is after exactly the

type of data that the likes of Amazon and

Google have got in spades. That said, the

majority of the appetite right now is for

standard measures of reach frequency,

incremental reach.”

Amazon and Google data

• Amazon and Google data enables highly granular behavioural targeting based on verified first-party data

• These granular targeting options are attractive to response advertisers and brand advertisers who want to target narrow audiences. In many cases,

these brands currently focus on digital advertising and are new to advertising on TV screens

• Other CTV ad providers also offer a degree of granular targeting, supplementing their first-party data with third-party data, and offering advertiser first-

party data matching (e.g. Planet V offers over 400 targeting options)

• ACR data provides gateway platforms with household ad exposure data, enabling targeting options such as:

○ Reach extension - advertisers target CTV ads at households that have not already seen their ads on broadcast TV

○ Tactical retargeting - advertisers target ads at households who have been exposed to competitor ads

(1)

• These options may appeal to TV advertisers, though stakeholders noted that ACR data/targeting is fragmented by platform, not independently audited,

and may be limited by low opt-in rates and incomplete ACR ad content libraries

CTV advertising market dynamics | © Spark Ninety 2020

There are complementarities between Google and Amazon CTV advertising

businesses and their other areas of activity

27

Synergies between Google and Amazon CTV advertising and other lines of business 4. Horizontal synergies

Source: (1) CMA digital markets Appendix F: The role of data in digital advertising.

CTV

advertising

Devices

Services

Ad tech

“Google have verticalized all parts of the communications process. From mass reach, not

simultaneous, through retargeting and customized messaging, through personalisation

by narrow attribution-based mechanisms - all powered by a single view of the consumer

because the Google ID operates pretty much universally… That is massively

advantageous in the advertising market, but they still struggle to penetrate the TV

community, on account of the nature of the content and the way in which it is sold”

“We would expect to see a chunk of performance advertisers - Google's

core market in digital platforms and digital video, like YouTube - moving to

the big screen… Data exists to make the impact far more measurable than

it ever has been before. And actually lots of that measurement still runs

through Google's platforms, Google systems, Google's attribution

models.”

Other LOBs

Desktop

Mobile

Shopping

Ad tech

Voice

• Data - Google and Amazon collect data across multiple services and devices, with valuable data categories including

shopping behaviour and search history. They use this data to generate targeting segments (e.g. auto intenders) which can

be activated in CTV media buys. The platforms can also use CTV data, such as service usage or ACR, to add to their overall

view of user behaviour.

• Analytics and attribution - Google and Amazon have established analytics and attribution models used in desktop and

mobile environments, where desired actions such as product purchases generally occur. They can link these models to CTV

ad exposure data, allowing CTV advertisers to determine ad impact and effectiveness.

• Demand - Google and Amazon have substantial customer bases, including global agencies and a long tail of SME advertisers

that they can cross-sell CTV advertising, though CTV is generally packaged with other forms of OTT video advertising.

• Logins - Google and Amazon operate logins on most services, enabling them to track users across services.

CTV advertising market dynamics | © Spark Ninety 2020

Gateway platforms may limit access to or use of device IDs for advertising, which

may create challenges monetising long-tail CTV content

28

Access to and use of device IDs 5. Device ID

Source: (1) https://www.adexchanger.com/mobile/apples-policy-is-clear-email-is-not-gonna-take-the-place-of-idfa/. (2) https://lp.liveramp.com/meet-liveramp-identitylink.html (3) https://id5.io/solutions/

“Identity is less of a problem for content owners

with scale. If you're big enough and you have

logged in data and managed to collect consent,

then you'll still be good to go. But there is no doubt

that a significant part of the consumption will go to

the long tail of smaller content providers.”

“Whether theses platforms will let the content

provider access a user identity or not, is a very big

issue... the recent change in Apple policy, around

IDFA... There are already providers who are not

sharing any device ID with third parties, though

they probably still leverage it for their own

advertising business. And this can create a huge

distortion in the market.”

“In the UK, loss of device IDs would be minimally

disruptive, just because a lot of those identifiers

have already been stripped out by the broadcasters

with the advent of GDPR. IP addresses and

persistent device IDs have been removed by pretty

much every major broadcaster. So in a way the CTV

marketplace is already primed for a world that

doesn't have a lot of identifiers.”

• Device IDs are persistent identifiers generated by a particular CTV device and may be used in advertising to identify a user across content services running on the

same device, enabling practices such as audience tracking and targeting, and frequency capping.

• Each CTV OS has its own system of IDs, such as IDFA (Apple), RIDA (Roku), Amazon Advertising ID, Google Play Advertising ID.

• Access to device IDs for advertising differs and could be limited by gateway platforms. Apple plans to make access to IDFA, its identifier, opt-in only on iOS14

(1)

.

Amazon and Roku allow use of their IDs for advertising, with restrictions.

• Interviewees generally believe that potential restriction of access to device IDs will not be a problem for major broadcasters that use logins as identifiers. Smaller-

scale media owners that sell advertising programmatically are more likely to be affected due to aggregation in the programmatic ad ecosystem. However, ID is a

highly complex field and vendors such as LiveRamp

(2)

and ID5

(3)

are developing solutions that may work in the absence of device ID.

CTV advertising market dynamics | © Spark Ninety 2020

Dynamic ad replacement (DAR) in broadcast TV requires use of gateway platform

technology - for which platforms may negotiate a revenue share

29

Gateway platforms enabling DAR in return for ad revenue share 6. DAR in broadcast TV

Source: (1) https://projectoar.org/

“In the context of dynamic ad insertion, the operator or the platform, is playing

the DSP role a little bit. And they're playing it particularly well at the moment.

The value proposition that they can bring is enriching your inventory with data

segments - such as Sky Adsmart. Being distributed on our platform not only

gives you more reach, it brings you enhanced media value. Ultimately, then it

becomes a revenue conversation, rather than a revenue share conversation.”

“The hybrid environment [linear broadcast TV + connected TV devices] allows us

to bring addressability to linear live TV, not waiting for users go to OTT. You just

need to have a connected TV in the middle. And this is what really developed

this year. There are a couple of initiatives: project OAR, the consortium, and

Nielsen Advanced Advertising… These initiatives will drive the market forward.”

• Replacement of broadcast TV advertising with addressable advertising requires the use of technology on a CTV device (this differs from ad replacement on linear OTT

streams which is done on servers).

• In the UK at present, proprietary Sky AdSmart technology enables DAR on certain broadcast TV channels on enabled Sky and Virgin set-top boxes. The gateway

platforms, in this case Sky and Virgin, receive a share of DAR revenue.

• In the US, new models of dynamic ad insertion are emerging in which broadcast TV ads are replaced on smart-TV sets. Project OAR

(1)

is a consortium of industry

participants, including smart TV manufacturer Vizio, that is developing a standard for dynamic ad insertion on smart TV sets.

• In the future, there is the potential for an increasing range of smart TV gatekeeper platforms to enable DAR on their devices. They would need to reach agreement

with broadcasters and other value chain participants over terms such as revenue share.

www.sparkninety.com